Maximize Rental Profits with DSCR Refinance Magic Secrets

Maximize your rental profits by unlocking the secrets of DSCR refinance, where you can browse options to enhance your income potential and explore valuable insights that could transform your real estate investments.

Understanding DSCR Refinance

Debt Service Coverage Ratio (DSCR) refinance is a powerful financial tool that can help property owners maximize their rental income by leveraging the equity in their properties. This type of refinancing focuses on the property's income-generating ability rather than the owner's personal income, making it an attractive option for investors with multiple rental properties. By refinancing through a DSCR loan, you can potentially lower your interest rates, reduce monthly payments, and free up cash flow for further investments.

How DSCR Refinance Works

DSCR is a measure used by lenders to determine a property's ability to cover its debt obligations. It is calculated by dividing the property's net operating income (NOI) by its total debt service. A DSCR of 1.25, for example, indicates that the property generates 25% more income than is needed to cover its debt payments. Lenders typically look for a DSCR of at least 1.2 to 1.5 to ensure the property can comfortably service its debt1.

When you refinance a property using a DSCR loan, the focus is on the property's cash flow rather than your personal financial situation. This allows investors with high-performing rental properties to secure favorable loan terms even if their personal credit scores are less than stellar.

Benefits of DSCR Refinance

1. **Improved Cash Flow**: By refinancing at a lower interest rate, you can reduce your monthly mortgage payments, thereby increasing your net rental income.

2. **Access to Equity**: DSCR refinance can enable you to tap into the equity of your property, providing you with funds for further investments or property improvements.

3. **Flexible Qualification**: Since the loan is based on the property's income, investors with multiple properties can qualify more easily, even if their personal income is variable.

4. **Portfolio Growth**: With improved cash flow and access to equity, you can expand your property portfolio more rapidly, increasing your overall rental income potential.

Real-World Examples and Opportunities

Consider an investor who owns a multi-family property generating a net operating income of $120,000 per year. With a total annual debt service of $90,000, the DSCR is 1.33, which is attractive to lenders. By refinancing, the investor can lower their interest rate from 5% to 4%, reducing annual debt service to $85,000. This change increases the investor's cash flow by $5,000 annually, which can be reinvested into property improvements or additional acquisitions.

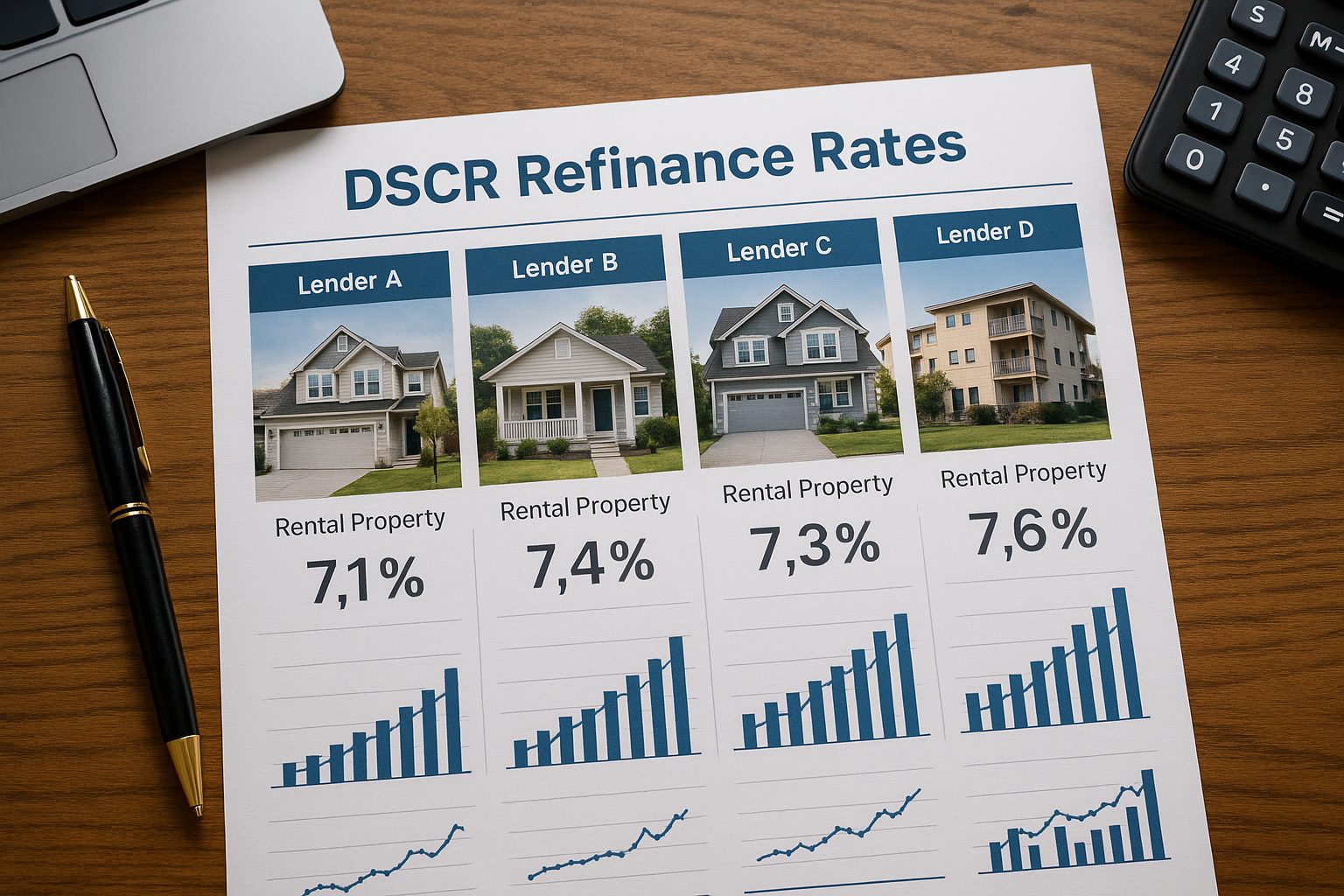

Moreover, many lenders offer competitive DSCR refinance programs with options tailored to different investment strategies. It's crucial to visit websites of reputable lenders to see these options and find the best fit for your needs.

Considerations and Costs

While DSCR refinance offers numerous benefits, it's important to consider the costs involved. Closing costs, appraisal fees, and potential prepayment penalties can impact the overall savings. Always calculate the break-even point to ensure that the refinance will be beneficial in the long run2.

Additionally, market conditions and lender requirements can vary, so it's essential to stay informed about current rates and terms. Many online platforms provide tools to compare different DSCR refinancing options, allowing you to make an informed decision.

Explore Your Options

Maximizing rental profits through DSCR refinance requires careful planning and consideration of your investment goals. By understanding the mechanics of DSCR loans and exploring the various options available, you can make strategic decisions that enhance your rental income and expand your property portfolio. For those ready to take the next step, browse options and visit websites of financial institutions offering DSCR loans to find the best solutions tailored to your investment strategy.