Self Funded Plans' Secret Stop Loss Insurance Wins

If you're looking to unlock the hidden advantages of self-funded plans with stop-loss insurance, now is the time to browse options and discover how these strategies can transform your approach to healthcare benefits.

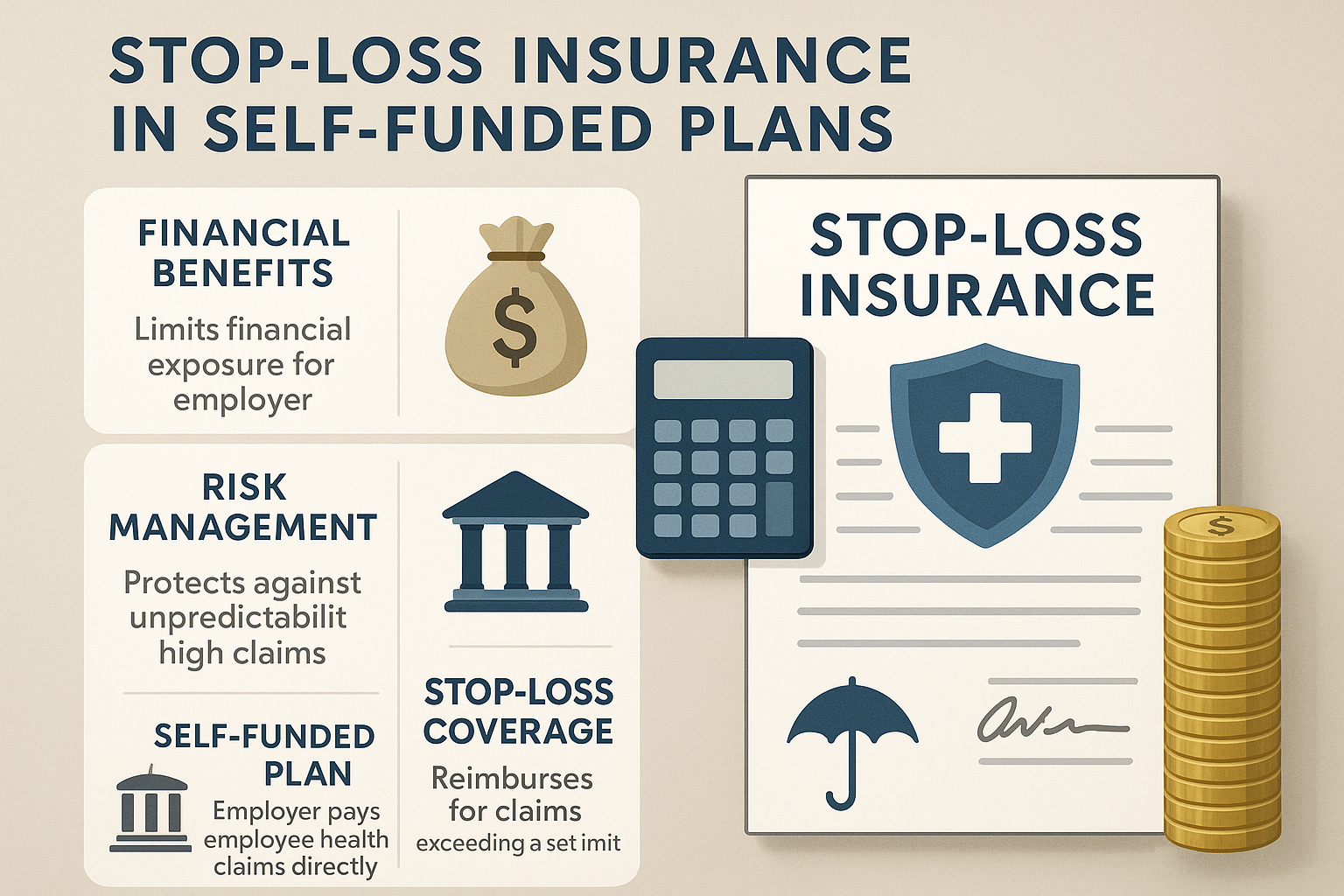

Understanding Self-Funded Plans

Self-funded health plans, also known as self-insured plans, offer employers a way to provide health benefits by paying for claims out of pocket rather than purchasing a traditional insurance policy. This approach allows companies to tailor their health benefits to the specific needs of their workforce, potentially reducing costs and increasing control over plan design. Employers assume the financial risk for providing healthcare benefits to their employees, but this risk is often mitigated by purchasing stop-loss insurance.

The Role of Stop-Loss Insurance

Stop-loss insurance is a crucial component for employers who opt for self-funded plans. It protects against catastrophic claims by capping the amount an employer would have to pay. There are two main types of stop-loss insurance: specific and aggregate. Specific stop-loss insurance covers claims that exceed a predetermined amount for an individual, while aggregate stop-loss insurance covers total claims that exceed a set threshold for the entire group. This dual protection ensures that employers are not overwhelmed by unexpected high-cost claims1.

Benefits of Self-Funded Plans with Stop-Loss Insurance

Employers who choose self-funded plans with stop-loss insurance enjoy several benefits. Firstly, there is the potential for significant cost savings. By only paying for the healthcare services actually used by employees, companies can avoid the high premiums associated with fully insured plans. Additionally, stop-loss insurance provides a safety net, ensuring that the company's financial exposure is limited2.

Moreover, self-funded plans offer greater flexibility. Employers can customize their health benefits to better meet the needs of their workforce, which can lead to improved employee satisfaction and retention. This customization can include wellness programs, preventive care, and other initiatives tailored to the specific health profiles of employees3.

Real-World Examples and Data

Many companies have successfully implemented self-funded plans with stop-loss insurance, resulting in substantial savings. For instance, a mid-sized company reported saving over 20% on their healthcare costs after switching to a self-funded model with stop-loss insurance. This was achieved through careful management of claims and the strategic use of stop-loss coverage to mitigate high-cost incidents4.

Considerations and Next Steps

While self-funded plans with stop-loss insurance present numerous advantages, they are not without challenges. Employers must be prepared to manage the complexities of claims processing and compliance with regulatory requirements. It is essential to work with experienced third-party administrators and consultants who can guide the process and ensure that the plan operates smoothly.

For those interested in exploring this option further, it's advisable to visit websites offering detailed comparisons and reviews of self-funded plan options. By understanding the intricacies of stop-loss insurance and how it integrates with self-funded plans, employers can make informed decisions that align with their financial and healthcare goals.

Self-funded plans with stop-loss insurance offer a compelling alternative to traditional health insurance, providing cost savings, flexibility, and control. As you search options and consider the potential benefits for your organization, remember that expert guidance and thorough research are key to a successful transition.