Cut Your Duplex Insurance Costs Today Effortlessly

Cutting your duplex insurance costs doesn't have to be a hassle—by exploring ways to save and browsing options, you can effortlessly reduce your expenses while maintaining the coverage you need.

Understanding Duplex Insurance

Duplex insurance is a specialized form of property insurance designed to cover multi-family dwellings. These policies typically protect against property damage, liability claims, and loss of rental income. As a duplex owner, you might be renting out one or both units, making it crucial to have comprehensive coverage that secures your investment against unforeseen events.

Key Strategies to Reduce Your Insurance Costs

One of the most effective ways to lower your duplex insurance premiums is by increasing your deductible. A higher deductible means you'll pay more out of pocket in the event of a claim, but it can significantly reduce your monthly premium. For instance, raising your deductible from $500 to $1,000 could save you up to 25% on your premium1.

Another strategy is to bundle your insurance policies. Many insurers offer discounts when you combine multiple policies, such as home and auto insurance, with the same provider. This not only simplifies your billing process but can also lead to substantial savings2.

Enhancing Property Security

Improving the security of your duplex can also lead to lower insurance costs. Installing security systems, smoke detectors, and deadbolt locks can make your property safer and less risky to insure. Some insurers offer discounts for properties with enhanced security features, as they reduce the likelihood of theft and damage3.

Regularly Review and Compare Policies

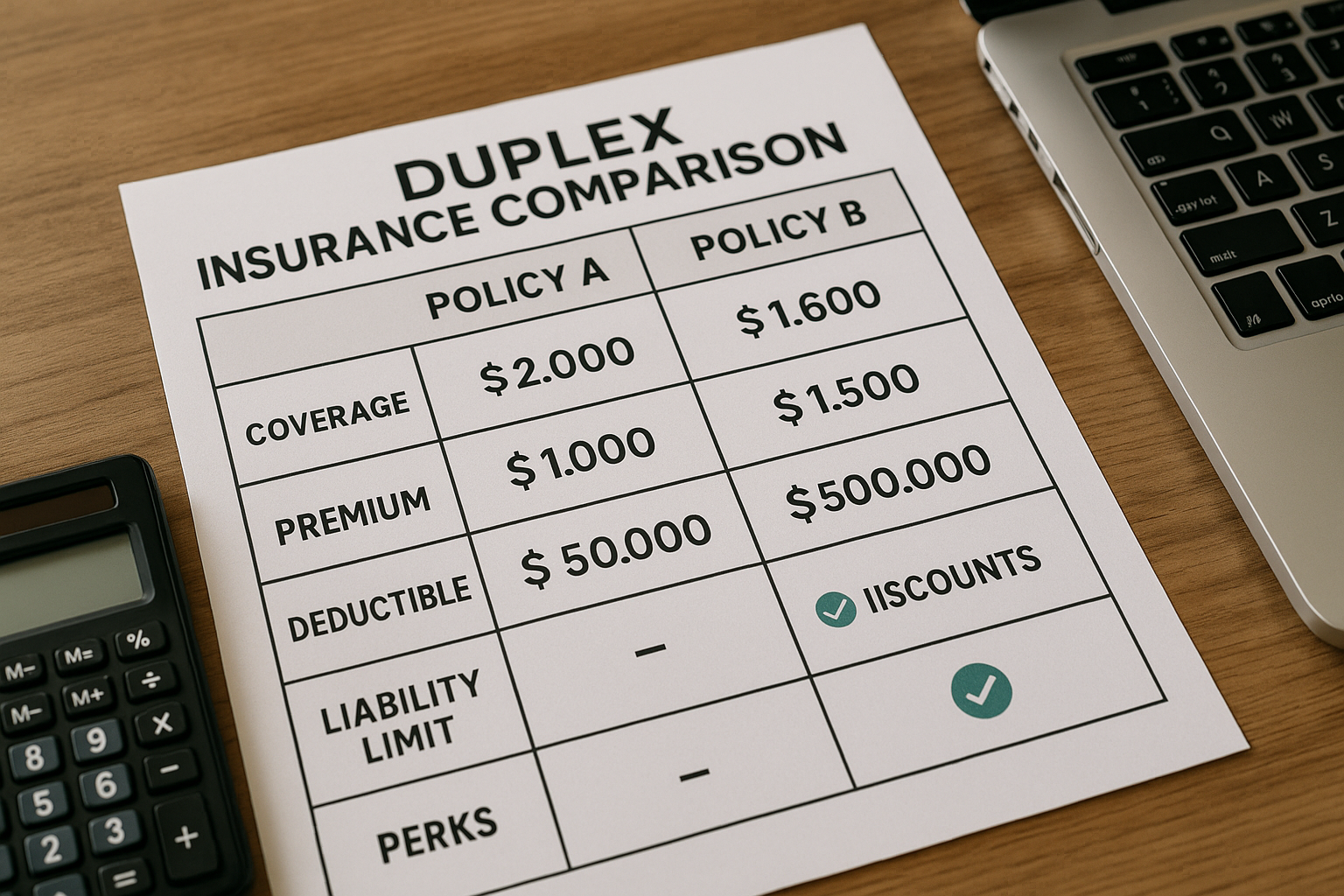

Insurance needs can change over time, so it's important to regularly review your policy and compare it with other available options. By visiting websites and searching for options, you can ensure you're not overpaying for coverage you no longer need. Additionally, comparing policies from different insurers can uncover better deals or coverage options that are more suited to your current situation4.

Consider Specialized Insurance Providers

Some insurance companies specialize in multi-family dwelling coverage and may offer more competitive rates or tailored policies for duplex owners. These providers understand the unique risks and requirements of insuring a duplex, which can result in more comprehensive and cost-effective coverage. Exploring these options can lead to finding the perfect balance between cost and protection.

Leverage Discounts and Promotions

Finally, always be on the lookout for discounts and promotions offered by insurers. These can include loyalty discounts for long-term customers, new customer promotions, or discounts for being claims-free for a certain period. Taking advantage of these offers can further reduce your insurance costs without compromising on coverage.

By following these strategies, you can effectively manage your duplex insurance expenses and ensure you're getting the best possible deal. Remember, the key is to stay informed and proactive about your insurance needs, allowing you to make adjustments as necessary and capitalize on available savings.