Cut Costs With Best Cyber Liability Insurance Quote Comparison

Cutting costs on cyber liability insurance is easier than you think when you take the time to browse options and compare quotes from top providers, ensuring you find the best coverage at the most competitive price.

Understanding Cyber Liability Insurance

In today's digital age, cyber liability insurance has become a crucial component for businesses of all sizes. This type of insurance protects companies from financial losses due to cyberattacks, data breaches, and other online threats. As cybercrime continues to rise, having a robust cyber liability policy is not just a luxury but a necessity. By understanding the different aspects of these policies, you can make informed decisions that safeguard your business without breaking the bank.

Benefits of Comparing Cyber Liability Insurance Quotes

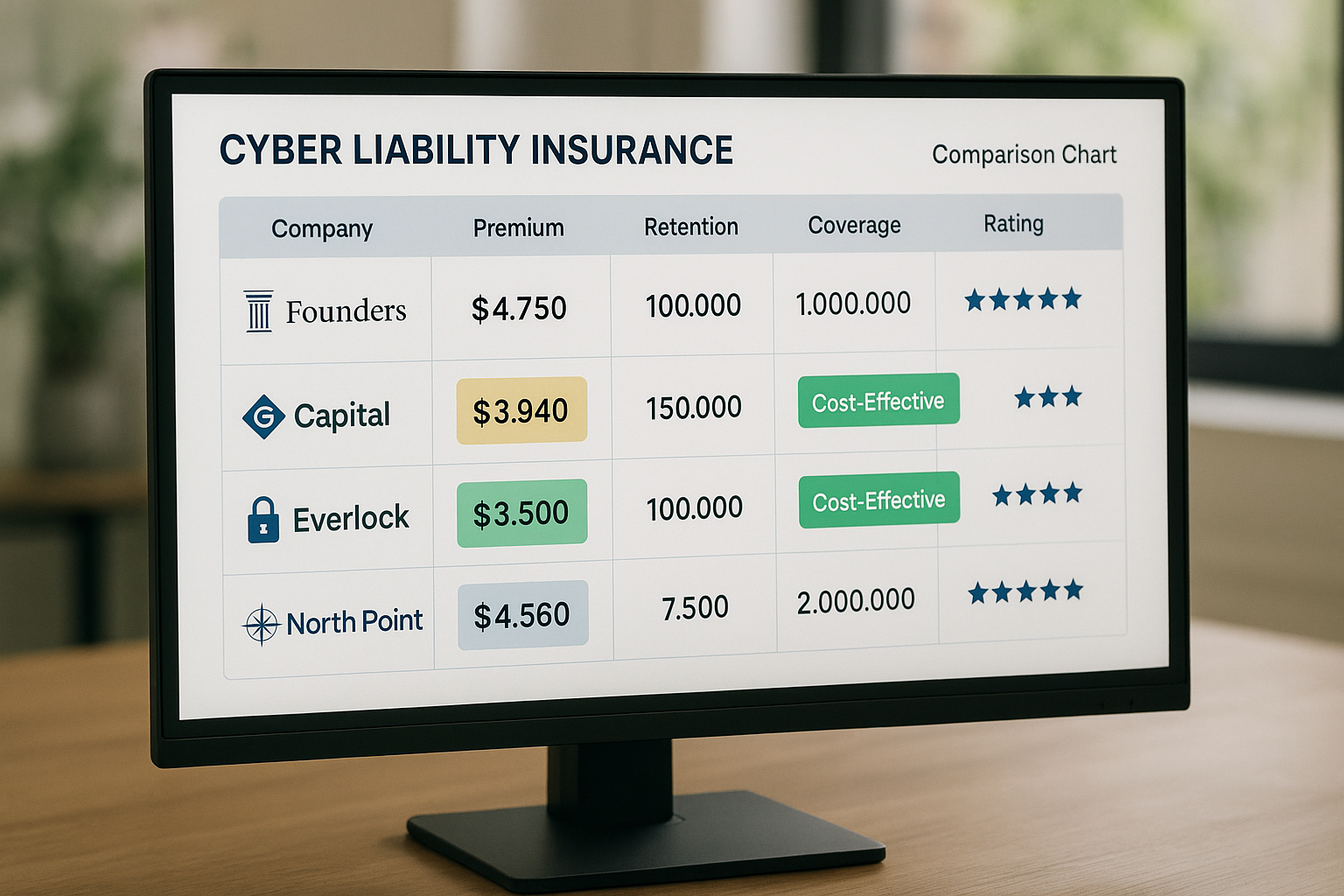

Comparing quotes from different insurers can lead to significant cost savings. Insurance providers offer varying coverage options, limits, and premiums. By evaluating these factors, you can identify a policy that meets your needs without unnecessary expenses. Additionally, some insurers offer discounts or bundled packages if you purchase multiple types of insurance, such as general liability or property insurance. This approach can further reduce your overall insurance costs.

Key Factors to Consider

When comparing cyber liability insurance quotes, consider the following factors:

1. **Coverage Limits**: Ensure the policy provides adequate coverage for potential data breach costs, including legal fees, notification expenses, and crisis management.

2. **Policy Exclusions**: Be aware of what is not covered by the policy. Common exclusions include intentional acts by employees or pre-existing conditions.

3. **Deductibles**: Higher deductibles can lower your premium, but ensure you can afford the out-of-pocket expenses in the event of a claim.

4. **Insurer Reputation**: Research the insurer's reputation and financial stability. You want a provider known for reliable claims processing and customer service.

Real-World Examples and Pricing

The cost of cyber liability insurance varies based on several factors, including the size of your business, the industry, and your risk profile. For instance, a small business in the retail sector might pay between $1,000 and $5,000 annually for a policy with a $1 million coverage limit1. Larger companies or those in high-risk industries, such as finance or healthcare, can expect higher premiums due to increased exposure to cyber threats.

How to Get the Best Quotes

To get the best quotes, start by assessing your business's specific risks and coverage needs. Then, reach out to multiple insurers or use online comparison tools to gather quotes. Be sure to provide accurate information to receive precise estimates. Additionally, consider working with an insurance broker who specializes in cyber liability insurance to navigate complex policy terms and find the best deals.

Exploring Additional Resources

For businesses looking to deepen their understanding or explore specialized insurance options, many resources are available. Websites like the National Association of Insurance Commissioners (NAIC) offer valuable insights into insurance regulations and consumer rights2. Additionally, consulting with cybersecurity experts can help you implement best practices that may lower your insurance costs by reducing your risk profile.

In summary, by taking the time to compare cyber liability insurance quotes, you can secure the best coverage for your business needs while keeping costs manageable. Don't hesitate to visit websites and follow the options available to find the perfect policy that protects your company from the ever-evolving landscape of cyber threats.