Secret Hack to Maximize 0 Percent APR Savings

Unlock the secret to maximizing your 0 percent APR savings and seize the opportunity to browse options that could transform your financial strategy into a powerhouse of interest-free growth.

Understanding 0 Percent APR Offers

Zero percent APR (Annual Percentage Rate) offers can be a financial game-changer, allowing you to make significant purchases or consolidate debt without the burden of interest for a specified period. These offers are commonly found in credit card promotions, auto loans, and even some personal loans. The allure of 0 percent APR lies in the potential to save money on interest payments, but to truly benefit, it's crucial to understand the terms and conditions that accompany these deals.

The Mechanics of 0 Percent APR

When a financial institution offers a 0 percent APR, they essentially allow you to borrow money without paying interest for a promotional period, which typically ranges from 6 to 24 months. During this time, every dollar you pay goes directly towards the principal, allowing you to reduce your debt more quickly. However, it's important to note that these offers often come with specific requirements, such as making minimum monthly payments and avoiding late fees to maintain the interest-free status1.

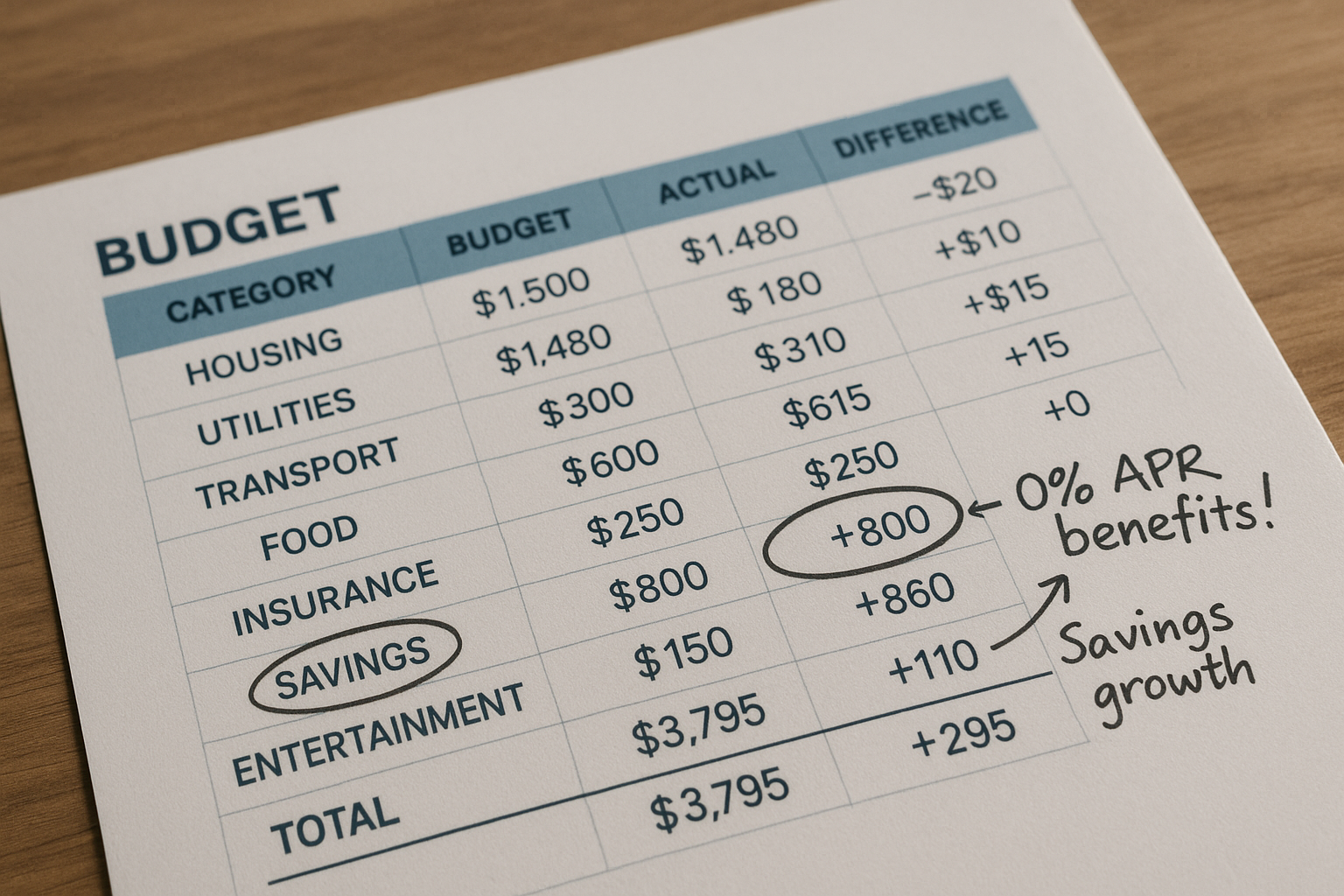

Strategies to Maximize Savings

To make the most out of 0 percent APR offers, consider these strategic approaches:

- Pay Off High-Interest Debt: Use the interest-free period to pay down high-interest debt, like credit card balances. By transferring these balances to a 0 percent APR credit card, you can save on interest and reduce your debt faster.

- Plan Major Purchases: If you're planning to make a significant purchase, such as appliances or electronics, consider using a 0 percent APR offer. This allows you to spread the cost over several months without additional interest, effectively lowering the overall expense.

- Set Up Automatic Payments: Avoid the risk of losing your 0 percent APR status by setting up automatic payments. This ensures you never miss a payment, which could trigger a high penalty APR.

Potential Pitfalls to Avoid

While 0 percent APR offers are enticing, they come with potential pitfalls. One common issue is the deferred interest clause. If you don't pay off the balance by the end of the promotional period, you might be charged interest retroactively on the entire original balance. Additionally, some offers may include balance transfer fees, typically around 3 to 5 percent of the transferred amount, which can offset the interest savings2.

Real-World Examples and Data

According to a recent survey, nearly 40 percent of consumers have utilized 0 percent APR offers to manage their finances better3. Furthermore, data shows that when used wisely, these offers can lead to significant savings. For instance, if you transfer a $5,000 balance from a card with a 20 percent APR to a 0 percent APR card for 12 months, you could save approximately $1,000 in interest over the year4.

Exploring Additional Resources

For those eager to maximize their savings, exploring various financial tools and resources can be invaluable. Many websites offer calculators to help you determine potential savings from 0 percent APR offers. Additionally, financial advisors can provide personalized guidance to navigate these opportunities effectively.

By understanding the intricacies of 0 percent APR offers and implementing smart strategies, you can leverage these deals to enhance your financial well-being. As you explore these options, remember the importance of adhering to the terms and staying informed about the latest offers available in the market.