Access Exclusive Loan Deals With October Lending Platform

Accessing exclusive loan deals can transform your financial landscape, and with October Lending Platform, you have the chance to browse options that could redefine your borrowing experience.

Understanding October Lending Platform

October Lending Platform is a leading European marketplace that connects businesses with investors, facilitating loans that are often more competitive than traditional bank offerings. This platform is renowned for its ability to provide quick access to funds, making it an attractive option for small to medium-sized enterprises (SMEs) seeking growth capital without the lengthy processes typically associated with bank loans.

Benefits of Using October Lending Platform

One of the primary advantages of using October Lending Platform is the speed of loan approval. Businesses can expect to receive funding in as little as a few days, a stark contrast to the weeks or even months it can take through conventional banks. This rapid access to capital empowers businesses to seize opportunities as they arise, whether it’s expanding operations, purchasing new equipment, or managing cash flow.

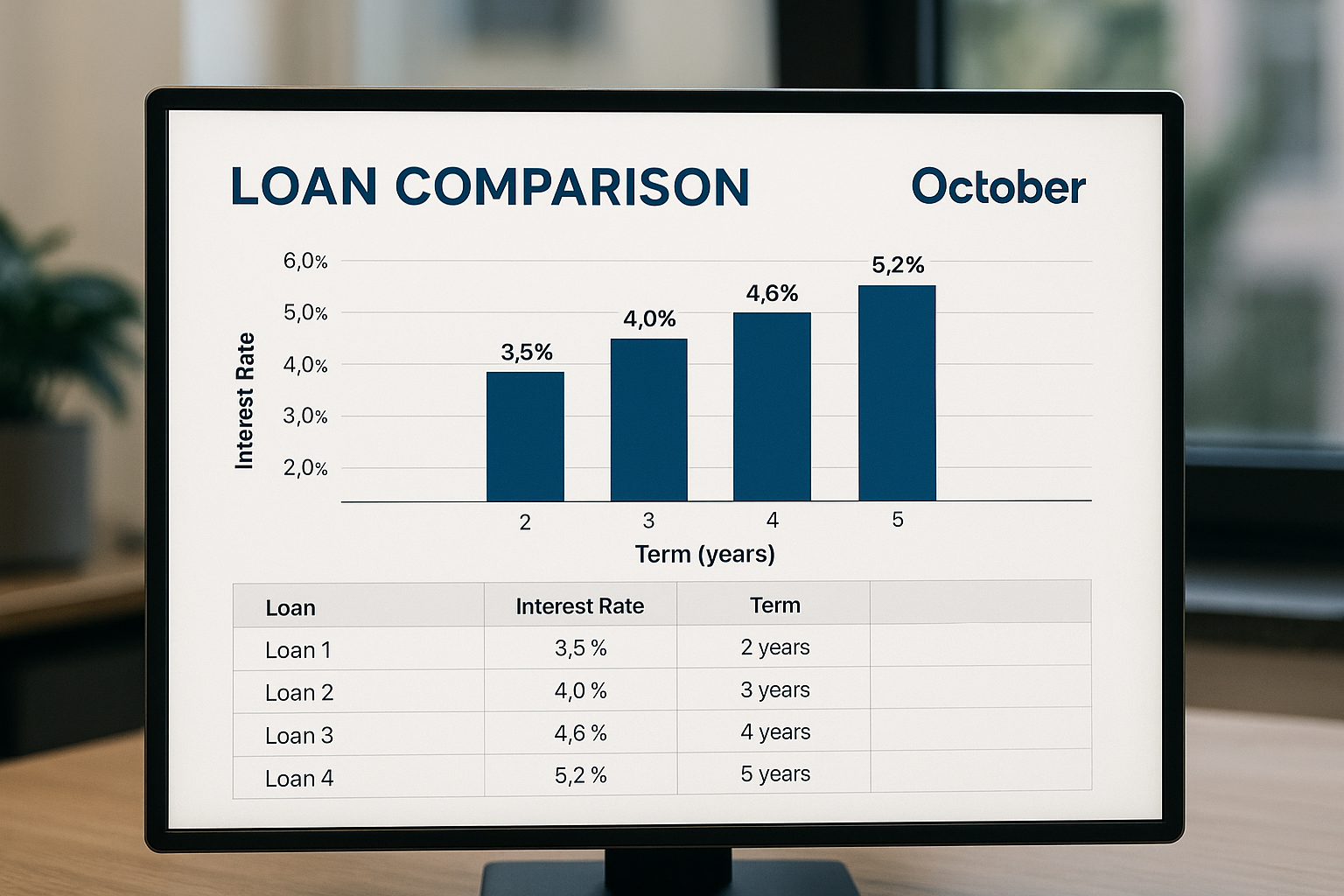

Moreover, the platform's competitive interest rates are a significant draw. By leveraging a diverse pool of investors, October can offer rates that are often lower than those found in traditional financial institutions. This can result in substantial savings over the life of the loan, allowing businesses to allocate resources more efficiently.

Types of Loans Available

October Lending Platform provides a variety of loan options to cater to different business needs:

- Business Expansion Loans: Designed for companies looking to grow their operations, these loans can be used for opening new locations or increasing production capacity.

- Equipment Financing: These loans help businesses acquire essential machinery or technology without depleting their cash reserves.

- Working Capital Loans: Ideal for managing day-to-day expenses, these loans ensure businesses have the liquidity needed to operate smoothly.

How to Access Exclusive Deals

To access the exclusive deals offered by October Lending Platform, businesses should start by creating an account on their website. This process involves providing basic information about the company and its financial health. Once registered, businesses can browse options tailored to their specific needs and apply for loans directly through the platform.

The platform’s intuitive interface makes it easy to compare different loan options and select the one that best fits your financial goals. Additionally, October's customer support team is available to assist with any questions, ensuring a smooth and transparent borrowing experience.

Real-World Impact

October Lending Platform has facilitated over €600 million in loans to more than 2,000 businesses across Europe1. This impressive track record highlights the platform's effectiveness in supporting business growth and development. For example, a French SME specializing in eco-friendly packaging utilized an October loan to expand its production line, resulting in a 30% increase in revenue within a year2.

Financial Considerations

While the benefits of using October Lending Platform are clear, it's essential for businesses to carefully consider their financial situation before applying for a loan. Factors such as cash flow, repayment ability, and long-term financial goals should be evaluated to ensure that taking on new debt aligns with the company's strategic objectives.

Exploring Further Opportunities

For businesses ready to explore the transformative potential of exclusive loan deals, visiting websites like October Lending Platform is a logical next step. By following the options available, companies can unlock new avenues for growth and financial stability.