Slash Costs with Florida's Insurance Secret Today

Are you ready to slash your insurance costs and discover Florida's best-kept secret? Dive into the world of savings by exploring your options today, and you'll be amazed at the benefits waiting for you.

Understanding Florida's Insurance Landscape

Florida's insurance market is a unique entity, shaped by its geographical location and susceptibility to natural disasters such as hurricanes. This has led to a complex insurance environment where costs can be significantly higher than the national average. However, savvy consumers can navigate this landscape to find substantial savings. The key is understanding the various options available and leveraging them to your advantage.

The Secret to Lowering Your Insurance Costs

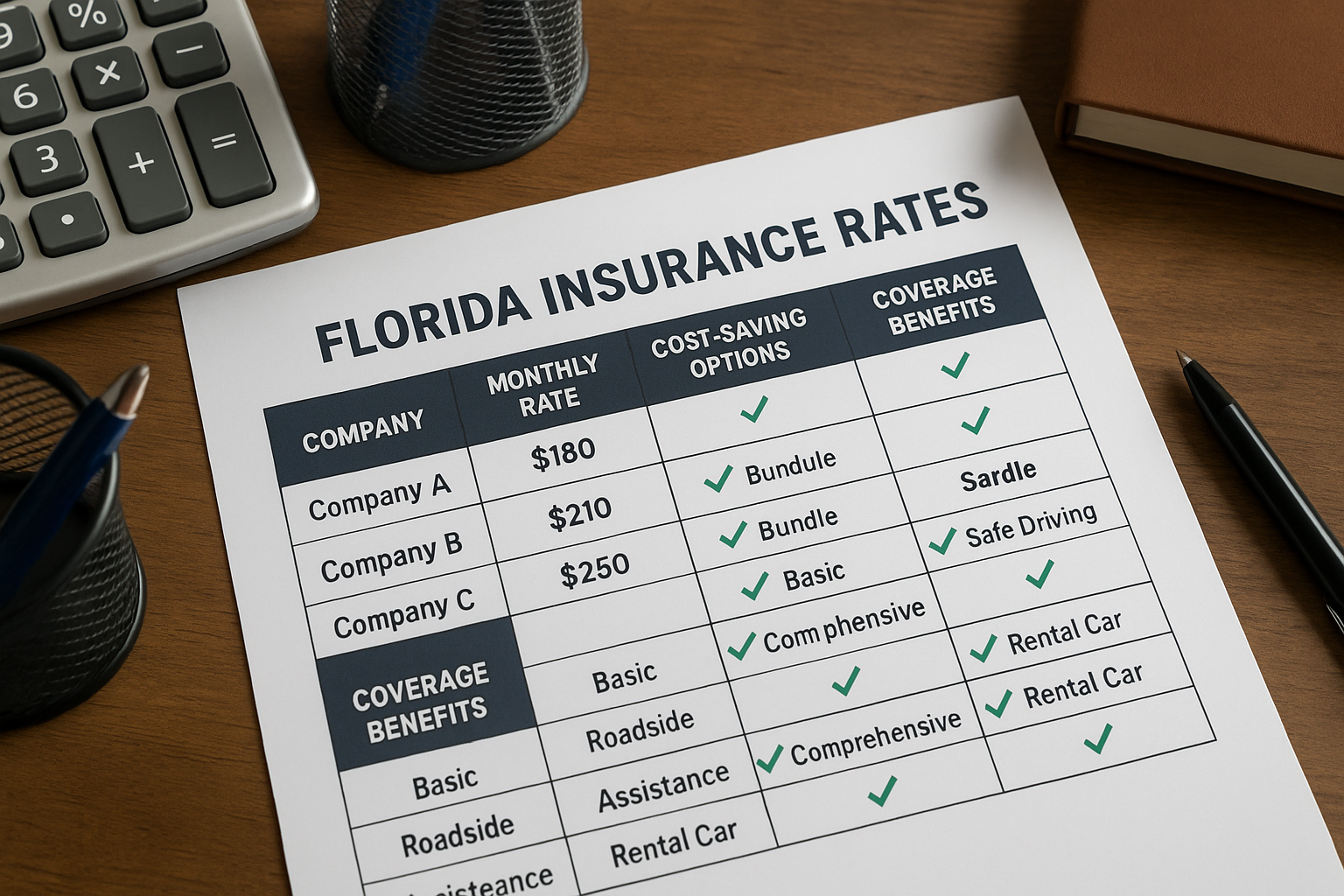

The secret to reducing your insurance costs in Florida lies in the state's unique insurance programs and competitive market. One of the most effective strategies is to bundle your insurance policies. Many providers offer significant discounts when you combine home, auto, and other types of insurance. This not only simplifies your payments but also reduces your overall premiums.

Another option is to take advantage of Florida's wind mitigation credits. Given the state's vulnerability to hurricanes, insurers provide discounts for homes that have features reducing wind damage risks. By investing in improvements such as storm shutters or reinforced roofing, you can qualify for these credits and substantially lower your insurance costs1.

Exploring Competitive Insurance Rates

Florida's insurance market is highly competitive, with numerous providers offering a range of policies. This competition can be beneficial for consumers, as it often leads to better deals and more tailored options. By browsing and comparing different providers, you can find policies that not only meet your needs but also fit your budget. Websites like Florida's Office of Insurance Regulation provide tools to compare rates and coverage options2.

Leveraging State-Sponsored Programs

Florida offers several state-sponsored programs designed to help residents manage their insurance costs. The Florida Market Assistance Program (FMAP) assists consumers in finding affordable property insurance by connecting them with insurers willing to write new policies. Additionally, Citizens Property Insurance Corporation, a state-run insurer, provides coverage options for those unable to find insurance in the private market3.

Real-World Savings and Opportunities

Many Florida residents have successfully reduced their insurance costs by implementing these strategies. For example, a homeowner in Miami reported saving over $1,000 annually by installing wind-resistant features and bundling their home and auto insurance4. Such real-world examples highlight the tangible benefits of exploring these options.

By understanding the intricacies of Florida's insurance market and taking proactive steps, you can significantly reduce your insurance expenses. Whether it's through bundling policies, taking advantage of wind mitigation credits, or leveraging state-sponsored programs, the opportunities for savings are plentiful. As you explore these options, you'll not only enjoy reduced costs but also gain peace of mind knowing you're well-protected.