Cut Costs Now Technology E&O Insurance Goldmine

In the fast-paced world of technology, cutting costs without compromising on quality is crucial, and exploring Technology Errors & Omissions (E&O) Insurance options can be your golden ticket to safeguarding your business while maintaining financial efficiency—browse options, search options, and see these options to find the best fit for your needs.

Understanding Technology E&O Insurance

Technology E&O Insurance, often referred to as professional liability insurance for tech companies, is designed to protect businesses from claims of negligence, errors, or omissions in the services they provide. In an industry where even a minor oversight can lead to significant financial repercussions, having this insurance is not just a safety net but a strategic asset. By mitigating risks associated with lawsuits and claims, businesses can focus on innovation and growth.

The Financial Benefits of Technology E&O Insurance

Investing in Technology E&O Insurance can lead to substantial cost savings in the long run. The average cost of a data breach, for instance, was estimated to be around $4.24 million in 20211. With the right insurance policy, businesses can avoid these exorbitant costs, as the insurance covers legal fees, settlements, and any other financial liabilities that may arise from a claim. Furthermore, having E&O coverage can enhance a company's reputation, making it more attractive to potential clients and partners who value risk management.

Tailoring Your Insurance to Fit Your Needs

Not all Technology E&O Insurance policies are created equal, and it's important to tailor your coverage to fit the specific needs of your business. Factors to consider include the size of your company, the nature of your services, and your client base. Many insurers offer customizable plans, allowing you to select coverage limits and deductibles that align with your risk tolerance and budget. By visiting websites of various providers, you can compare policies and find one that offers the best balance of coverage and cost.

Real-World Examples and Pricing Insights

Consider a mid-sized software development firm that recently faced a lawsuit due to a software malfunction that led to significant client losses. Without Technology E&O Insurance, the company would have been responsible for legal fees and damages, potentially crippling its finances. However, with a comprehensive policy in place, the insurer covered these costs, allowing the firm to continue operations without major financial strain.

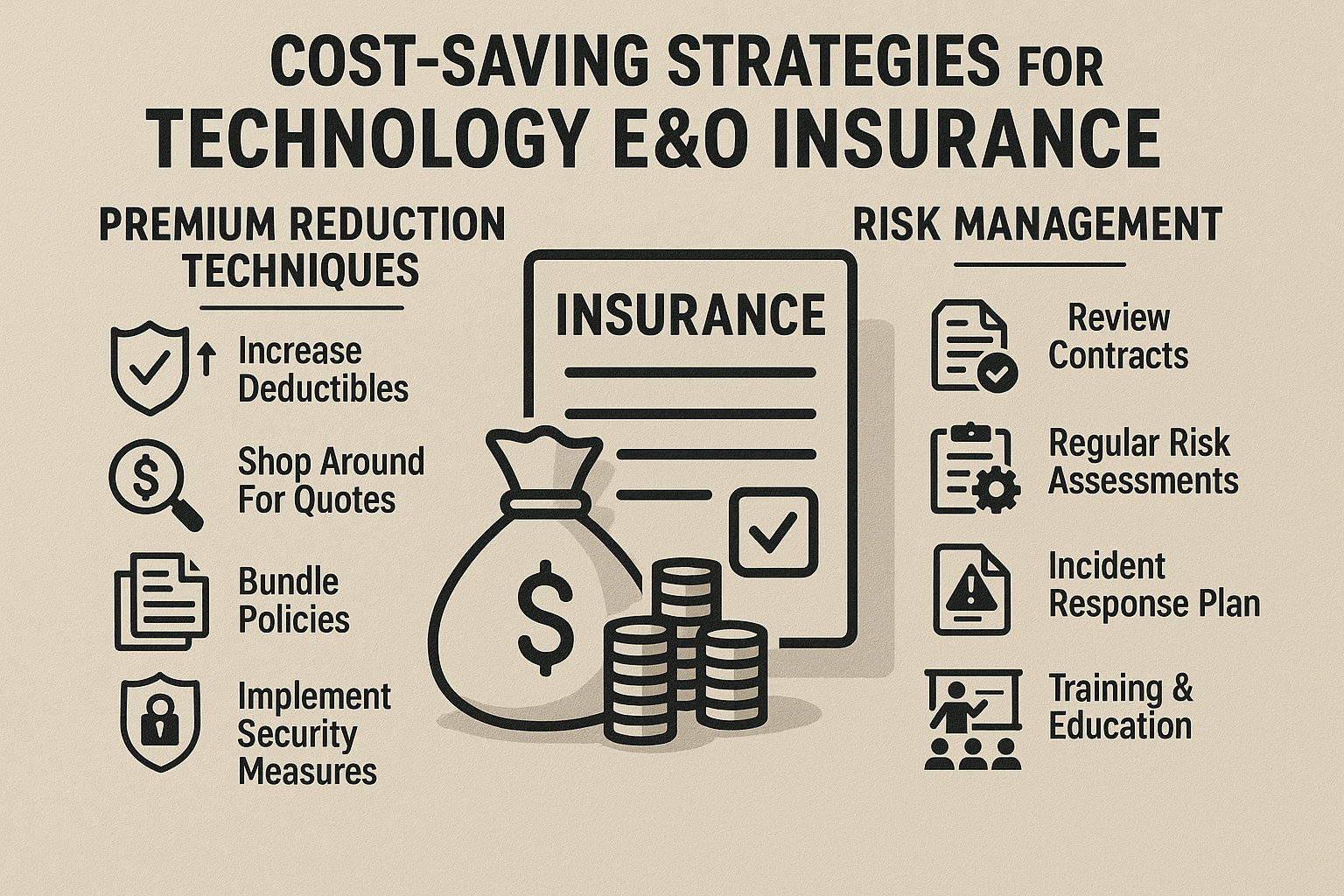

In terms of pricing, the cost of Technology E&O Insurance varies depending on several factors, including the company's size, revenue, and risk exposure. Generally, premiums for small to medium-sized tech firms range from $1,000 to $5,000 annually2. By following the options and comparing different insurers, businesses can find competitive rates and potentially secure discounts for bundling policies or implementing risk management strategies.

Exploring Further Options and Resources

For businesses keen on optimizing their insurance strategy, numerous resources and specialized services are available. Consulting with an insurance broker who specializes in technology can provide valuable insights and help identify the best policy options. Additionally, many insurers offer online tools for quote comparisons and policy management, making it easier for businesses to stay informed and make educated decisions.

Ultimately, Technology E&O Insurance is more than just a protective measure; it's a strategic investment that can provide peace of mind and financial stability. By understanding the benefits and exploring the available options, you can ensure that your business is well-equipped to handle any challenges that come its way.