Maximize Savings Multilocation Dental Insurance Renewal Secrets Found

When it comes to renewing your multilocation dental insurance, you can unlock significant savings and gain peace of mind by understanding the secrets behind maximizing your benefits—browse options to see these opportunities unfold.

Understanding Multilocation Dental Insurance

Multilocation dental insurance is specifically designed for businesses with multiple locations, offering a streamlined approach to manage dental benefits across various sites. This type of insurance not only simplifies administrative tasks but also provides cost-effective solutions for companies aiming to offer consistent benefits to all employees, regardless of their location. By consolidating your dental insurance under one plan, you can leverage bulk purchasing power to negotiate better rates and coverage options, ultimately saving your business money.

Key Benefits of Multilocation Dental Insurance

One of the primary advantages of multilocation dental insurance is the potential for significant cost savings. By pooling together employees from various locations, businesses can often secure more favorable terms and lower premiums. This is particularly beneficial for large companies that might otherwise face higher costs if each location were to negotiate separately. Additionally, a unified plan simplifies the benefits administration process, reducing the time and resources spent on managing multiple policies.

Another key benefit is the consistency in coverage it provides. Employees across different locations receive the same level of dental benefits, ensuring fairness and equality within the organization. This can enhance employee satisfaction and retention, as workers are more likely to appreciate a company that offers comprehensive and equitable benefits.

Strategies to Maximize Savings

To truly maximize savings during your dental insurance renewal, consider the following strategies:

- Evaluate Your Current Plan: Before renewing, thoroughly assess your existing plan's performance. Identify any gaps in coverage or areas where costs have increased unexpectedly. This analysis will inform your negotiations with insurers.

- Negotiate with Insurers: Use your business's size and the potential for a long-term relationship as leverage to negotiate better terms. Many insurers are willing to offer discounts or enhanced coverage to secure a large client.

- Consider Alternative Providers: Don't hesitate to shop around. Compare different insurers to find one that offers the best combination of cost and coverage. Browse options through industry websites to identify potential providers.

- Utilize Wellness Programs: Some insurers offer wellness programs that focus on preventive care, which can reduce long-term costs. Encourage employees to participate in these programs to maintain better oral health and prevent expensive dental issues.

Real-World Examples and Data

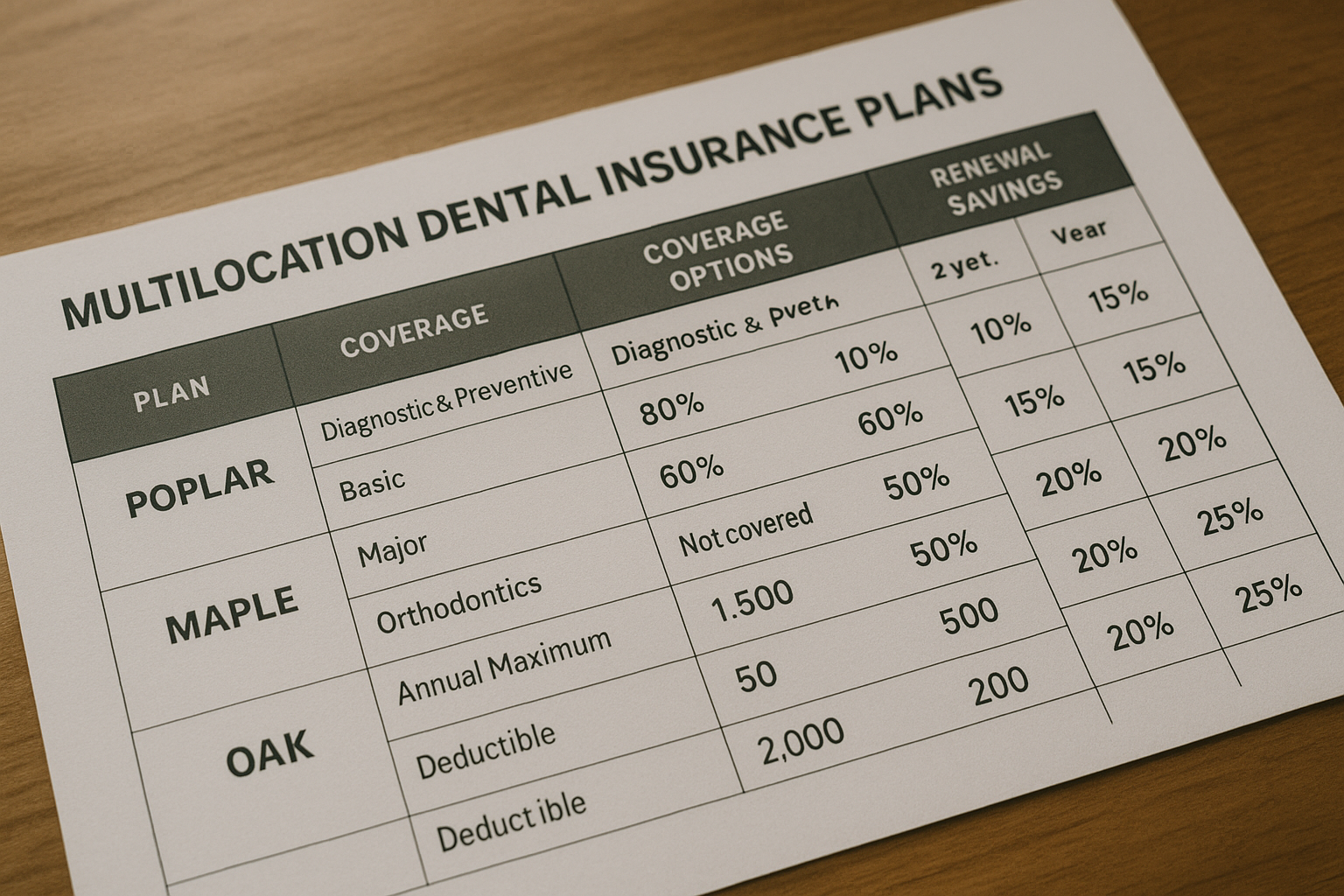

Recent studies have shown that companies utilizing multilocation dental insurance plans have experienced cost savings of up to 15% compared to those managing separate policies for each location1. Furthermore, businesses that actively engage in negotiating their terms often achieve even greater savings, with some reporting reductions in premiums by 20% or more2.

In a case study conducted by a leading benefits consultancy, a national retailer with over 100 locations successfully reduced their dental insurance costs by 18% by consolidating their plans and negotiating directly with insurers3. This example highlights the tangible financial benefits that can be achieved with strategic planning and negotiation.

Exploring Specialized Solutions

For businesses seeking tailored solutions, there are specialized services that offer bespoke consulting to optimize dental insurance plans. These services analyze your specific needs and provide recommendations to maximize savings and coverage. By visiting websites of these consulting firms, you can explore how their expertise might benefit your organization.

Maximizing your savings on multilocation dental insurance renewals requires a proactive approach and a willingness to explore all available options. By leveraging the strategies and insights discussed, you can achieve significant cost reductions and enhance the value of your employee benefits package.