Choose Wisely Guaranteed vs Indexed Universal Life Battle

Choosing between Guaranteed and Indexed Universal Life insurance can significantly impact your financial security, so take a moment to browse options and see these opportunities to ensure you make the right decision.

Understanding Guaranteed Universal Life Insurance

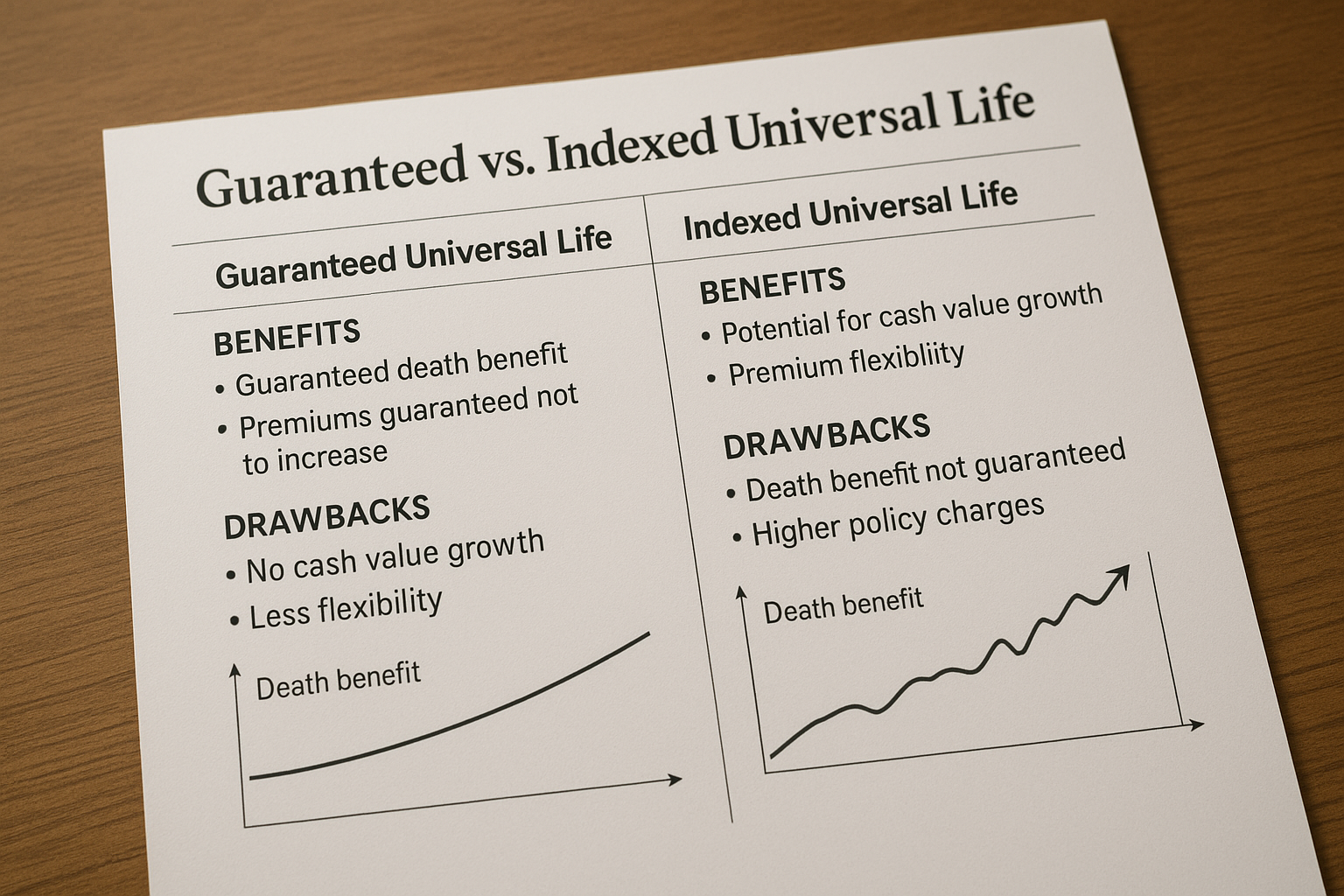

Guaranteed Universal Life (GUL) insurance offers a blend of affordable premiums and lifetime coverage, making it a popular choice for individuals seeking stability and predictability. Unlike traditional whole life insurance, GUL policies focus less on cash value accumulation and more on providing a death benefit that lasts your entire life, as long as premiums are paid. This type of policy is particularly appealing to those who want the assurance of a permanent death benefit without the high costs associated with whole life insurance.

One of the key benefits of GUL is its flexible premium structure. You can adjust the amount and frequency of your payments, which can be advantageous if your financial situation changes over time. However, the primary appeal lies in its guaranteed death benefit, which remains intact regardless of market fluctuations1.

Exploring Indexed Universal Life Insurance

Indexed Universal Life (IUL) insurance offers a different approach by combining death benefit protection with the potential for cash value growth linked to a stock market index, such as the S&P 500. This feature allows policyholders to potentially earn higher returns compared to traditional fixed-interest policies, without directly investing in the stock market2.

IUL policies are attractive for those interested in building wealth over time while maintaining life insurance coverage. The cash value component can be used for various purposes, such as supplementing retirement income or funding significant life events. However, it’s important to note that while the potential for growth is higher, there is also more risk involved, as returns are not guaranteed and can fluctuate with market performance.

Comparing Costs and Benefits

When deciding between GUL and IUL, cost is a significant factor. GUL policies typically have lower premiums compared to IUL because they do not offer the same level of cash value growth potential. For those who prioritize lifetime coverage at a predictable cost, GUL can be a more economical choice.

Conversely, IUL policies may have higher premiums due to their investment component, but they offer the opportunity for cash value growth. This growth potential can offset higher initial costs over time, especially if the market performs well. It’s crucial to evaluate your financial goals and risk tolerance when considering IUL3.

Making the Right Choice for You

Ultimately, the decision between Guaranteed and Indexed Universal Life insurance should align with your financial objectives and risk appetite. If you seek stability and guaranteed coverage, GUL might be the better option. However, if you're comfortable with some level of risk and are interested in potentially growing your cash value, IUL could be more suitable.

To make an informed decision, consider consulting with a financial advisor who can provide personalized guidance based on your unique circumstances. Additionally, visiting websites and exploring specialized services can offer more tailored solutions to meet your insurance needs.