Effortlessly Automate Fintech Crime Insurance Certificate Solutions

Effortlessly automating your fintech crime insurance certificate solutions can streamline your processes and save you valuable time, so why not browse options today to discover how these solutions can revolutionize your operations?

Understanding Fintech Crime Insurance Certificate Solutions

In the fast-evolving world of financial technology, the need for robust and efficient crime insurance solutions has never been more critical. Fintech companies are increasingly targeted by cybercriminals, necessitating comprehensive insurance coverage to mitigate risks. Automating the issuance and management of insurance certificates can significantly enhance operational efficiency, reduce manual errors, and ensure compliance with regulatory standards.

The Benefits of Automation in Fintech Insurance

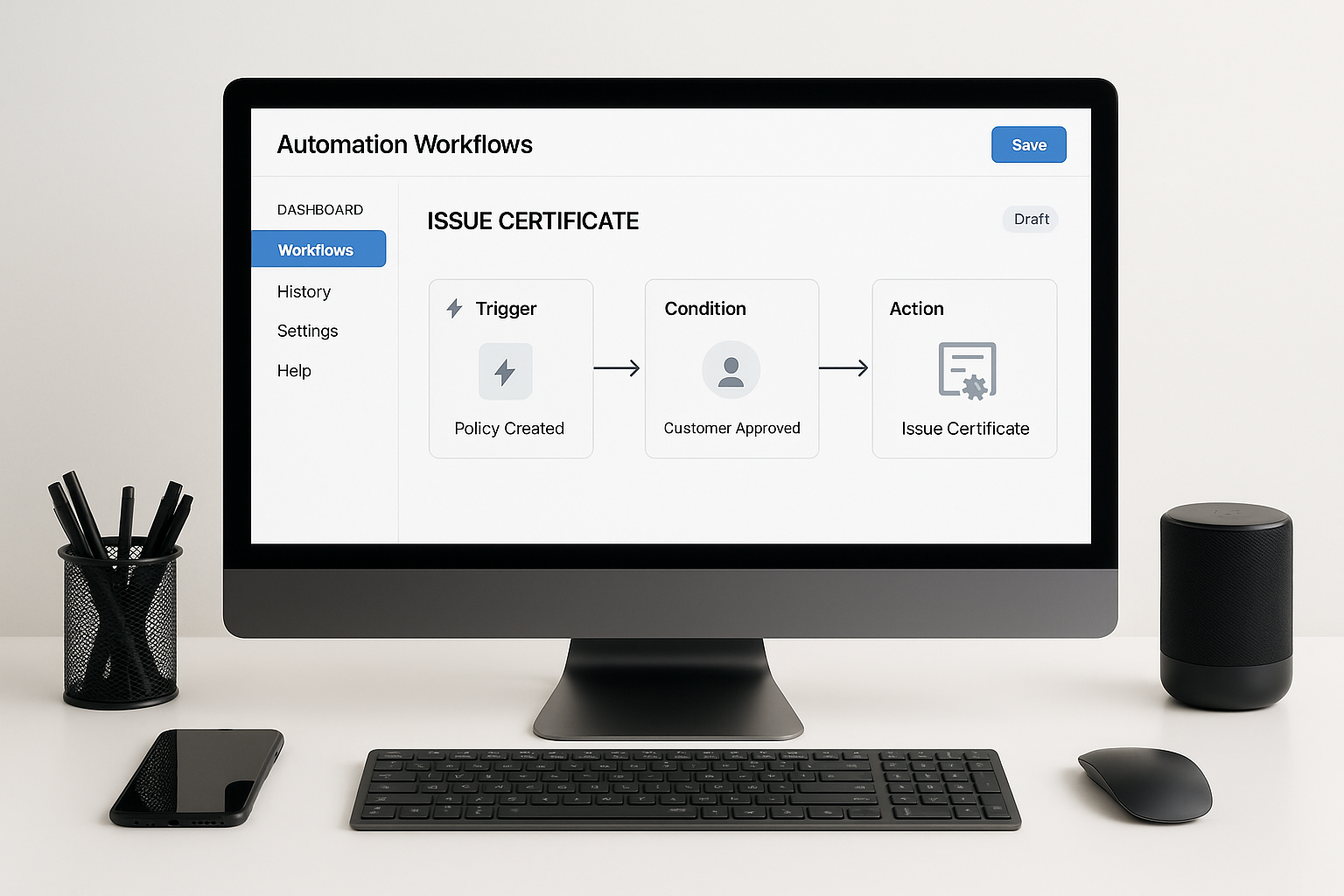

Automation in fintech crime insurance solutions offers numerous advantages. Firstly, it reduces the time and effort required to manage insurance certificates, allowing companies to focus on core business activities. Automated systems can handle repetitive tasks such as data entry, document generation, and compliance checks with greater accuracy and speed. This not only minimizes the risk of human error but also ensures that all necessary documentation is consistently up-to-date.

Moreover, automation facilitates seamless integration with existing systems, enabling real-time data sharing and improved coordination across different departments. This leads to enhanced transparency and better decision-making processes. By automating these services, fintech firms can also benefit from cost savings, as fewer resources are needed to manage insurance-related tasks.

Real-World Applications and Examples

Several fintech companies have successfully implemented automated insurance solutions to streamline their operations. For instance, a leading digital bank integrated an automated certificate management system that reduced their processing time by 50% and improved compliance accuracy1. Similarly, a fintech startup specializing in blockchain technology adopted an automated insurance platform, which enabled them to scale their operations rapidly while maintaining robust security measures2.

Exploring the Costs and Savings

While the initial investment in automation technology can be substantial, the long-term savings often outweigh the costs. Automated systems can reduce labor expenses by decreasing the need for manual data entry and document handling. Additionally, these systems can help avoid costly compliance fines by ensuring that all regulatory requirements are met promptly and accurately.

Many providers offer scalable solutions that can be tailored to the specific needs of fintech companies, allowing businesses to pay only for the services they require. This flexibility can lead to significant cost savings, particularly for startups and small to medium-sized enterprises (SMEs) looking to optimize their resources without compromising on security or compliance.

Future Trends and Opportunities

The fintech industry is poised for continued growth, and with it comes the increasing demand for innovative insurance solutions. As technology advances, we can expect to see even more sophisticated automation tools that leverage artificial intelligence and machine learning to further enhance efficiency and accuracy. These advancements will offer fintech companies the opportunity to stay ahead of the curve, providing them with a competitive edge in a crowded market.

For those looking to explore these options, there are numerous specialized services and platforms available that cater specifically to the needs of fintech firms. By visiting websites of leading providers, you can discover a range of solutions designed to meet your unique requirements.

Automating fintech crime insurance certificate solutions not only improves operational efficiency but also offers significant cost savings and compliance benefits. As the industry continues to evolve, embracing these technologies will be crucial for fintech companies aiming to protect themselves against emerging threats while maximizing their growth potential.