Side-by-Side Home Equity Loan Fixed Rate Secrets

If you're looking to unlock the true potential of your home equity while enjoying the stability of fixed rates, you might find the perfect solution when you search options and visit websites that offer side-by-side comparisons of home equity loan fixed rates.

Understanding Home Equity Loans

Home equity loans, often referred to as second mortgages, allow homeowners to borrow against the equity they've built up in their homes. This type of loan is particularly attractive because it typically offers lower interest rates compared to unsecured loans or credit cards, making it an efficient way to finance large expenses such as home renovations, debt consolidation, or even education costs. By opting for a fixed rate, you gain the advantage of predictable monthly payments, which can be a significant relief in volatile economic times.

Benefits of Fixed-Rate Home Equity Loans

One of the primary benefits of a fixed-rate home equity loan is the stability it offers. Unlike variable-rate loans, which can fluctuate with market conditions, fixed-rate loans provide certainty. This means that your interest rate—and consequently, your monthly payment—remains constant throughout the life of the loan, allowing for better financial planning and peace of mind.

Moreover, fixed-rate loans can be particularly beneficial in a rising interest rate environment. By locking in a rate now, you can protect yourself against potential increases in the future. This can result in significant savings over the loan term, especially if rates rise substantially.

Comparing Your Options

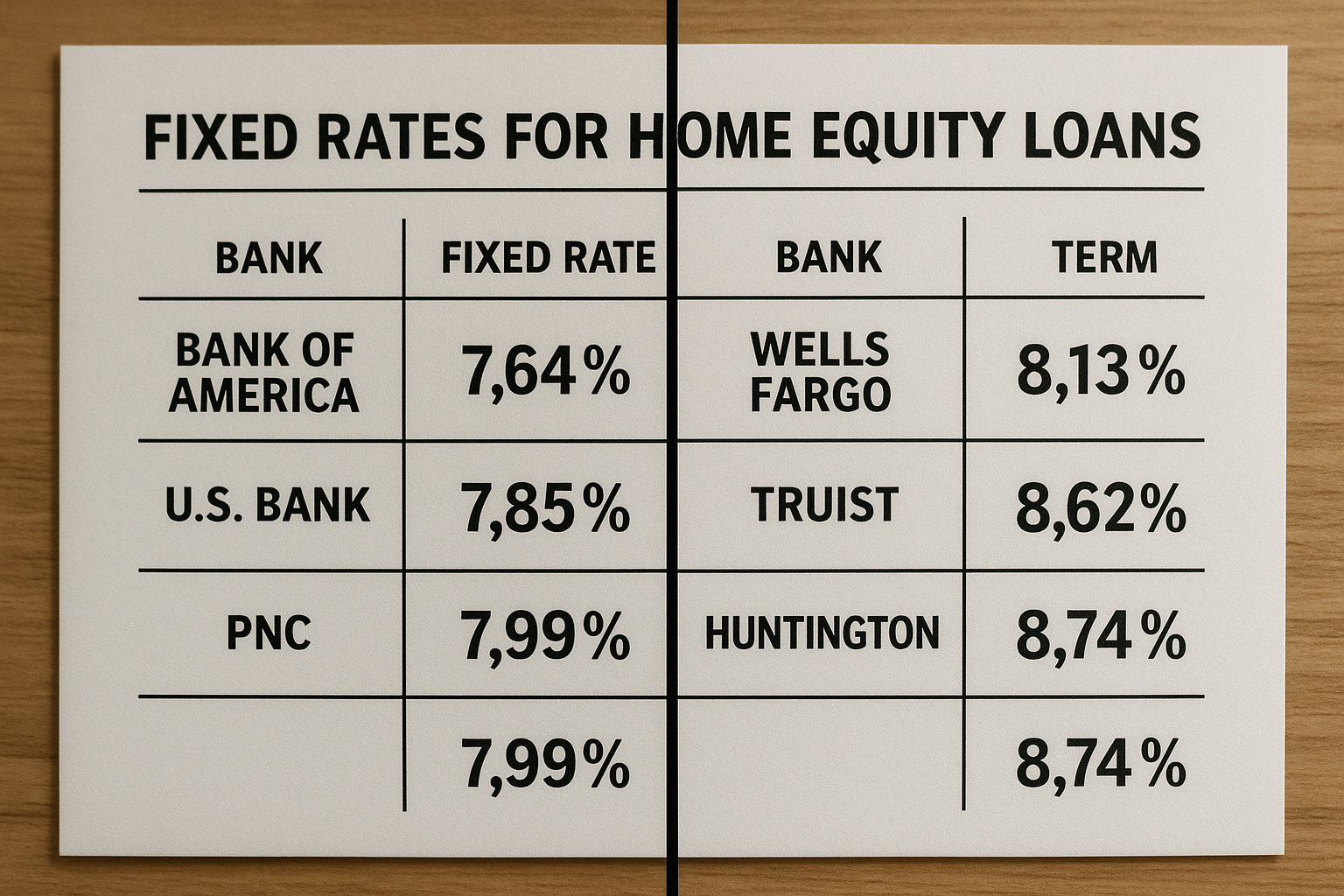

When considering a home equity loan, it's crucial to compare the various options available to you. Different lenders may offer varying rates, terms, and fees, so it's wise to conduct thorough research. Many financial institutions provide online tools that allow you to compare rates side-by-side, helping you to identify the best deal for your circumstances. As you browse options, pay attention to the Annual Percentage Rate (APR), which includes both the interest rate and any additional fees, giving you a more comprehensive view of the loan's cost.

Real-World Application and Costs

In practical terms, the cost of a home equity loan can vary widely based on several factors, including your credit score, the amount of equity in your home, and the current interest rate environment. For example, as of the latest data, fixed rates for home equity loans can range from around 3% to 8%1. It's important to note that while a lower rate is attractive, the best option for you will depend on your individual financial situation and goals.

Exploring Additional Resources

For those interested in exploring further, numerous resources are available online that provide detailed comparisons and reviews of different lenders. Websites like Bankrate and NerdWallet offer comprehensive tools and calculators that can help you make an informed decision2. Additionally, consulting with a financial advisor can provide personalized insights tailored to your financial situation and objectives.

In summary, a side-by-side comparison of home equity loan fixed rates can be a powerful tool in your financial toolkit, offering both stability and the potential for significant savings. By understanding the benefits and thoroughly researching your options, you can make a decision that aligns with your financial goals. As you explore these opportunities, consider specialized services and resources that can further enhance your decision-making process.