Secure Unbelievable Savings With New Insurance Renewal Strategies

Secure your financial future by exploring innovative insurance renewal strategies that can unlock unbelievable savings and guide you to browse options that maximize your benefits.

Understanding the Importance of Insurance Renewal Strategies

Insurance renewal is a critical aspect of maintaining financial security, yet many overlook the potential savings and benefits that come with a strategic approach. By understanding and implementing new renewal strategies, you can significantly reduce your premiums and enhance your coverage. The key is to stay informed about the latest trends and options available in the market, enabling you to make well-informed decisions that align with your financial goals.

Exploring Cost-Saving Opportunities

One of the most effective ways to secure savings during insurance renewal is by comparing different policies and providers. Many insurers offer competitive discounts to attract new customers, which can lead to substantial savings if you are willing to switch providers. For instance, bundling multiple policies, such as home and auto insurance, can result in discounts of up to 25%1. Additionally, maintaining a clean claims history and a good credit score can further reduce your premiums, as these factors are often used by insurers to assess risk.

The Role of Technology in Insurance Renewals

Technology has transformed the insurance industry, offering consumers more control and transparency over their policies. Online platforms and mobile apps provide easy access to policy details, renewal dates, and premium calculations. These tools allow you to quickly compare options and make adjustments to your coverage as needed. Moreover, some insurers offer telematics-based policies, where your driving habits are monitored to potentially lower your auto insurance rates2.

Understanding Policy Terms and Conditions

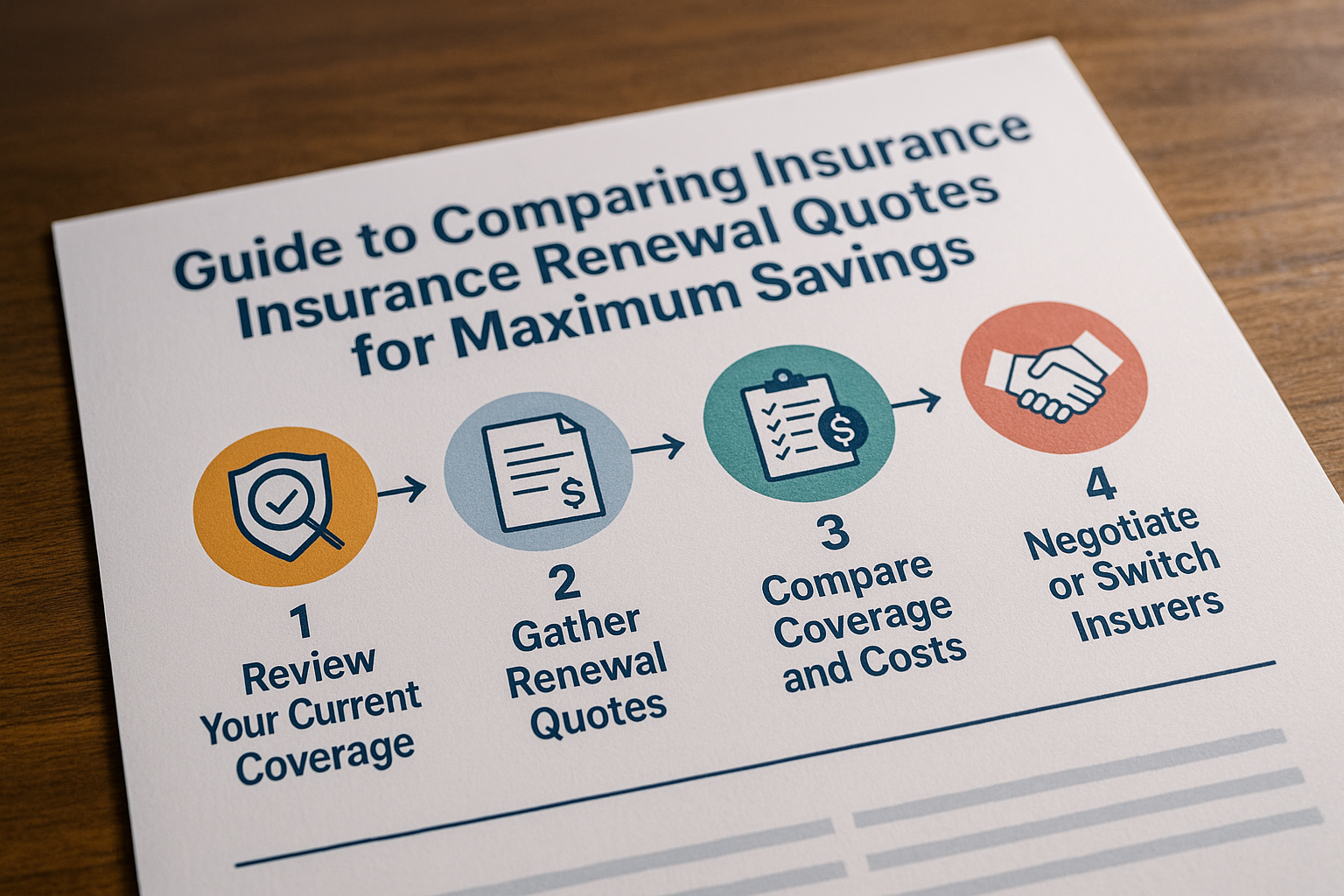

A thorough understanding of your policy's terms and conditions is crucial for maximizing savings. Carefully reviewing the fine print can reveal hidden fees or clauses that may affect your premiums. For example, some policies include automatic renewals with increased rates unless explicitly canceled. By being aware of these terms, you can proactively negotiate better rates or choose to switch providers before renewal.

Leveraging Professional Advice

Consulting with an insurance broker or financial advisor can provide valuable insights into optimizing your renewal strategy. These professionals can help you navigate complex policy details, identify potential savings, and recommend the best options based on your specific needs. According to a survey, 70% of consumers who used a broker reported higher satisfaction with their insurance choices3.

Real-World Examples of Successful Strategies

Consider the case of a family who saved over $500 annually by switching to a new provider that offered a better rate for their home insurance. By taking the time to browse options and compare quotes, they were able to secure a policy that not only reduced their premiums but also enhanced their coverage with additional benefits4.

Adopting new insurance renewal strategies can lead to significant financial savings and improved coverage. By staying informed, leveraging technology, understanding policy details, and seeking professional advice, you can make the most of your insurance renewals. As you explore these options, remember that the right strategy can make a substantial difference in your financial well-being.