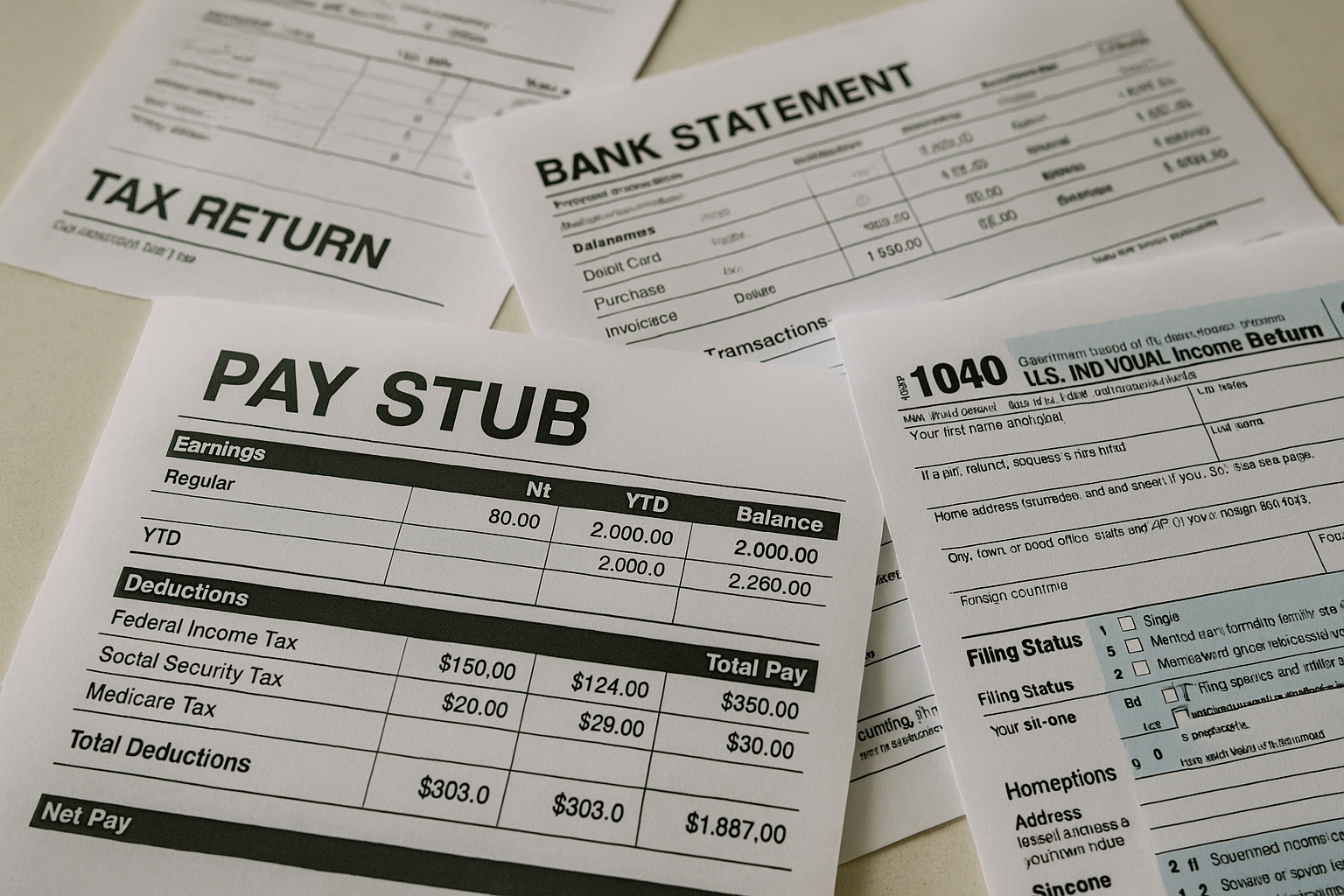

Easiest Way Bank Mortgages Even Without W-2 Forms

If you're looking to secure a bank mortgage without the traditional W-2 forms, you're in the right place to discover how you can browse options and find solutions tailored to your unique financial situation.

Understanding Non-Traditional Mortgages

Securing a mortgage without W-2 forms might seem daunting, but it's entirely possible with the right approach and knowledge. Traditional mortgages often require proof of income through W-2 forms, which can be a hurdle for self-employed individuals, freelancers, or those with non-traditional income streams. Fortunately, there are mortgage options specifically designed for such scenarios.

Bank Statement Loans

One of the most popular alternatives is a bank statement loan. These loans allow borrowers to use personal or business bank statements to verify income instead of W-2s or tax returns. Typically, lenders will review 12-24 months of bank statements to assess income stability and cash flow. This option is ideal for self-employed individuals or those with fluctuating incomes, as it provides a more accurate picture of their financial situation.

Asset-Based Loans

Another viable option is an asset-based loan, where the lender evaluates the borrower's assets, such as savings, investments, or real estate, to determine eligibility. This type of loan is beneficial for individuals who may have significant assets but lack traditional income documentation. Asset-based loans often come with higher interest rates due to the increased risk for lenders, but they offer a pathway to homeownership for those who otherwise might not qualify.

Alternative Documentation Loans

Alternative documentation loans, or "alt-doc" loans, require less traditional forms of income verification. Instead of W-2s, these loans might accept a combination of bank statements, profit and loss statements, or even letters from clients or employers. This flexibility makes them an attractive option for individuals with non-traditional employment or income sources.

Benefits and Considerations

Opting for a non-traditional mortgage can offer several benefits. It allows greater flexibility in terms of income verification and can open doors for individuals who are self-employed or have varied income streams. However, it's important to note that these loans often come with higher interest rates and may require a larger down payment compared to traditional mortgages. Borrowers should carefully assess their financial situation and consult with a mortgage professional to understand the full implications.

How to Get Started

To begin the process of securing a mortgage without W-2 forms, start by gathering your financial documents, such as bank statements, asset records, and any other income verification you can provide. Research lenders who specialize in non-traditional mortgages and compare their offerings. Many financial institutions now offer online platforms where you can easily browse options and submit applications.

Additionally, consider reaching out to a mortgage broker who can provide guidance and connect you with lenders that match your unique financial profile. Brokers often have access to a wider array of loan products and can help you navigate the complexities of non-traditional mortgages.

In summary, while securing a mortgage without W-2 forms requires a different approach, it is entirely feasible with the right preparation and resources. By exploring bank statement loans, asset-based loans, and alternative documentation loans, you can find a solution that fits your financial needs and goals. Remember, there are numerous resources and specialized services available to assist you in this journey, so don't hesitate to explore these options further.