Unlock exclusive deals best renters insurance Texas offers today

Unlock the best renters insurance deals in Texas today and protect your home with confidence while saving money by browsing options and visiting websites that offer exclusive promotions tailored just for you.

Understanding Renters Insurance in Texas

Renters insurance is a crucial safeguard for anyone leasing a property, offering protection for personal belongings and liability coverage. In Texas, the need for renters insurance is heightened by the state's unique weather conditions, ranging from hurricanes on the coast to tornadoes in the plains. This makes securing a policy not just a prudent choice, but often a necessary one to ensure peace of mind.

Why You Should Invest in Renters Insurance

Investing in renters insurance can protect you from significant financial loss. For example, if a fire or flood damages your rental home, renters insurance can cover the cost of replacing your belongings. Furthermore, it provides liability coverage in case someone is injured on your property and sues you. The average cost of renters insurance in Texas is quite affordable, typically around $15 to $30 per month, depending on the coverage and provider1.

Exclusive Deals and Discounts

Many insurance companies offer exclusive deals and discounts for Texas residents. Common discounts include bundling renters insurance with other policies like auto insurance, which can save you up to 10% or more2. Additionally, some providers offer discounts for safety features such as smoke detectors, security alarms, and sprinkler systems. It's worth your time to search options and compare different providers to find the best deal.

How to Choose the Right Policy

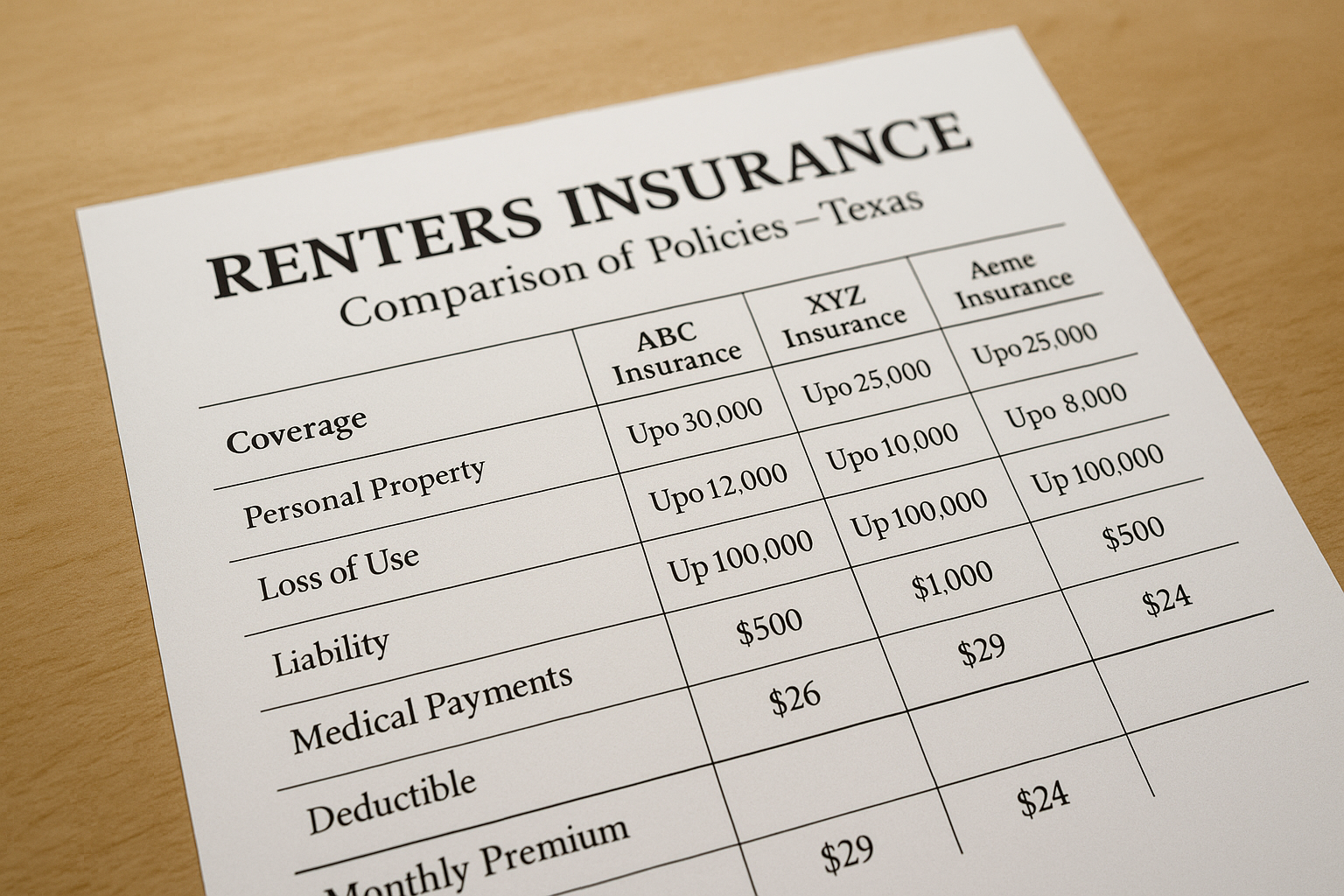

Selecting the right renters insurance policy involves evaluating your specific needs. Consider the value of your personal belongings and the amount of liability coverage you require. Most policies offer a minimum of $100,000 in liability coverage, but you may need more depending on your circumstances3. It's also essential to understand the difference between actual cash value and replacement cost coverage. The latter ensures you can replace items at their current market value, which is often more beneficial.

Additional Coverage Options

For those with unique needs, there are additional coverage options available. For instance, if you own high-value items like jewelry or electronics, you might need a rider or endorsement to cover these specifically. Flood insurance is another critical consideration in Texas, as standard renters insurance typically does not cover flood damage4.

Steps to Secure the Best Deals

To secure the best renters insurance deals in Texas, follow these steps:

- Assess your insurance needs based on the value of your belongings and potential liabilities.

- Compare quotes from multiple insurance providers to find competitive rates.

- Look for bundling discounts and inquire about other available discounts.

- Review the policy details carefully to ensure it meets your needs.

- Consider additional coverage options if necessary.

By taking these steps, you can find a policy that offers the protection you need at a price you can afford. Remember, the right renters insurance policy is an investment in your peace of mind and financial security.

As you explore your options, keep in mind the variety of specialized services and deals available to Texas residents. By browsing options and visiting websites, you can unlock the best renters insurance deals and ensure your home is well-protected.