Secure Financial Stability Self-Employed Disability Insurance Secret

If you're self-employed, securing your financial stability with the right disability insurance can be a game-changer, and by exploring options now, you can protect your income and gain peace of mind.

Understanding Self-Employed Disability Insurance

Self-employed individuals often enjoy the freedom and flexibility that come with running their own business, but this independence also brings unique financial risks. One of the most significant is the potential loss of income due to a disability. Disability insurance for the self-employed is designed to provide a safety net, ensuring you can maintain your lifestyle even if you're unable to work due to illness or injury.

Why Disability Insurance is Crucial for the Self-Employed

Unlike traditional employees, self-employed individuals typically do not have access to employer-sponsored disability insurance. This lack of coverage means that if you become disabled, your income could quickly dwindle, jeopardizing your financial security. Disability insurance offers a vital solution by replacing a portion of your income, allowing you to focus on recovery without the added stress of financial instability.

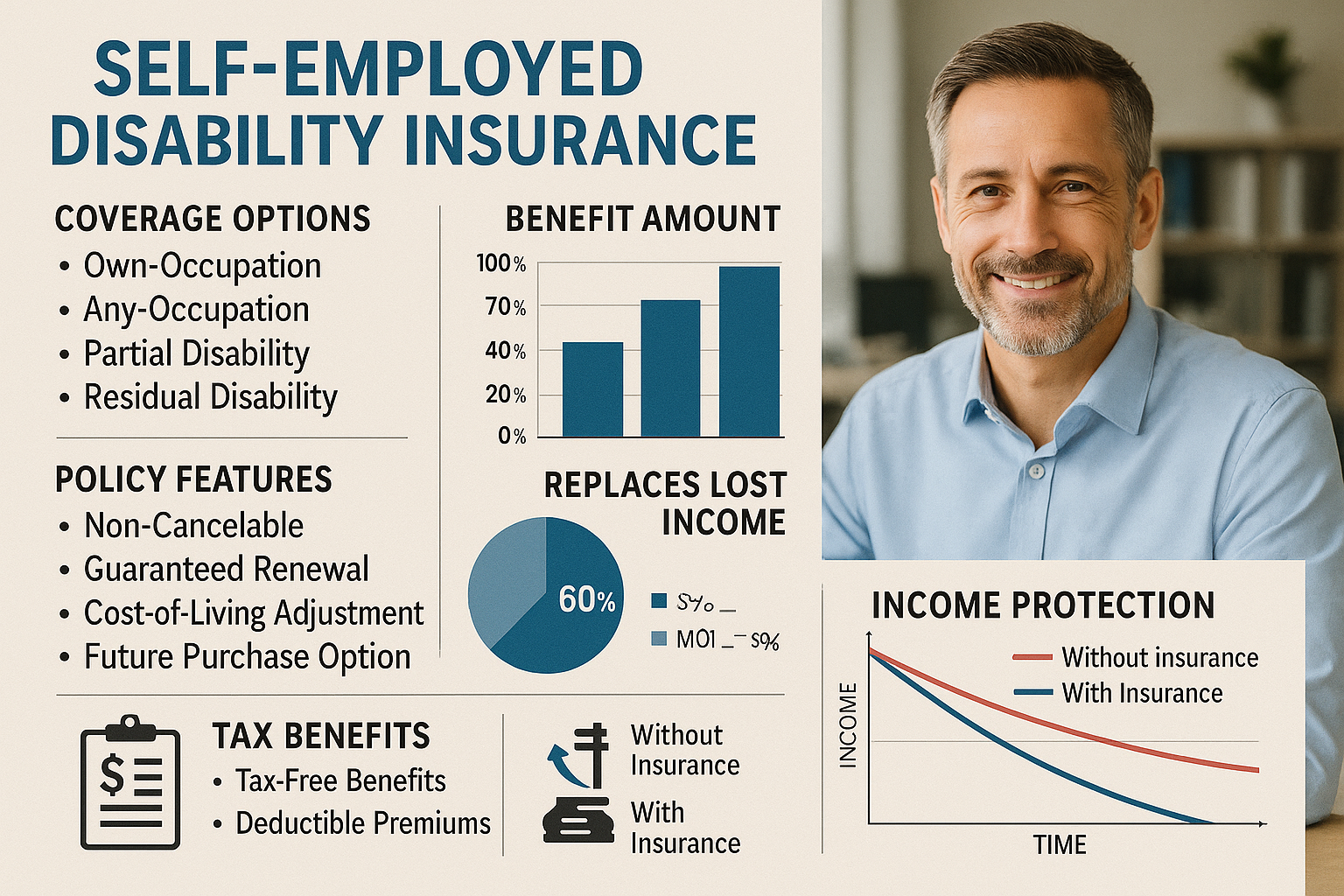

Types of Disability Insurance Available

When considering disability insurance, it's essential to understand the different types available:

- Short-Term Disability Insurance: This type of policy provides benefits for a limited period, typically ranging from a few months up to a year. It's designed to cover temporary disabilities, ensuring you have an income stream during recovery.

- Long-Term Disability Insurance: Offering more extensive coverage, long-term policies can last several years or even until retirement age. This type is ideal for protecting against severe or chronic conditions that prevent you from working for an extended period.

Key Benefits of Self-Employed Disability Insurance

Investing in disability insurance offers numerous advantages:

Cost Considerations and Real-World Pricing

The cost of disability insurance varies based on several factors, including age, health, occupation, and coverage amount. Generally, premiums range from 1% to 3% of your annual income1. For instance, if you earn $50,000 annually, you might expect to pay between $500 and $1,500 per year for a policy. It's advisable to compare multiple quotes and browse options to find the best deal.

Finding the Right Policy

To choose the best disability insurance policy, consider the following steps:

- Assess Your Needs: Determine how much income you need to replace and for how long.

- Research Insurers: Look for reputable companies with strong financial ratings and positive customer reviews.

- Compare Policies: Evaluate different plans, focusing on coverage terms, exclusions, and premium costs.

- Consult a Professional: An insurance advisor can provide personalized recommendations based on your unique situation.

Additional Resources and Opportunities

For those seeking specialized solutions, numerous websites offer tools to compare disability insurance policies and explore additional coverage options. By visiting these resources, you can ensure you're making an informed decision that best suits your financial goals.

In securing disability insurance, you're not just protecting your income—you're investing in your future stability. By taking proactive steps now, you can safeguard your business and personal finances against unforeseen events, ensuring peace of mind and continued success as a self-employed professional.