Get Lowest Motor Carrier Cargo Insurance Quote Ever

If you're on a mission to secure the lowest motor carrier cargo insurance quote ever, it's time to explore your options, discover exclusive deals, and unlock significant savings that can enhance your business's bottom line.

Understanding Motor Carrier Cargo Insurance

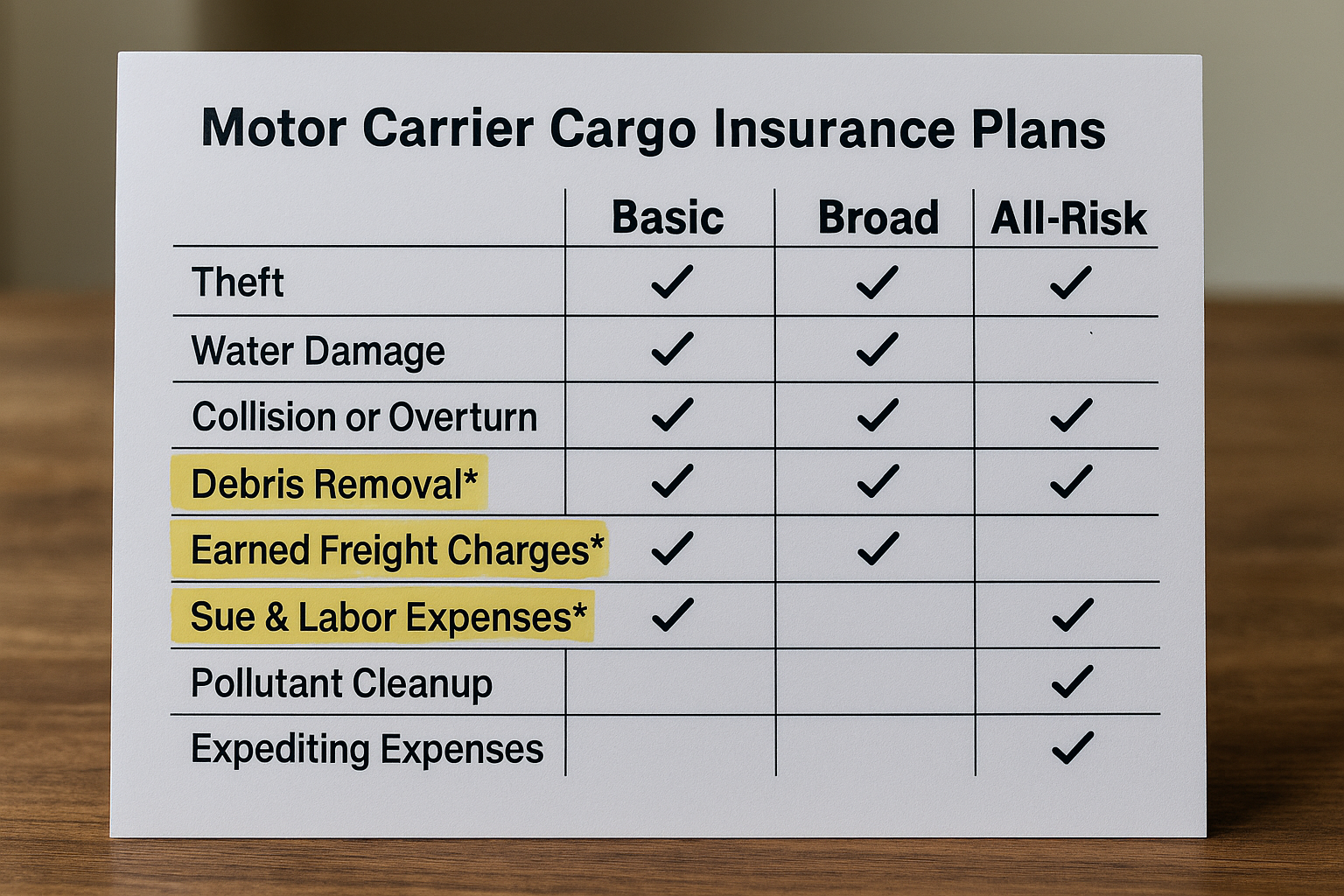

Motor carrier cargo insurance is a critical component of risk management for businesses involved in the transportation of goods. It provides coverage for the loss or damage of cargo during transit, ensuring that your business is protected against unforeseen events. This type of insurance is particularly important for companies that transport high-value or sensitive goods, as it offers peace of mind and financial security.

Why You Need Cargo Insurance

Without adequate cargo insurance, your business could face significant financial losses in the event of an accident, theft, or natural disaster. The cost of replacing damaged or lost cargo can be substantial, and without insurance, these expenses would need to be covered out of pocket. By investing in motor carrier cargo insurance, you can mitigate these risks and protect your business's financial stability.

Factors Affecting Insurance Quotes

Several factors can influence the cost of your motor carrier cargo insurance quote:

- Type of Cargo: High-value or hazardous materials typically result in higher premiums due to increased risk.

- Distance and Route: Longer routes or routes through high-risk areas can increase insurance costs.

- Claims History: A history of frequent claims can lead to higher premiums.

- Safety Record: Companies with strong safety records and protocols may benefit from lower insurance rates.

How to Get the Best Quote

To secure the lowest possible quote, consider the following strategies:

- Shop Around: Compare quotes from multiple insurers to find the best rate. Use online tools to browse options and gather quotes efficiently.

- Bundle Policies: Some insurers offer discounts if you bundle cargo insurance with other types of coverage, such as liability insurance.

- Improve Safety Measures: Implementing robust safety protocols can lead to lower premiums by reducing the likelihood of accidents.

- Negotiate Terms: Don't hesitate to negotiate with insurers to secure better terms or discounts.

Real-World Pricing and Discounts

While specific deals and discounts can vary, many insurers offer competitive rates and promotions for businesses that meet certain criteria. For instance, companies with a track record of safe operations and minimal claims might qualify for reduced premiums1. Additionally, some insurers provide loyalty discounts for long-term customers or offer incentives for businesses that implement advanced tracking and security technologies2.

Exploring Specialized Options

For businesses with unique needs, such as transporting perishable goods or operating in international markets, specialized insurance solutions are available. These tailored policies can address specific risks and provide coverage that aligns with your operational requirements. By visiting websites and consulting with industry experts, you can identify these specialized options and ensure comprehensive coverage for your cargo.

In summary, securing the lowest motor carrier cargo insurance quote involves understanding the various factors that affect pricing, actively comparing options, and leveraging discounts and specialized solutions. By taking these steps, you can protect your business while optimizing your insurance costs. As you explore these opportunities, remember that the right insurance policy can be a valuable asset in safeguarding your operations and enhancing your competitive edge.