Snag Top Perks From Best Renters Insurance Picks

If you're ready to snag top perks from the best renters insurance picks, now is the perfect time to browse options that not only protect your belongings but also offer surprising benefits like discounts on premiums and added coverage features you won't want to miss.

Understanding Renters Insurance and Its Importance

Renters insurance is an essential safeguard for anyone leasing a home or apartment. It provides financial protection against the loss or damage of personal property due to events like theft, fire, or natural disasters. Many renters mistakenly believe their landlord's insurance will cover their personal belongings, but this is not the case. A comprehensive renters insurance policy ensures that your possessions are protected, providing peace of mind and financial security in the event of unforeseen circumstances.

Key Benefits of Renters Insurance

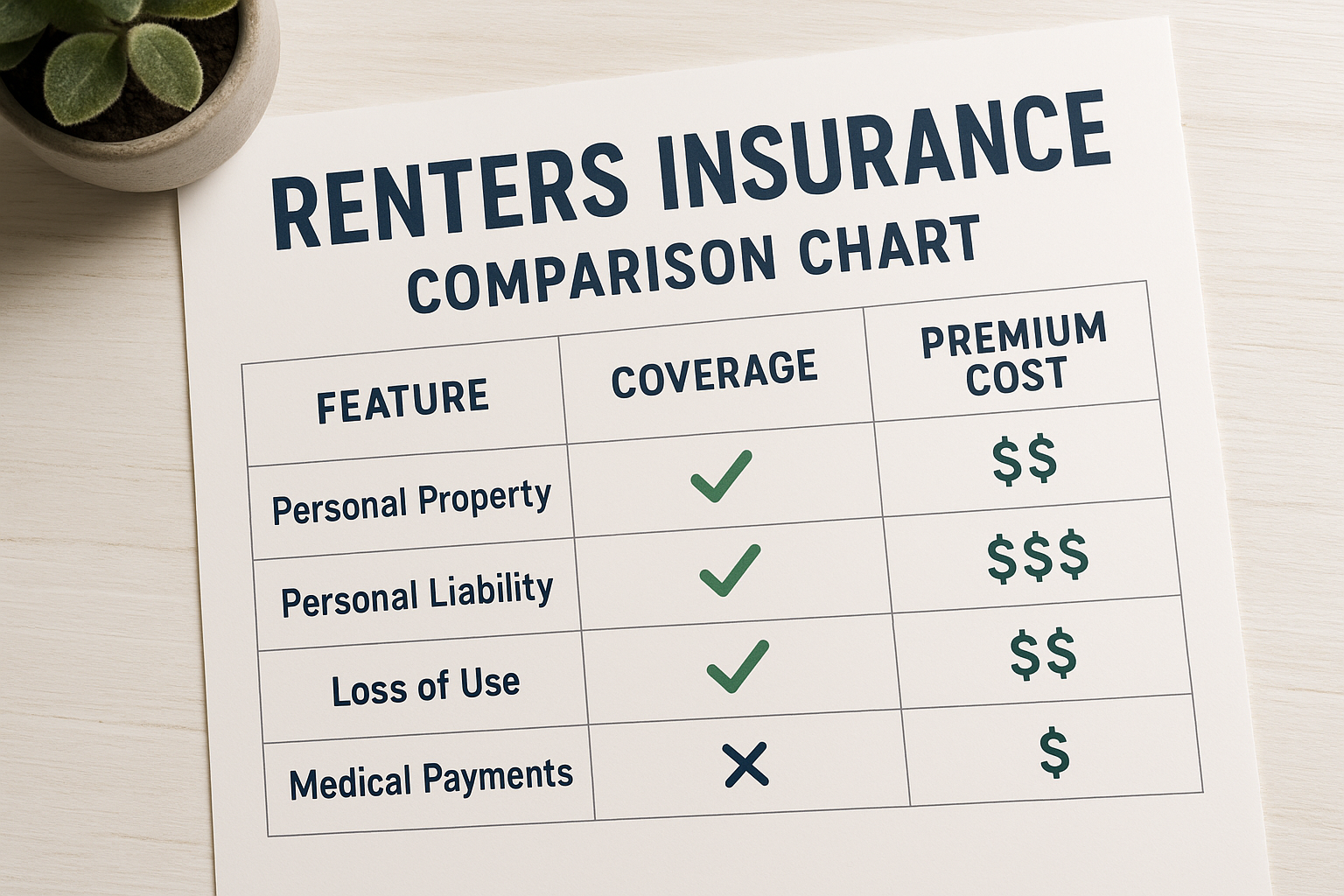

Renters insurance offers a range of benefits beyond just property protection. One of the primary advantages is liability coverage, which protects you if someone is injured in your home or if you accidentally cause damage to someone else's property. This coverage can save you from significant out-of-pocket expenses in legal fees or settlements.

Additionally, renters insurance can include loss-of-use coverage, which provides funds for temporary living expenses if your home becomes uninhabitable due to a covered event. This means you won't have to worry about finding a place to stay or how to afford it if disaster strikes.

Exploring the Best Renters Insurance Options

When searching for the best renters insurance, it's crucial to compare policies from different providers to find one that fits your needs and budget. Many insurers offer customizable policies, allowing you to add specific coverage options like identity theft protection or increased limits for high-value items. As you browse options, pay attention to customer reviews and ratings, as these can provide valuable insights into the company's reliability and customer service.

Common Discounts and Savings Opportunities

Renters insurance is often more affordable than people expect, with average premiums costing around $15 to $20 per month1. However, there are several ways to save even more. Many insurers offer discounts for bundling renters insurance with other policies, such as auto insurance. Additionally, you may qualify for savings if your rental property has safety features like smoke detectors, security systems, or deadbolt locks2.

Real-World Examples and Case Studies

Consider the case of a young professional who recently moved into a city apartment. By choosing a renters insurance policy that offered a discount for having a fire alarm system and bundling with their existing car insurance, they were able to reduce their monthly premium by nearly 20%. This real-world example highlights the potential savings and value that can be achieved by carefully selecting and customizing a renters insurance policy.

Taking Action: Secure Your Peace of Mind

As you see these options, it's important to take the time to review what each policy offers and how it aligns with your specific needs. By doing so, you can ensure that you're not only protecting your belongings but also taking advantage of potential savings and added benefits. Whether you're a first-time renter or looking to switch providers, the right renters insurance policy can provide invaluable protection and peace of mind.