Maximize coverage with best family health insurance plan comparison

If you're looking to ensure your family's health is protected without breaking the bank, it's time to browse options for the best family health insurance plans that maximize your coverage.

Understanding Family Health Insurance Plans

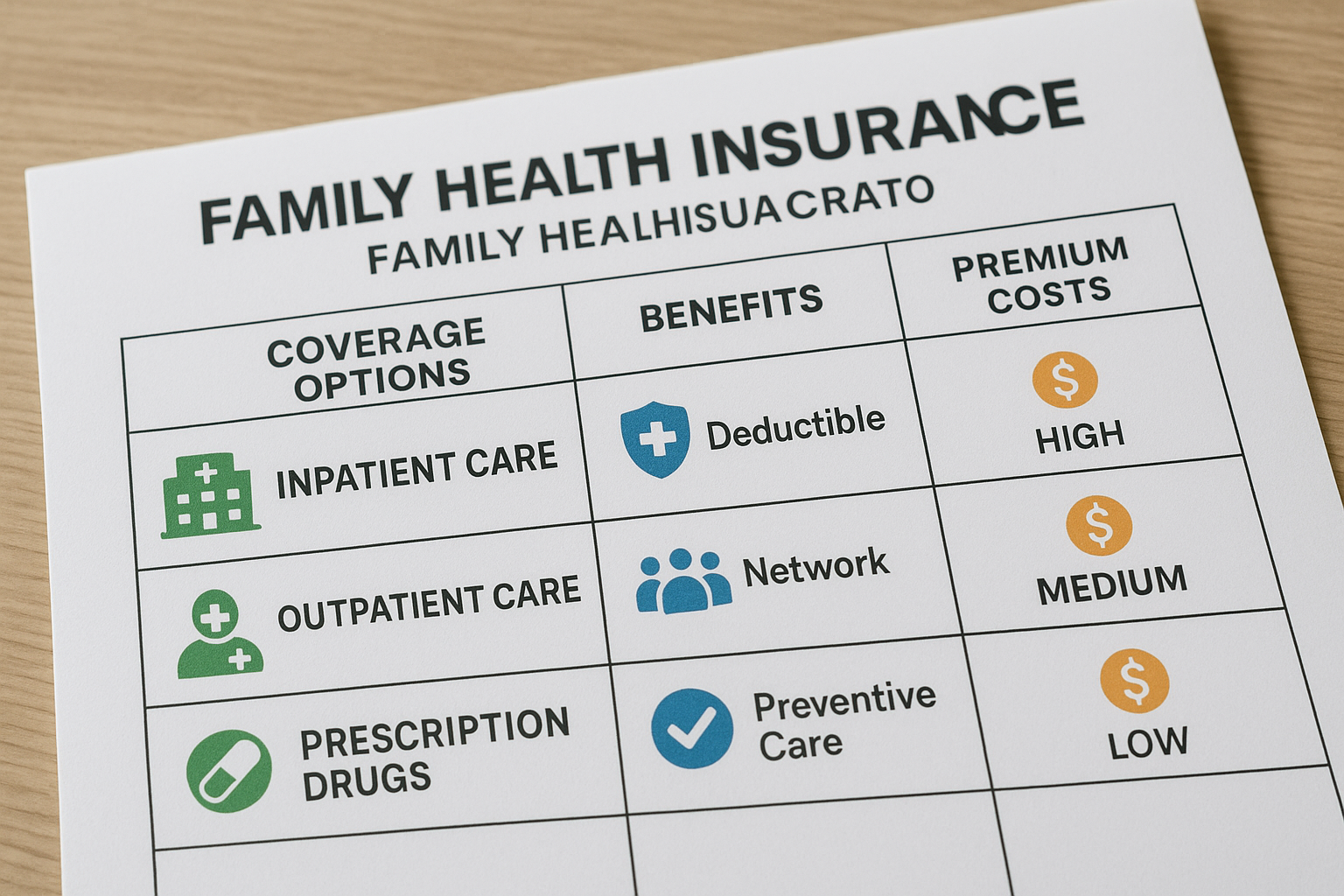

Family health insurance plans are designed to provide comprehensive medical coverage for all members of a household under a single policy. These plans typically offer a range of benefits, including preventive care, emergency services, hospital stays, and prescription drug coverage. The primary goal is to safeguard your family’s health while managing costs effectively.

Benefits of Comparing Family Health Insurance Plans

When you compare family health insurance plans, you gain the opportunity to find a policy that offers the best coverage for your unique needs at a competitive price. By evaluating different plans, you can identify which ones offer comprehensive benefits such as pediatric care, mental health services, and maternity care. Moreover, comparing plans allows you to understand the network of doctors and hospitals included, ensuring that your preferred healthcare providers are covered.

Factors to Consider When Choosing a Family Health Insurance Plan

1. **Coverage and Benefits**: Assess the scope of coverage each plan offers. Consider whether the plan covers routine check-ups, emergency care, and specialized treatments. It's crucial to ensure that the plan covers the specific health needs of each family member.

2. **Premiums and Out-of-Pocket Costs**: While lower premiums may seem attractive, they often come with higher out-of-pocket costs. Evaluate the balance between monthly premiums and other expenses like deductibles, co-pays, and co-insurance.

3. **Network of Providers**: Ensure that the plan includes a network of healthcare providers that are convenient and preferred by your family. Access to a broad network can save you money and provide peace of mind.

4. **Flexibility and Additional Features**: Some plans offer additional features like telemedicine services, wellness programs, or discounts on gym memberships. These can add significant value to your policy.

Real-World Data and Statistics

According to the Kaiser Family Foundation, the average annual premium for family coverage in the U.S. was $22,221 in 2023, with workers on average paying $6,106 toward the cost of their coverage1. This highlights the importance of carefully evaluating your options to find a plan that offers both value and comprehensive protection.

Exploring Specialized Solutions and Resources

Many families are turning to Health Savings Accounts (HSAs) and Flexible Spending Accounts (FSAs) to manage healthcare costs more effectively. These accounts allow you to set aside pre-tax dollars for medical expenses, providing tax advantages and greater financial flexibility2.

Additionally, some insurers offer family plans with wellness incentives that reward you for maintaining a healthy lifestyle. These could include discounts on premiums for participating in health assessments or achieving fitness goals.

Maximize Your Family's Health Coverage Today

By taking the time to thoroughly compare family health insurance plans, you can ensure that your family receives the best possible care without unnecessary financial strain. As you explore your options, consider the specific needs of each family member, the financial implications, and the additional benefits that can enhance your overall coverage. With the right plan, you can enjoy peace of mind knowing that your family’s health is protected.