Is Your Homeowners Insurance Replacement Cost Too High

Have you ever wondered if your homeowners insurance replacement cost is too high, and felt the urge to browse options or visit websites for a better deal?

Understanding Homeowners Insurance Replacement Costs

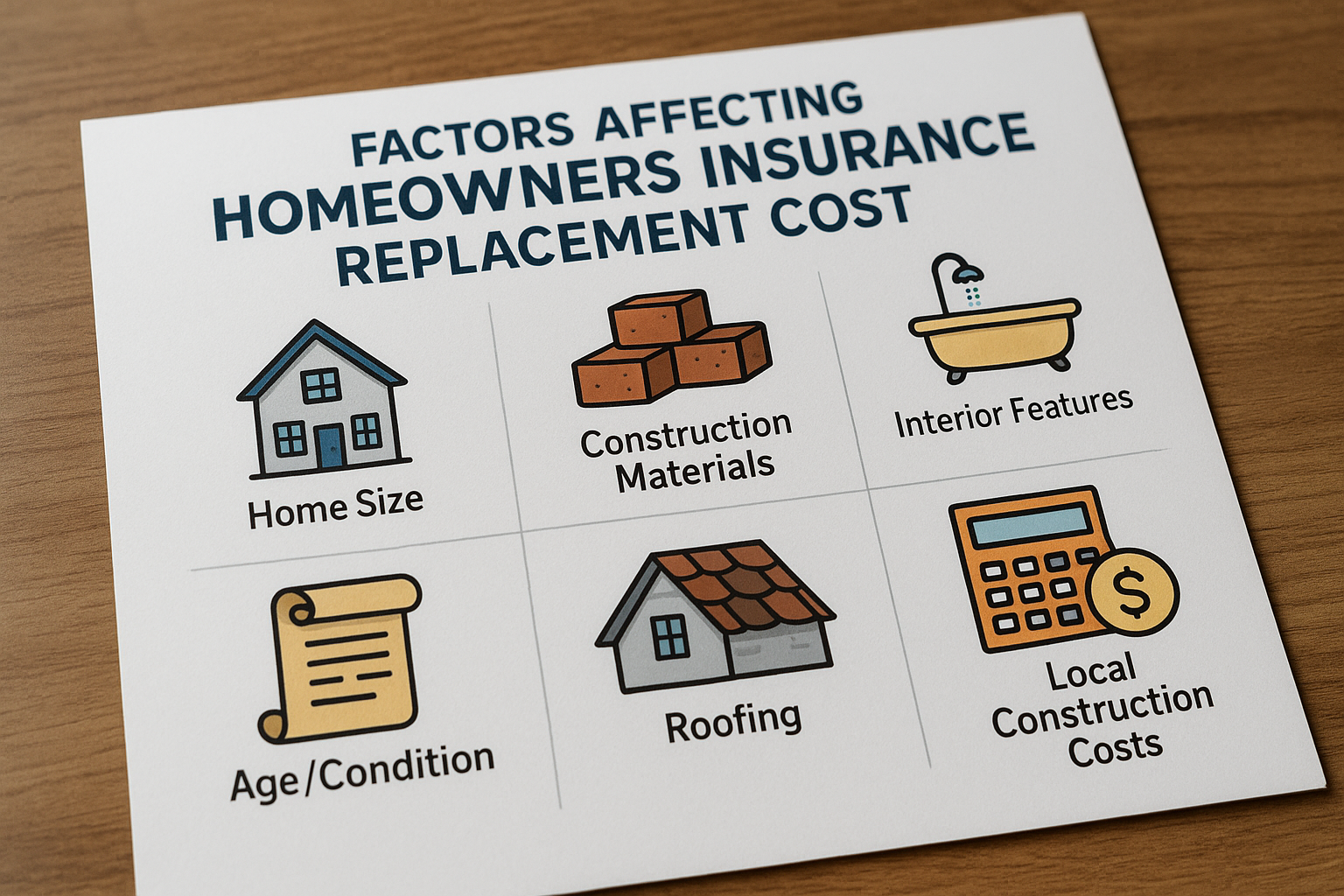

Your homeowners insurance replacement cost is a critical component of your policy, ensuring that you can rebuild your home in the event of a total loss. However, it's essential to understand what this cost entails and whether you're overpaying. The replacement cost is not the same as market value; it specifically covers the cost to rebuild your home with similar materials and craftsmanship at current prices. This means that fluctuations in construction costs, materials, and labor can significantly impact your policy.

Why Replacement Costs Might Be Too High

There are several reasons why your replacement cost might be higher than necessary. Insurers often use broad estimates that may not account for specific local factors affecting construction costs. Additionally, increases in building material prices or labor shortages can lead to inflated estimates. It's crucial to periodically review your policy to ensure it accurately reflects current rebuilding costs, rather than outdated or generalized figures.

How to Evaluate and Adjust Your Replacement Cost

To determine if your replacement cost is too high, start by obtaining a detailed estimate from a local contractor. This can provide a more accurate picture of what it would cost to rebuild your home today. Compare this estimate with the amount listed in your policy. If there's a discrepancy, contact your insurance provider to discuss adjustments. Many insurers offer tools or calculators on their websites to help you assess your coverage needs, so be sure to search options and use these resources.

Opportunities for Savings

If you find that your replacement cost is overstated, there are several ways to potentially reduce your premium. First, consider raising your deductible, which can lower your monthly payments. Additionally, some insurers offer discounts for safety features like smoke detectors, security systems, or updated plumbing and electrical systems. It's also worth shopping around and comparing quotes from different insurers to find the best rate. For those willing to follow the options, many online platforms provide easy comparison tools to help you find the most competitive offers.

Additional Resources

For homeowners looking to delve deeper, there are numerous resources available. Organizations like the Insurance Information Institute offer guides on understanding homeowners insurance, while sites like Zillow provide tools to estimate rebuilding costs based on your home's specifications. These resources can be invaluable for ensuring your policy is both adequate and cost-effective.

In summary, regularly reviewing and adjusting your homeowners insurance replacement cost can lead to significant savings and ensure you have the right coverage. By taking the time to evaluate your policy and explore specialized services, you can make informed decisions that protect your home and your finances.