Maximize Profits With Insider Rental Property Report

Maximize your rental property profits by exploring insightful strategies and expert tips that can transform your investment approach, and see these options to elevate your earnings potential today.

Understanding the Rental Property Market

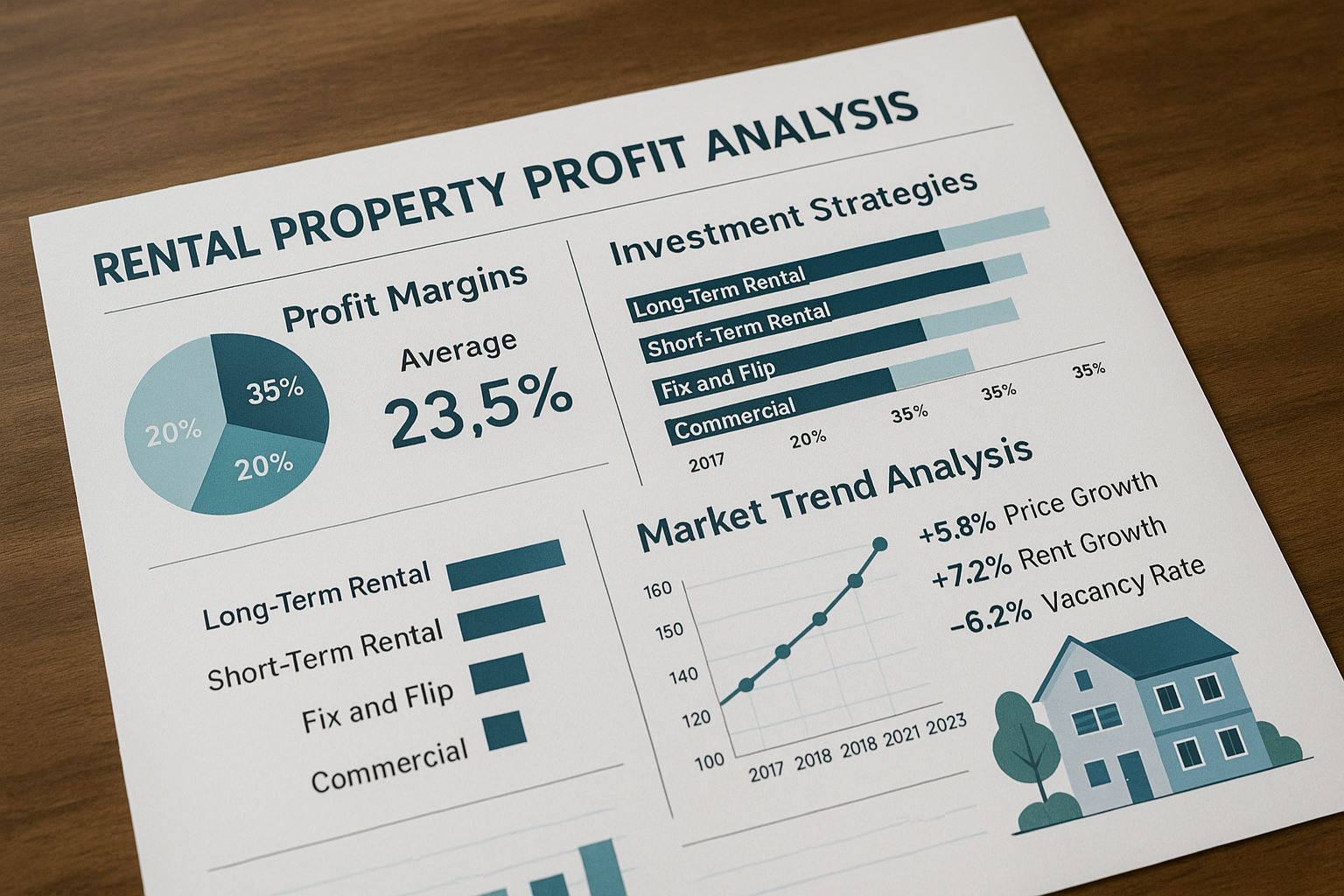

The rental property market offers a lucrative opportunity for investors looking to generate steady income and build long-term wealth. As of 2023, the demand for rental properties remains robust, driven by factors such as urbanization, housing shortages, and changing lifestyle preferences1. By leveraging insider knowledge and strategic insights, you can maximize your returns and stay ahead in this competitive market.

Key Strategies to Boost Rental Income

One of the most effective ways to enhance your rental income is by setting competitive rental rates. Conduct thorough market research to understand the average rental prices in your area and adjust your rates accordingly. This ensures that your property remains attractive to potential tenants while maximizing your earnings2.

Additionally, consider offering value-added services or amenities, such as high-speed internet, pet-friendly policies, or smart home technology. These features can justify higher rent and attract a broader range of tenants. Implementing energy-efficient upgrades can also reduce utility costs, making your property more appealing and environmentally friendly.

Managing Costs and Increasing Efficiency

Efficient property management is crucial for maintaining profitability. Hiring a professional property management company can help streamline operations, reduce vacancies, and handle maintenance issues promptly. While this incurs an additional cost, the long-term benefits often outweigh the expenses3.

Regularly reviewing and optimizing your property expenses is another vital step. This includes negotiating better deals with service providers, such as landscapers or cleaning services, and exploring insurance options that offer comprehensive coverage at competitive rates.

Tax Benefits and Financial Incentives

Rental property owners can take advantage of various tax benefits and financial incentives. Mortgage interest, property taxes, and operating expenses are generally deductible, reducing your taxable income4. Additionally, depreciation allows you to recover the cost of your property over time, further enhancing your financial position.

It's essential to stay informed about local and federal tax laws to ensure you maximize these benefits. Consulting with a tax professional can provide valuable insights and help you navigate the complexities of property-related tax regulations.

Exploring Technology and Market Trends

The integration of technology in property management is revolutionizing the rental industry. Online platforms for listing properties, virtual tours, and digital lease agreements have streamlined the rental process, making it more efficient and accessible for both landlords and tenants5.

Staying updated with market trends, such as the growing demand for flexible living arrangements and co-living spaces, can also provide a competitive edge. By adapting to these trends, you can attract a diverse tenant base and maximize your property's occupancy rate.

Maximizing profits from rental properties requires a strategic approach that encompasses competitive pricing, efficient management, and leveraging tax benefits. By staying informed and adapting to market trends, you can enhance your investment's profitability and secure a stable financial future. For those eager to delve deeper, numerous resources and specialized services are available to guide you through the process and help you unlock the full potential of your rental property investments.