Save Big on Leased Vehicle Insurance Today

You're just a few clicks away from discovering how you can save significantly on your leased vehicle insurance by exploring tailored options that meet your needs.

Understanding Leased Vehicle Insurance

Leased vehicle insurance is a specialized type of coverage designed to protect both the lessee and the leasing company. When you lease a car, the leasing company retains ownership of the vehicle, and as such, they require a specific level of insurance coverage to safeguard their asset. This typically includes comprehensive and collision coverage, along with the standard liability coverage. The nuances of these requirements can vary depending on the leasing agreement, making it crucial for lessees to understand their obligations fully.

Opportunities for Savings

Many drivers are unaware of the potential savings available on leased vehicle insurance. By taking the time to browse options and compare different insurance providers, you can often find competitive rates that may not be immediately apparent. For example, bundling your leased vehicle insurance with other policies, such as homeowners or renters insurance, can often lead to significant discounts1. Additionally, maintaining a clean driving record and opting for higher deductibles are proven strategies that can reduce premium costs2.

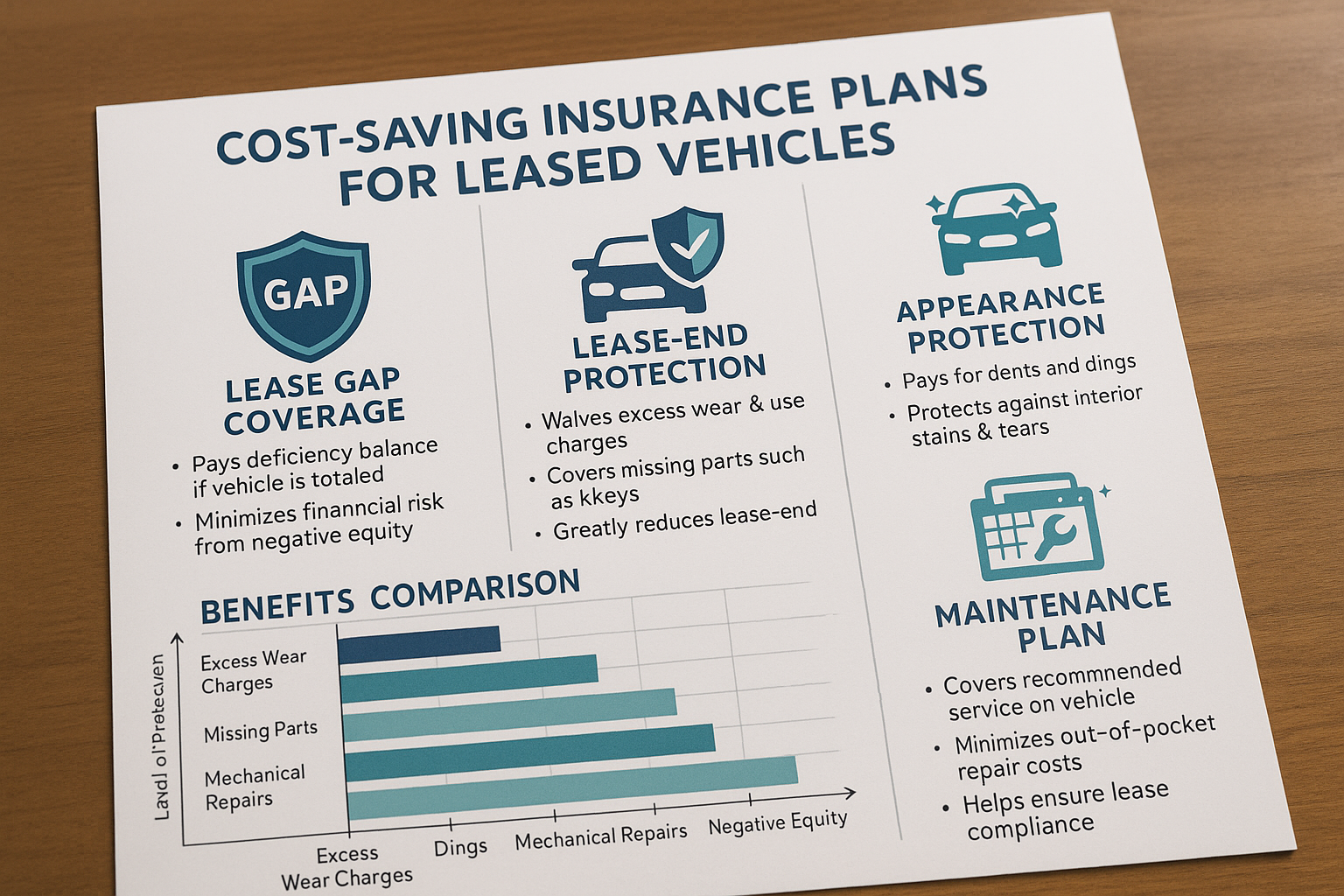

Understanding Gap Insurance

One critical aspect of leased vehicle insurance is gap insurance. This coverage is essential because it covers the difference between the car's actual cash value and the remaining balance on your lease in the event of a total loss. Without gap insurance, you could be left paying out of pocket for a car you can no longer drive. Many insurance providers offer gap insurance as an add-on, and some leases include it by default, so it's worth checking your lease agreement or consulting with your insurer to avoid unnecessary expenses3.

Comparing Insurance Providers

When it comes to leased vehicle insurance, not all providers are created equal. It pays to search options and compare quotes from multiple insurers to ensure you're getting the best deal. Online comparison tools can be particularly useful in this regard, allowing you to quickly and easily assess different policies and their costs. Look for insurers that offer specialized coverage for leased vehicles, as they may provide more tailored options that align with your leasing terms4.

Additional Savings Tips

Beyond comparing providers, there are several other strategies you can employ to save on leased vehicle insurance. Consider enrolling in a defensive driving course, which can lead to discounts with certain insurers. Additionally, regularly reviewing and updating your policy to reflect any changes in your driving habits or circumstances can ensure you're not paying for unnecessary coverage. Finally, staying informed about the latest insurance trends and promotions can help you capitalize on new opportunities for savings.

In summary, by taking the time to understand your lease agreement, explore insurance options, and leverage available discounts, you can significantly reduce the cost of your leased vehicle insurance. These efforts not only protect your financial interests but also ensure peace of mind while driving your leased vehicle. Now is the perfect time to visit websites offering comparison tools and specialized services to find the best coverage for your needs.