Florida's CD Rates Secret Banks Don’t Tell You

If you're eager to unlock the hidden potential of your savings, Florida's CD rates offer opportunities you won't want to miss—browse options and discover how to maximize your returns today.

Understanding Florida's CD Rates: A Hidden Gem

In recent years, Florida has emerged as a hotspot for competitive Certificate of Deposit (CD) rates, offering savvy savers a chance to grow their money with minimal risk. Unlike traditional savings accounts, CDs provide a fixed interest rate over a specified term, making them a stable investment choice. The allure of Florida's CD rates lies in their ability to offer higher returns compared to national averages, a fact many banks prefer to keep under wraps.

Why Florida?

Florida's banking sector is uniquely positioned to offer attractive CD rates due to its competitive financial environment. With a plethora of local and regional banks vying for consumer deposits, these institutions often provide superior rates to attract new customers. This competitive landscape creates a win-win situation for consumers, who can benefit from better returns on their investments while enjoying the security that CDs offer.

Types of CD Accounts Available

In Florida, you can find a variety of CD options tailored to different financial goals:

- Traditional CDs: These offer a fixed interest rate for a set term, typically ranging from six months to five years. The longer the term, the higher the interest rate tends to be.

- Bump-Up CDs: Allow you to increase your interest rate once during the term if rates rise, giving you flexibility and the potential for greater earnings.

- No-Penalty CDs: Provide the option to withdraw your funds before the term ends without incurring a penalty, offering liquidity alongside growth.

Maximizing Returns with Florida's CD Rates

To capitalize on Florida's competitive CD rates, it's crucial to shop around and compare offerings from various banks and credit unions. Many institutions provide promotional rates or special terms for first-time customers or those willing to invest larger sums. For instance, some banks may offer a higher rate for deposits exceeding $10,000, a tactic designed to attract substantial investments.

Moreover, aligning your CD terms with your financial goals can significantly enhance your returns. For example, if you anticipate needing access to your funds in two years, a 24-month CD might be the optimal choice, balancing interest earnings with liquidity.

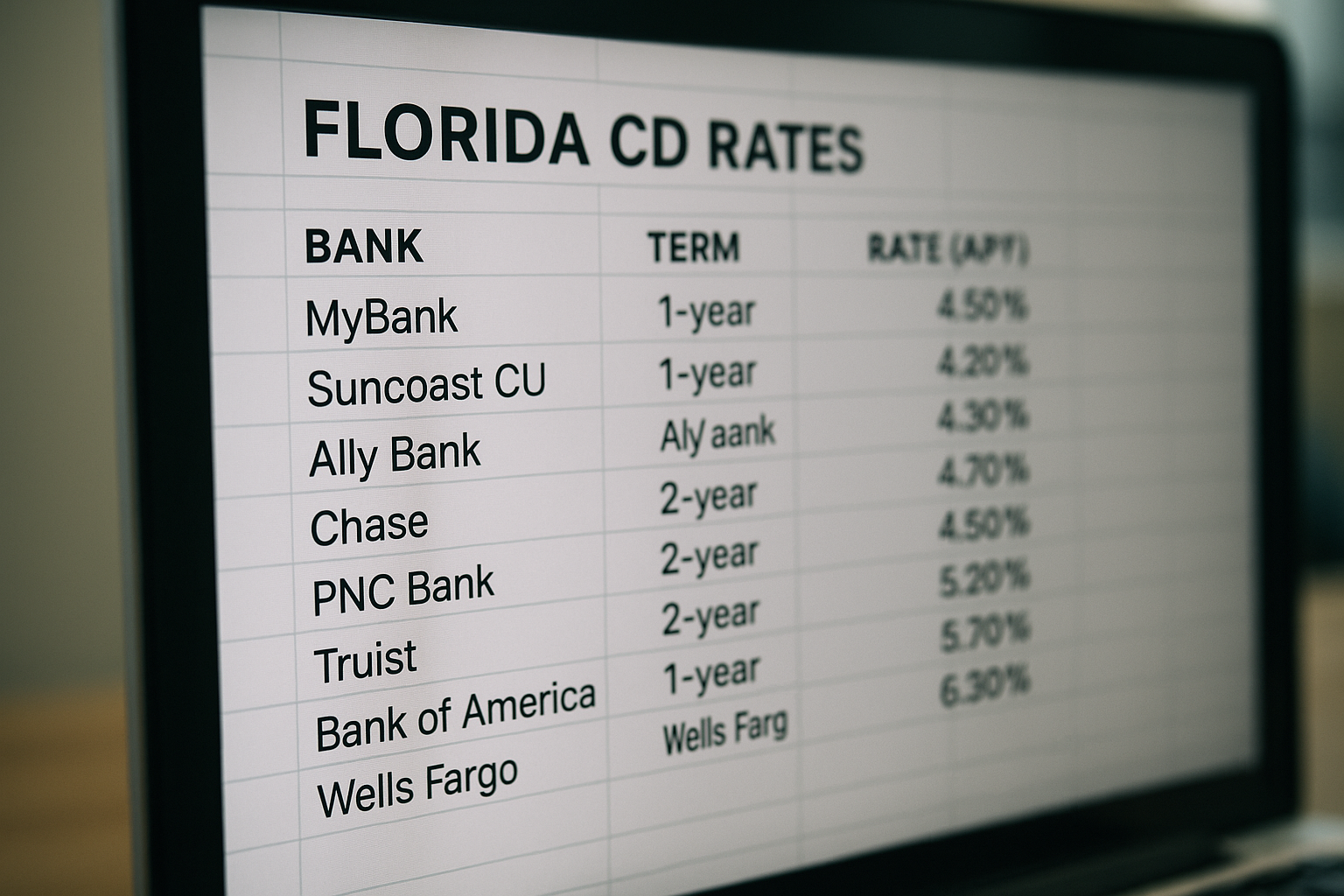

Real-World Examples and Data

According to data from the Federal Deposit Insurance Corporation (FDIC), the average national CD rate for a 12-month term is approximately 0.26%1. In contrast, many Florida-based banks offer rates exceeding 1.00% for similar terms, showcasing the state's advantageous position for CD investors. For example, a regional bank in Miami might offer a 24-month CD with a 1.50% interest rate, significantly outpacing the national average.

Exploring Your Options

To fully leverage Florida's CD rates, consider visiting websites of local banks and credit unions to explore their offerings. Many institutions provide online tools to help you calculate potential earnings based on different terms and deposit amounts. Additionally, some banks feature customer service chat options for personalized advice, ensuring you make informed decisions tailored to your financial aspirations.

By understanding the nuances of Florida's CD market and taking proactive steps to explore available options, you can enhance your savings strategy and achieve greater financial security.