Secure Future Wealth With These Best HELOC Secrets

Unlocking the secrets of a Home Equity Line of Credit (HELOC) can be your gateway to financial security, and as you explore these options, you'll discover ways to effectively manage your wealth and secure your future.

Understanding HELOC: A Smart Financial Tool

A Home Equity Line of Credit (HELOC) is a flexible financial tool that allows you to borrow against the equity of your home. Unlike a traditional loan, a HELOC provides you with a revolving line of credit, similar to a credit card, which means you can borrow, repay, and borrow again as needed. This flexibility makes it an attractive option for homeowners looking to manage large expenses or consolidate debt.

Why Choose a HELOC?

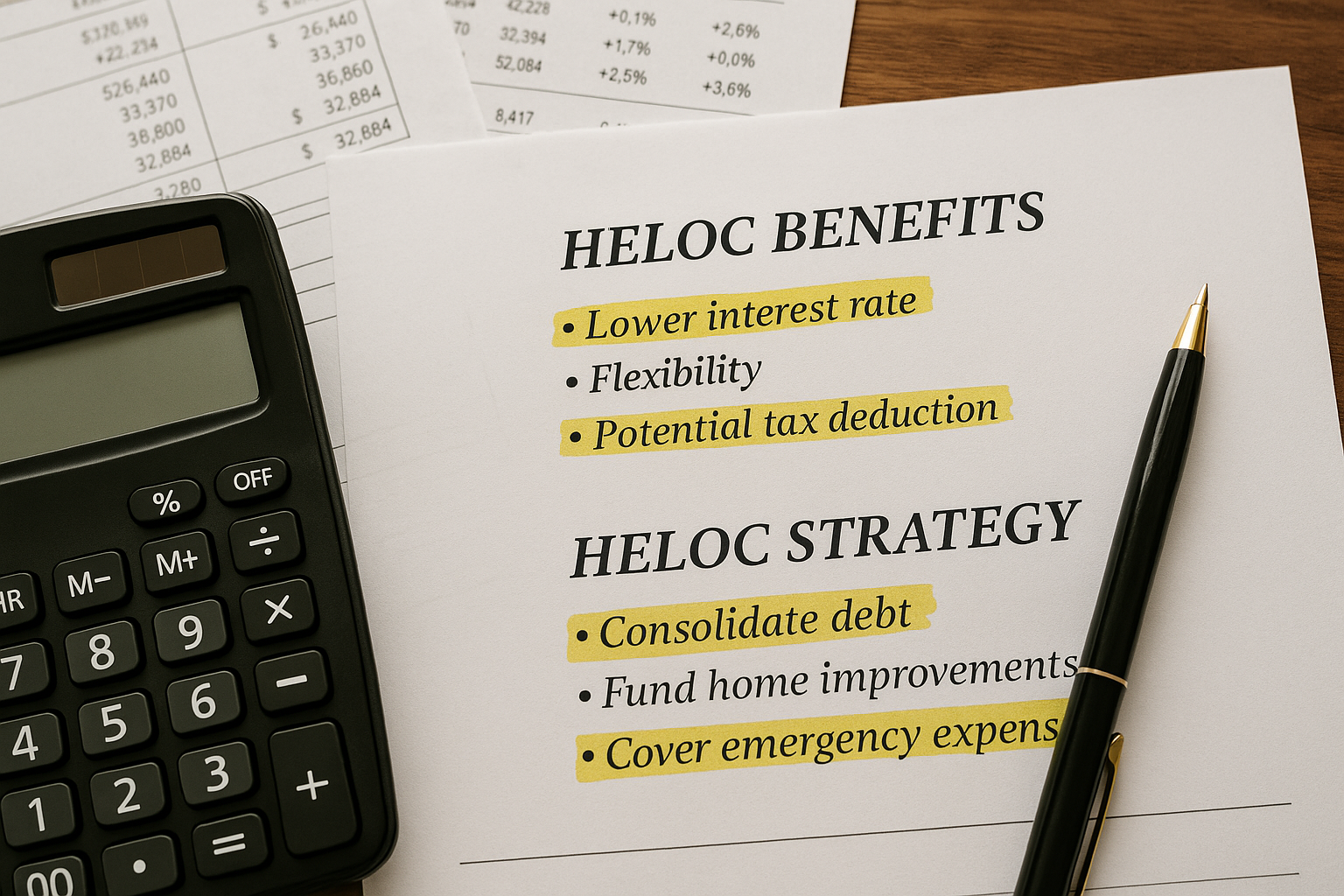

One of the primary benefits of a HELOC is its lower interest rates compared to personal loans and credit cards. As of 2023, the average HELOC interest rate is around 6.5%1, which is significantly lower than the average credit card interest rate of about 16%2. This can lead to substantial savings, especially if you're using the funds for home improvements, which can also increase your home's value.

Maximizing the Benefits of HELOC

To make the most of a HELOC, it's crucial to understand how to leverage it effectively. Here are some strategies:

1. **Home Improvements**: Use your HELOC to finance renovations that increase your home's value. This not only enhances your living space but also boosts your equity, creating a cycle of increasing wealth.

2. **Debt Consolidation**: Consolidate high-interest debts into a single, lower-interest HELOC payment. This can simplify your finances and reduce the overall interest you pay over time.

3. **Emergency Fund**: A HELOC can serve as a backup emergency fund, providing peace of mind without requiring you to keep large amounts of cash on hand.

Potential Costs and Considerations

While a HELOC offers numerous advantages, it's important to be aware of potential costs. Some lenders may charge annual fees, closing costs, or prepayment penalties. It's essential to compare different lenders and their terms. For instance, some banks offer promotional rates or waive certain fees for new customers3.

Additionally, because a HELOC is secured by your home, defaulting on payments could put your property at risk. Therefore, it's crucial to borrow responsibly and ensure you have a solid repayment plan.

Exploring Your Options

With so many lenders offering HELOCs, it's vital to browse options and compare terms to find the best fit for your financial needs. Consider factors such as interest rates, fees, and customer service. Many financial institutions provide online calculators to help you estimate potential costs and savings4.

Final Thoughts

A HELOC can be a powerful tool for securing future wealth and managing your finances effectively. By understanding the benefits and potential pitfalls, you can make informed decisions that align with your financial goals. As you search options and explore various lenders, remember that the key to maximizing a HELOC is responsible borrowing and strategic financial planning.

For those ready to take the next step, numerous resources and specialized services are available to guide you through the process, ensuring you make the most of this valuable financial opportunity.