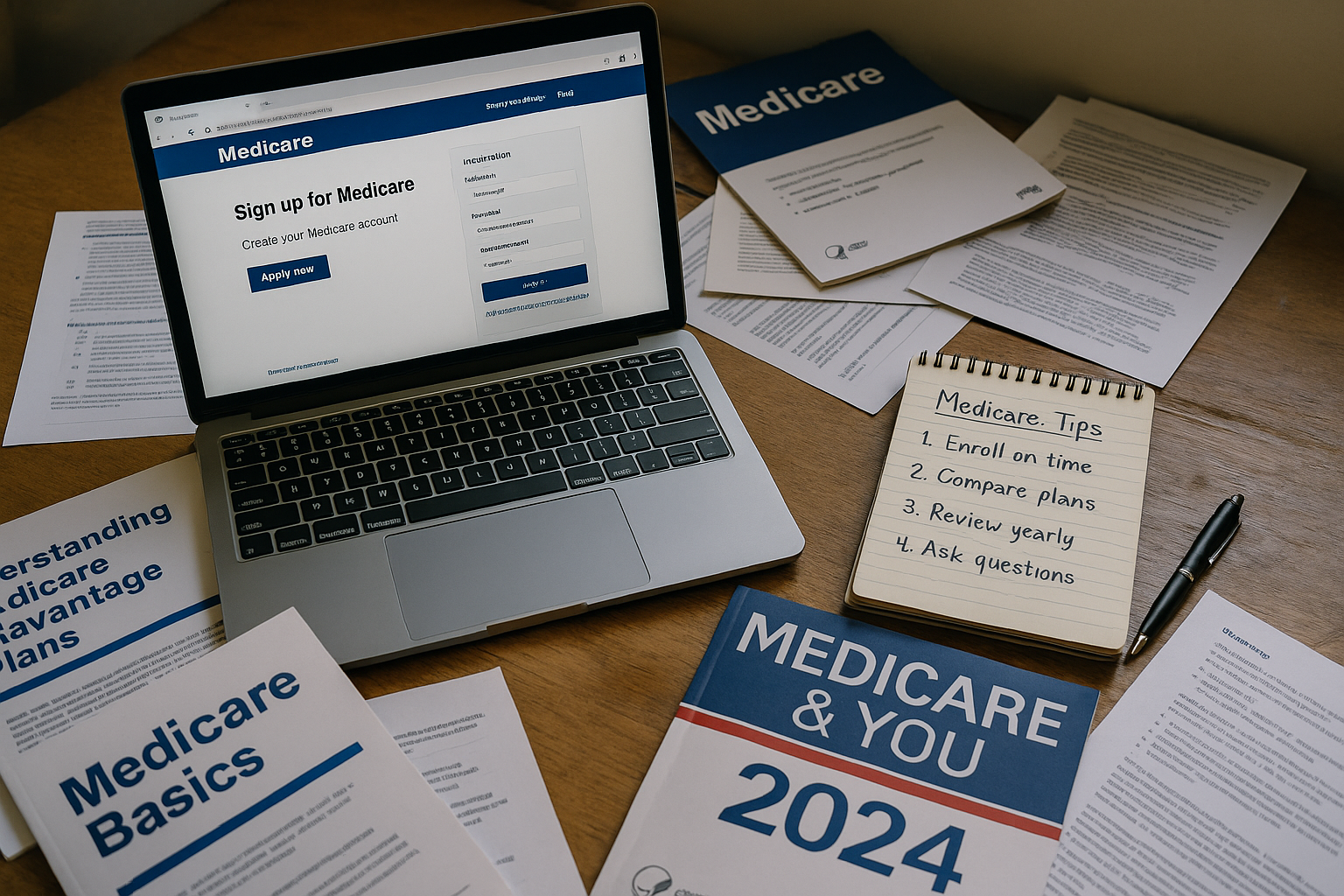

Beat The Medicare Signup Maze With These Insider Tips

Are you feeling overwhelmed by the complexities of Medicare enrollment and eager to discover insider tips that will help you navigate the maze with confidence and clarity? Browse options and see these opportunities that can save you time and stress.

Understanding the Basics of Medicare Enrollment

Medicare is a federal health insurance program primarily for individuals aged 65 and older, but it also covers some younger people with disabilities or specific health conditions. The enrollment process can be daunting due to the numerous options and deadlines involved. Understanding the basics is the first step toward making informed decisions about your healthcare coverage.

The Different Parts of Medicare

Medicare is divided into several parts, each covering different aspects of healthcare:

- Part A: Hospital Insurance, which covers inpatient hospital stays, care in a skilled nursing facility, hospice care, and some home health care.

- Part B: Medical Insurance, covering certain doctors' services, outpatient care, medical supplies, and preventive services.

- Part C: Medicare Advantage Plans, which are an alternative to Original Medicare and are offered by private companies approved by Medicare. These plans often include additional benefits like dental and vision care.

- Part D: Prescription Drug Coverage, which helps cover the cost of prescription drugs.

Choosing the right combination of these parts is crucial, as it affects your coverage and out-of-pocket costs. It's important to browse options and compare plans to find what best suits your healthcare needs and budget.

Key Enrollment Periods to Know

Missing the right enrollment window can lead to penalties or gaps in coverage. Here are the critical periods to be aware of:

- Initial Enrollment Period (IEP): This is a seven-month period that starts three months before the month you turn 65 and ends three months after. Enrolling during this time ensures you have coverage when you need it.

- General Enrollment Period (GEP): If you miss your IEP, you can enroll between January 1 and March 31 each year, with coverage starting on July 1. However, late enrollment penalties may apply.

- Special Enrollment Period (SEP): If you're still working and have health coverage through your employer, you may qualify for an SEP, allowing you to enroll without penalties after your employment ends.

Understanding these timelines is essential for avoiding unnecessary costs and ensuring continuous coverage.

Insider Tips to Simplify Your Medicare Journey

Here are some expert tips to help you navigate the Medicare maze more efficiently:

Financial Considerations and Potential Savings

The cost of Medicare can vary significantly depending on the plans and coverage you choose. For example, while Part A is usually premium-free if you or your spouse paid Medicare taxes for a certain period, Part B comes with a standard premium that can change annually1. Additionally, Medicare Advantage and Part D plans have their own costs, which can include premiums, deductibles, and co-pays.

To maximize savings, it's essential to compare plans and consider any additional benefits they offer, such as wellness programs or gym memberships. Some Medicare Advantage plans may offer these perks at no extra cost, providing added value to your healthcare coverage2.

By taking advantage of these insider tips and resources, you can confidently navigate the Medicare enrollment maze, ensuring you select the best plan for your healthcare needs while potentially saving money. Remember to browse options, consult experts, and stay informed about changes in Medicare policies to make the most of your coverage.