Master Mortgage Rate Lock vs Float Secrets Today

Unlock the secrets of mortgage rate locks and floats today, and discover how strategic timing and informed choices can save you thousands, as you browse options and follow the best strategies for your financial future.

Understanding Mortgage Rate Locks and Floats

When you're in the market for a mortgage, one of the most critical decisions you'll face is whether to lock in your interest rate or let it float. A rate lock guarantees your interest rate for a set period, typically ranging from 30 to 60 days, protecting you from rate increases during that time. Conversely, a floating rate means your interest rate could change with market fluctuations until your loan closes.

The Benefits of Locking Your Rate

Locking your mortgage rate can provide peace of mind and financial predictability. By securing a rate, you shield yourself from potential rate hikes that could increase your monthly payments. This stability is particularly beneficial in a volatile market where rates are expected to rise. For instance, if you're planning to close on a home in a few months, locking in a low rate today could save you significant amounts over the life of your loan.

Risks and Rewards of Floating

Opting to float your rate can be advantageous if you anticipate a drop in interest rates. This strategy allows you to capitalize on potential decreases, potentially lowering your monthly payments and total interest paid. However, it comes with the risk of rates rising, which could increase your costs. It's essential to weigh these risks and monitor market trends closely. According to recent data, mortgage rates can fluctuate based on economic indicators like inflation and Federal Reserve policies1.

Timing Your Decision

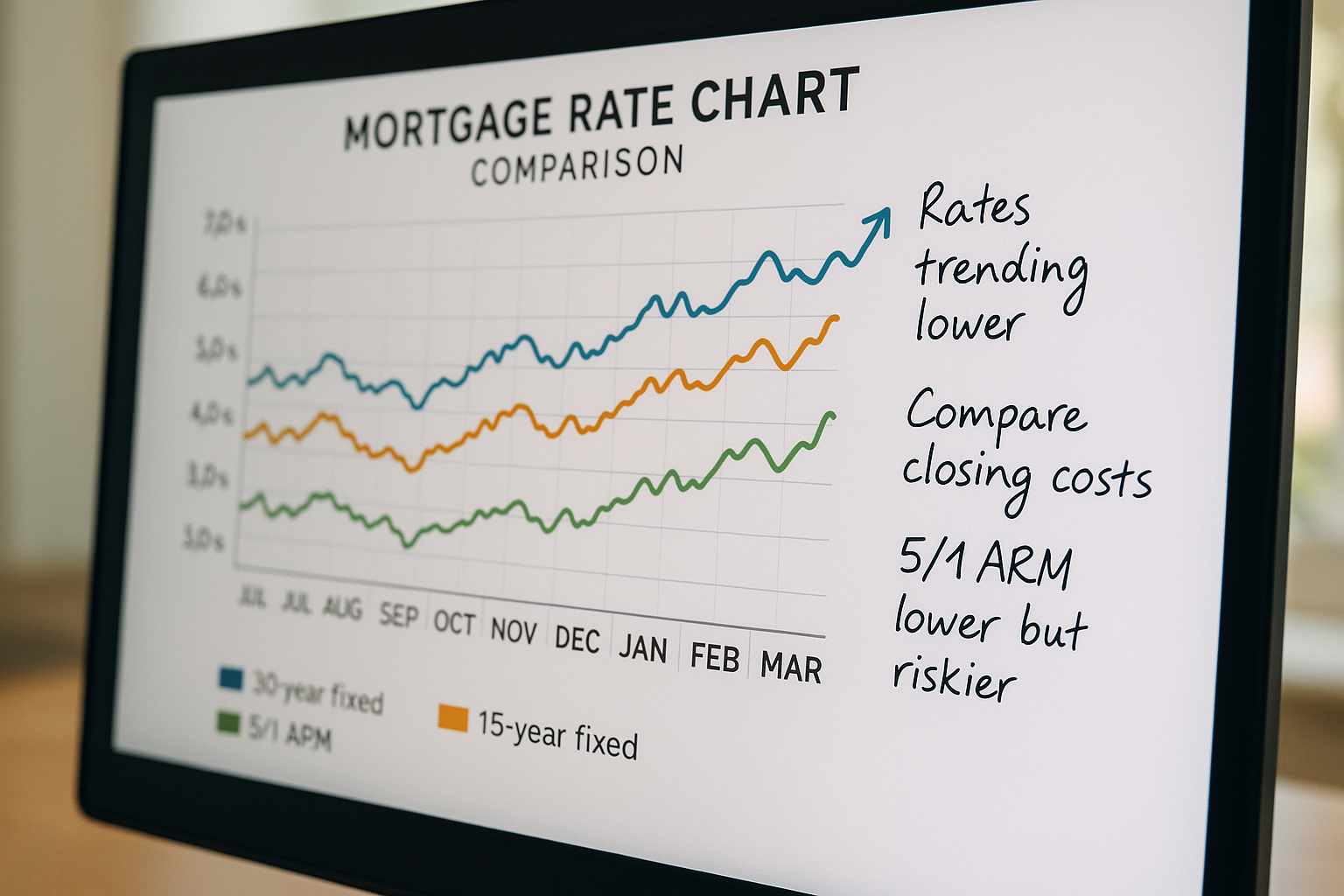

The timing of your rate lock or float decision can significantly impact your mortgage costs. Ideally, you should lock your rate when you believe rates are at their lowest or about to rise. Many experts suggest keeping an eye on economic forecasts and interest rate trends. For example, if you're nearing the end of your home-buying process and rates are on an upward trend, locking in your rate may be wise. Conversely, if economic indicators suggest a potential rate drop, floating might be more beneficial2.

Strategies for Making the Right Choice

To make an informed decision, consider consulting with a mortgage advisor who can provide insights based on current market conditions and your financial situation. Additionally, explore online resources and tools that offer rate predictions and comparisons. These can help you gauge whether locking or floating is the better option for you. Websites like Bankrate and Zillow offer calculators and rate comparison tools that can be invaluable in this decision-making process3.

Exploring Specialized Options

For those seeking more tailored solutions, some lenders offer hybrid options, such as the ability to lock a portion of your mortgage while allowing the rest to float. This approach can provide a balance between security and potential savings. Additionally, certain mortgage products may offer rate lock extensions, allowing you to extend your lock period if your closing date is delayed. It's worth visiting websites of lenders who provide these specialized services to explore your options further4.

By understanding the intricacies of mortgage rate locks and floats, you can make a confident decision that aligns with your financial goals. Whether you choose to lock or float, being informed and proactive will help you navigate the mortgage landscape effectively. As you explore these options, remember that the right choice can lead to substantial savings and financial security.