Access Top High Yield Savings Rates Instantly Today

Unlock the potential of your savings by exploring top high-yield savings rates available today, and see these options to maximize your financial growth effortlessly.

Understanding High-Yield Savings Accounts

High-yield savings accounts are specialized financial products that offer interest rates significantly higher than traditional savings accounts. These accounts are designed to help you grow your savings faster, providing a safe and reliable way to earn more on your deposited funds. Typically, these accounts are offered by online banks, credit unions, and some traditional banks aiming to attract customers with competitive rates.

The allure of high-yield savings accounts lies in their ability to offer returns that often outpace inflation, ensuring that your money retains its purchasing power over time. This is particularly important in today's economic climate, where inflation rates can erode the value of stagnant savings.

How to Access Top Rates Instantly

To access the best high-yield savings rates, you should start by researching and comparing different financial institutions. Online platforms and financial websites often list current rates, allowing you to browse options and identify the most competitive offers. Many banks offer easy online account setup, enabling you to start earning higher interest rates almost immediately.

When evaluating high-yield savings accounts, consider factors such as the annual percentage yield (APY), minimum balance requirements, and any associated fees. Some accounts may offer promotional rates that are higher for an introductory period, so it's essential to read the fine print and understand the terms and conditions.

The Benefits of High-Yield Savings Accounts

High-yield savings accounts offer several advantages beyond just higher interest rates. They provide liquidity, allowing you to access your funds when needed without penalties commonly associated with other investment vehicles like CDs or bonds. Additionally, these accounts are typically insured by the FDIC or NCUA, offering peace of mind that your deposits are protected up to $250,000 per depositor, per institution.

Moreover, high-yield savings accounts can serve as an excellent complement to your financial strategy. They are ideal for building an emergency fund, saving for short-term goals, or simply parking cash while earning a competitive return.

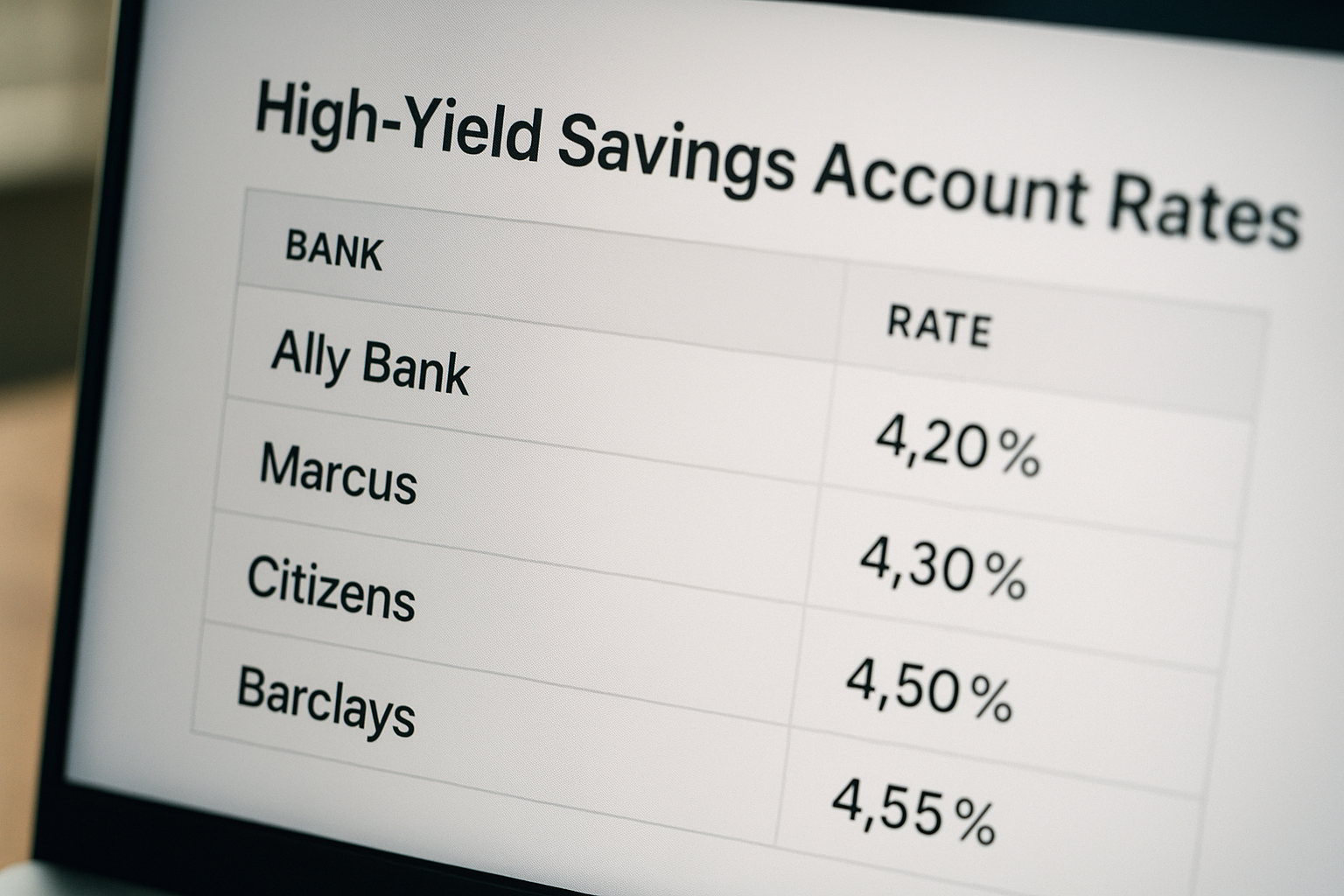

Current Market Trends and Rates

As of the latest data, high-yield savings accounts offer APYs ranging from 3% to 5%, depending on the institution and account conditions1. Online banks often lead the charge with the highest rates, as they have lower overhead costs compared to traditional brick-and-mortar banks. It's not uncommon to find promotional offers that provide even higher rates for new customers.

It's important to note that interest rates can fluctuate based on economic conditions and monetary policy decisions. Therefore, staying informed about market trends and regularly reviewing your savings strategy can help ensure you're taking advantage of the best opportunities.

Steps to Open a High-Yield Savings Account

Opening a high-yield savings account is usually straightforward. Here’s a general process you can follow:

- Research and compare rates from various financial institutions.

- Visit websites of selected banks to review terms and conditions.

- Gather necessary documents, such as identification and proof of address.

- Complete the online application form, providing personal and financial information.

- Fund your account to meet any minimum deposit requirements.

Once your account is set up, you can start enjoying the benefits of higher interest earnings on your savings.

By understanding the nuances of high-yield savings accounts and taking proactive steps to explore your options, you can significantly enhance your financial growth. Whether you're saving for a specific goal or simply looking to make your money work harder for you, these accounts offer a practical and rewarding solution. Explore the resources and opportunities available today to make the most of your savings potential.