Cut Mortgage Costs Now with Easy Refinance Comparison Secrets

Cutting down your mortgage costs can be easier than you think when you take advantage of refinance comparison secrets that allow you to browse options, visit websites, and explore the best deals available today.

Understanding Mortgage Refinancing

Mortgage refinancing is the process of replacing your current home loan with a new one, typically with better terms. This can lead to significant savings on your monthly payments, reduce your interest rate, or even allow you to pay off your mortgage sooner. By refinancing, you can potentially lower your interest rate by 0.5% to 1%, which can translate into thousands of dollars saved over the life of your loan1.

Why Refinance Now?

The current economic climate presents a unique opportunity for homeowners to refinance. Interest rates have been historically low, making it an ideal time to lock in better terms. By acting now, you can capitalize on these favorable conditions before rates potentially rise again2. Additionally, lenders are offering various incentives and reduced fees for refinancing, which can further reduce your costs.

How to Compare Refinance Options

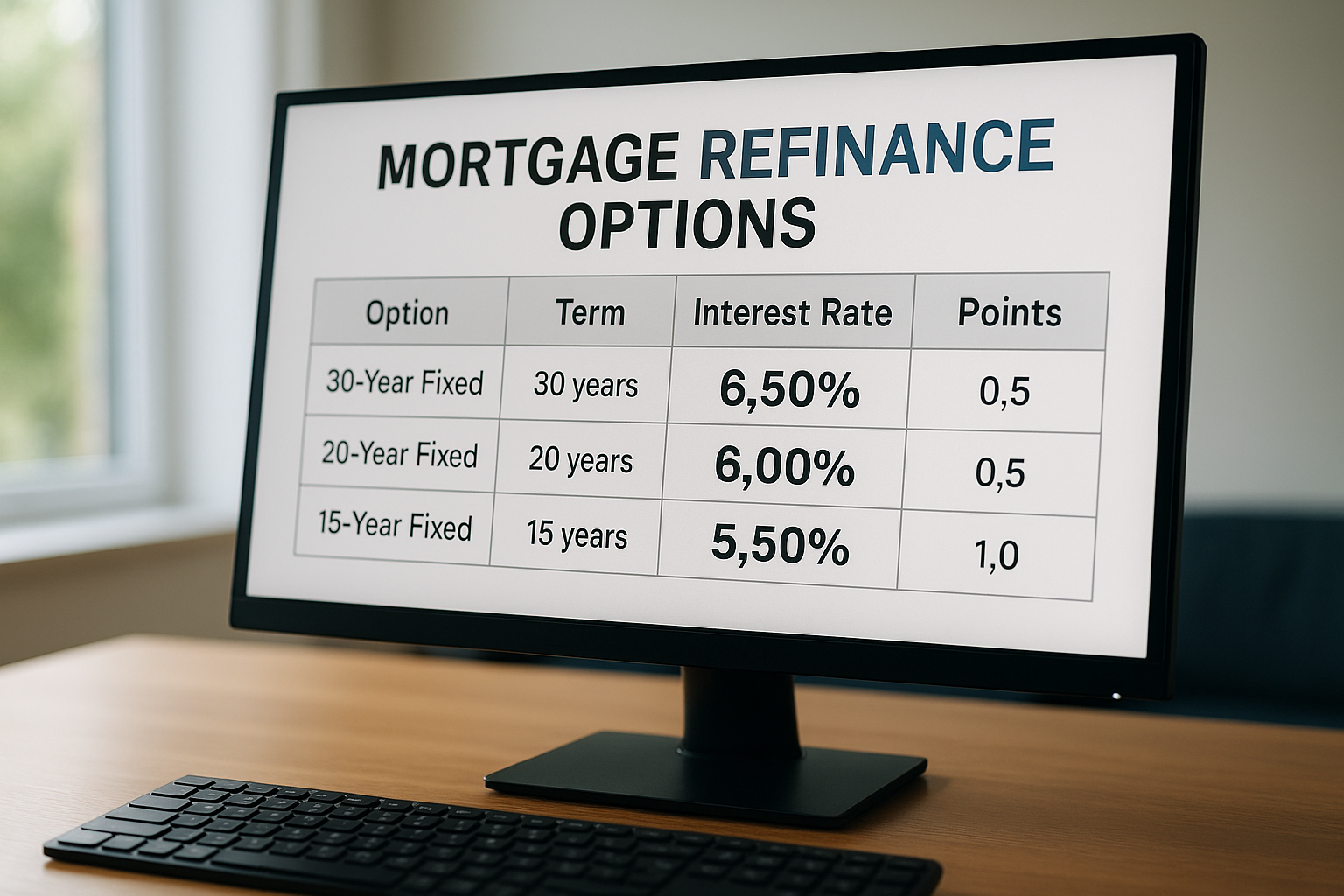

To effectively compare refinance options, start by gathering quotes from multiple lenders. This will give you a comprehensive view of the available rates and terms. Consider using online comparison tools that allow you to input your loan details and instantly see a range of offers. These tools can save you time and help you identify the most competitive rates3.

Next, evaluate the total cost of refinancing, including any closing costs, application fees, and potential penalties for early repayment. Some lenders might offer no-closing-cost refinancing, which can be beneficial if you're looking to minimize upfront expenses. However, it's crucial to weigh these against the long-term savings you expect to gain.

Real-World Savings and Examples

Consider a homeowner with a $300,000 mortgage at a 4.5% interest rate. By refinancing to a 3.5% rate, they could save approximately $167 per month, which amounts to over $2,000 annually4. Over a 30-year term, this could lead to savings of more than $60,000. Such tangible benefits make exploring refinancing options a smart financial move.

Additional Resources and Specialized Services

For those looking to delve deeper into refinancing options, consider consulting with a financial advisor or mortgage specialist. They can provide personalized advice and guide you through the complexities of the refinancing process. Additionally, many online platforms offer calculators and resources to help you understand your potential savings further.

By taking the time to search options and compare different refinancing offers, you can make an informed decision that aligns with your financial goals. Whether you're looking to reduce your monthly payments or shorten your loan term, the right refinance strategy can pave the way for significant financial benefits.