Reveal the Secret Cyber Liability Insurance Quote Trick

Unlocking the hidden secrets of cyber liability insurance can save you time and money, allowing you to browse options and explore the best coverage tailored to your business needs.

Understanding Cyber Liability Insurance

Cyber liability insurance is a specialized form of coverage designed to protect businesses from internet-based risks, such as data breaches and other cyber threats. With the increasing frequency and sophistication of cyberattacks, businesses of all sizes are recognizing the importance of having robust cyber insurance policies. This type of insurance typically covers costs related to data breaches, including notification expenses, legal fees, and even extortion payments in the event of ransomware attacks.

The Secret Trick to Obtaining the Best Quote

When it comes to obtaining a cyber liability insurance quote, many businesses are unaware of the strategic approaches that can significantly lower premiums. One effective method is to enhance your cybersecurity measures before seeking quotes. Insurers often offer better rates to businesses that demonstrate strong security practices, such as regular employee training, updated software, and comprehensive data protection protocols. By investing in these areas, you not only reduce your risk profile but also position yourself for more favorable insurance terms.

Real-World Benefits and Cost Savings

Implementing these strategies can lead to substantial cost savings. For instance, companies with robust cybersecurity frameworks can see premium reductions of up to 20%1. Additionally, some insurers provide discounts for businesses that use specific security technologies or have achieved certain cybersecurity certifications. By leveraging these options, businesses not only safeguard their data but also optimize their insurance expenses.

Exploring Different Coverage Options

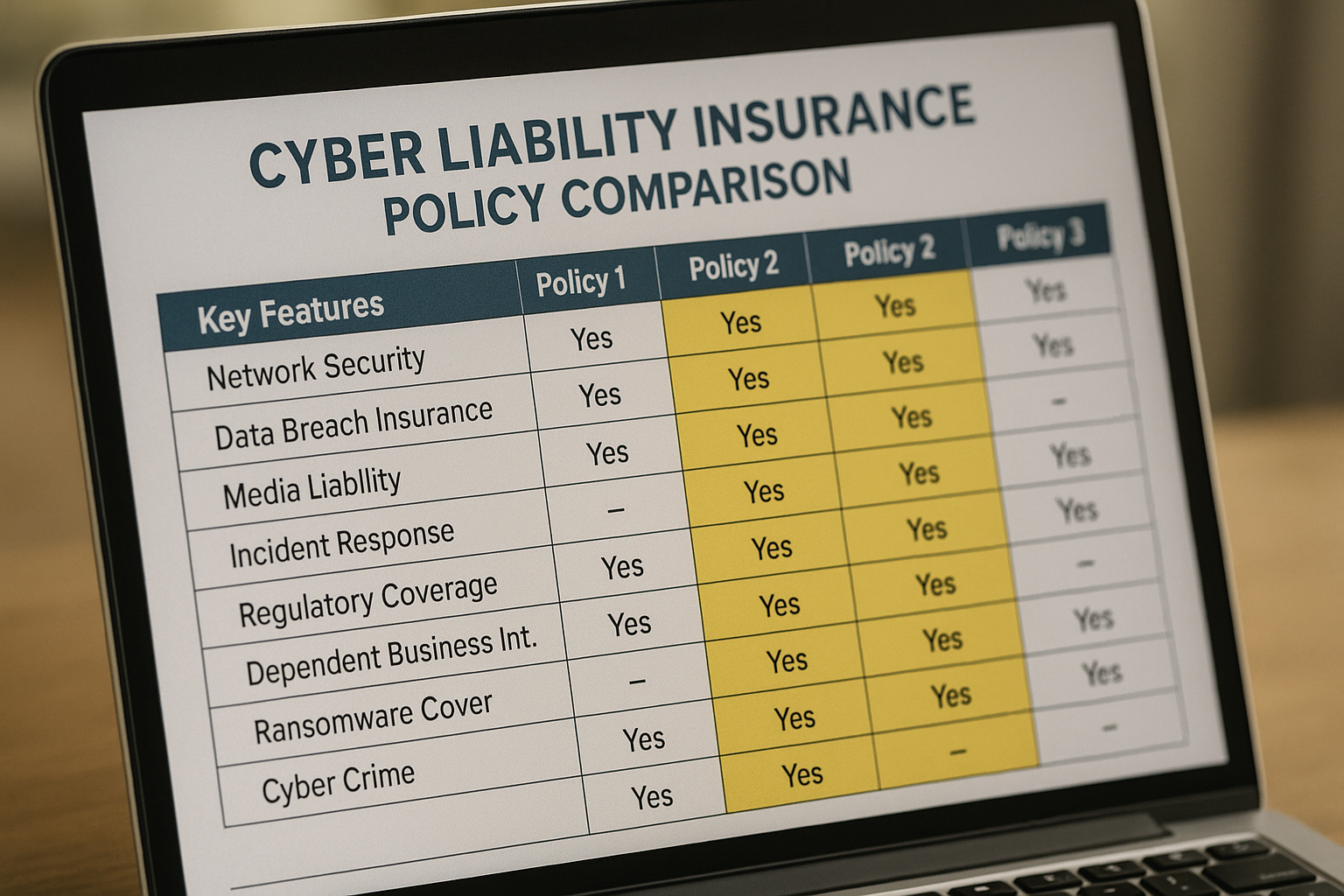

Cyber liability insurance policies can vary significantly, making it crucial to understand the different types of coverage available. Basic policies might cover only the essentials, such as data breach response and legal fees, while more comprehensive plans could include business interruption losses, cyber extortion, and reputational damage. It's essential to assess your business's specific needs and risks to determine the appropriate level of coverage. By doing so, you can ensure that you're not overpaying for unnecessary coverage or leaving critical areas unprotected.

How to Compare and Choose the Right Policy

To effectively compare policies, consider using online platforms that allow you to see these options side by side. These tools can provide insights into coverage limits, exclusions, and premium costs from multiple insurers, enabling you to make an informed decision. Additionally, consulting with a specialized insurance broker can be invaluable. Brokers have in-depth knowledge of the market and can guide you toward policies that align with your business's unique requirements.

Leveraging Resources for Better Decisions

Staying informed about the latest trends and developments in cybersecurity and insurance can further enhance your decision-making process. Industry reports and expert analyses available on reputable websites offer valuable insights into emerging threats and innovative insurance solutions. By keeping abreast of these resources, you can continually refine your cybersecurity strategies and insurance coverage to better protect your business.

In summary, by understanding the intricacies of cyber liability insurance and employing strategic measures, you can secure comprehensive protection while optimizing costs. As you explore these options, remember that investing in cybersecurity not only fortifies your defenses but also positions you for more favorable insurance quotes.