Find Your Ideal Reverse Mortgage Purchase Lender Today

Are you ready to unlock the potential of your home equity and discover the perfect reverse mortgage purchase lender today? Browse options to find the most suitable financial partner that aligns with your needs and goals.

Understanding Reverse Mortgage Purchase Loans

Reverse mortgage purchase loans, known as Home Equity Conversion Mortgages for Purchase (H4P), offer seniors aged 62 and above the chance to buy a new primary residence without the burden of monthly mortgage payments. This financial tool allows you to leverage the equity from the sale of your previous home or other savings to fund the purchase of a new home, while the reverse mortgage covers the remaining cost. The primary benefit is the ability to move into a home that better suits your retirement lifestyle without depleting your savings.

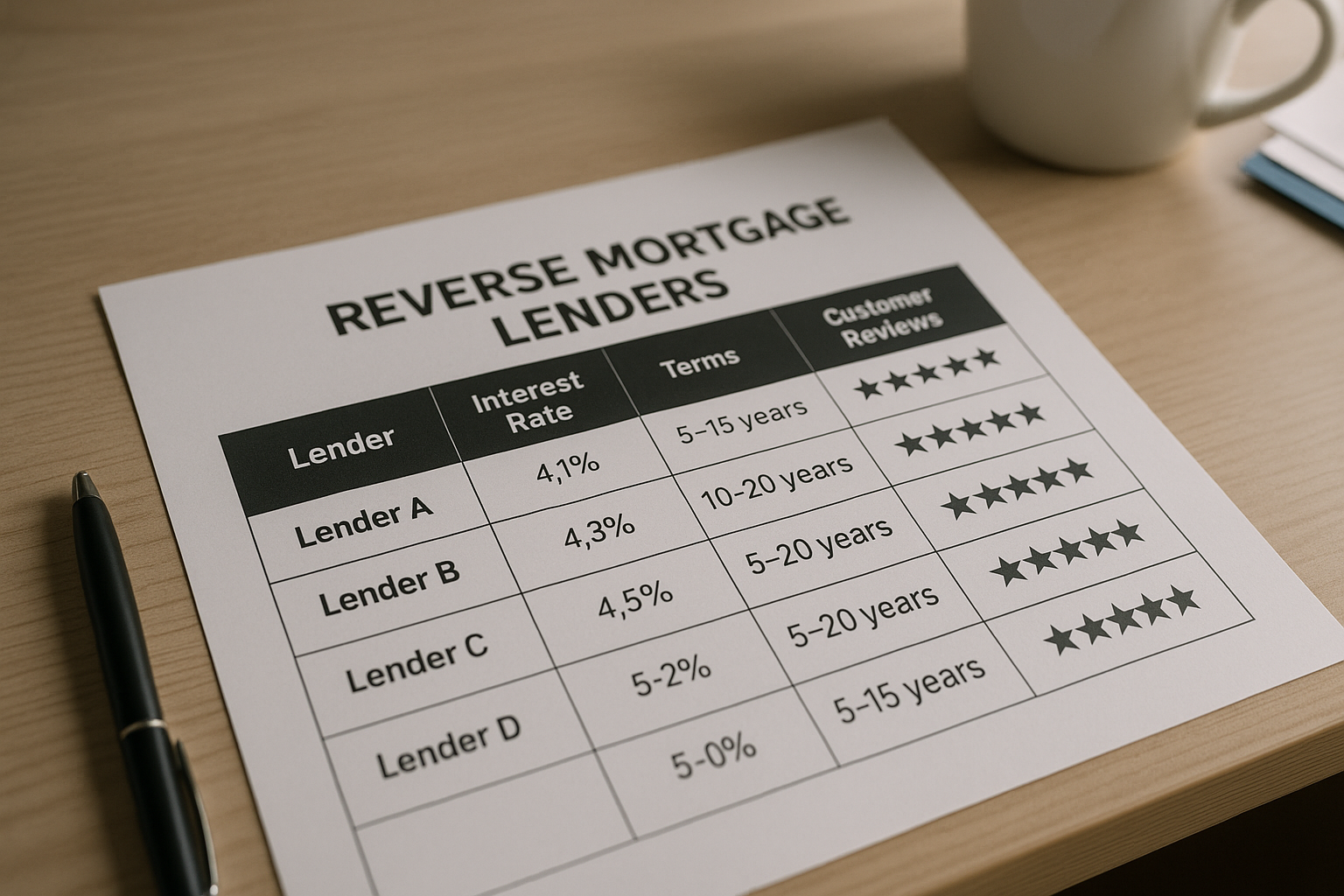

Benefits of Choosing the Right Lender

Finding the ideal lender for your reverse mortgage purchase can significantly impact your financial well-being. A reputable lender will offer competitive interest rates, transparent terms, and excellent customer service, ensuring a smooth and stress-free process. Additionally, the right lender can provide expert guidance, helping you understand the intricacies of reverse mortgages and assisting you in making informed decisions. By choosing wisely, you can maximize your financial flexibility and maintain a comfortable lifestyle in your new home.

Types of Reverse Mortgage Lenders

Reverse mortgage lenders can be broadly categorized into two types: direct lenders and brokers. Direct lenders, such as banks and credit unions, provide loans directly to consumers. They often have more straightforward processes and may offer better rates due to reduced overhead costs. On the other hand, brokers act as intermediaries, connecting borrowers with various lenders. They can offer a wider range of options and may help you find more tailored solutions, but their services might come with additional fees.

Key Considerations When Selecting a Lender

When searching for your ideal reverse mortgage purchase lender, consider the following factors:

- Reputation: Research the lender's reputation by reading customer reviews and checking their standing with the Better Business Bureau.

- Interest Rates and Fees: Compare rates and fees from multiple lenders to ensure you're getting the best deal.

- Customer Service: Choose a lender known for excellent customer service, as this can greatly affect your experience.

- Accreditation: Ensure the lender is accredited by the Federal Housing Administration (FHA) and adheres to industry standards.

Potential Costs and Financial Implications

While reverse mortgage purchase loans can be a valuable tool, it's essential to understand the associated costs and financial implications. These may include origination fees, closing costs, and mortgage insurance premiums. Additionally, the interest on the loan will accumulate over time, potentially reducing the equity in your home. It's crucial to work with your lender to understand all costs and ensure they align with your financial goals.

How to Get Started

To begin your journey towards finding the ideal reverse mortgage purchase lender, start by assessing your financial situation and determining your needs. Next, browse options to compare lenders and their offerings. Consider consulting with a financial advisor to ensure you're making the best decision for your retirement. By taking these steps, you can confidently move forward in securing the right reverse mortgage purchase loan for your needs.

With the right information and careful consideration, you can successfully navigate the reverse mortgage purchase process and enjoy the benefits of a new home that meets your retirement lifestyle. Explore the available resources and options to make an informed decision that aligns with your financial goals.