Slash Medical Costs Short Term Health Insurance Secrets

If you're looking to slash your medical costs without compromising on essential coverage, exploring short-term health insurance options can offer you immediate savings and flexibility while you browse options that fit your needs.

Understanding Short-Term Health Insurance

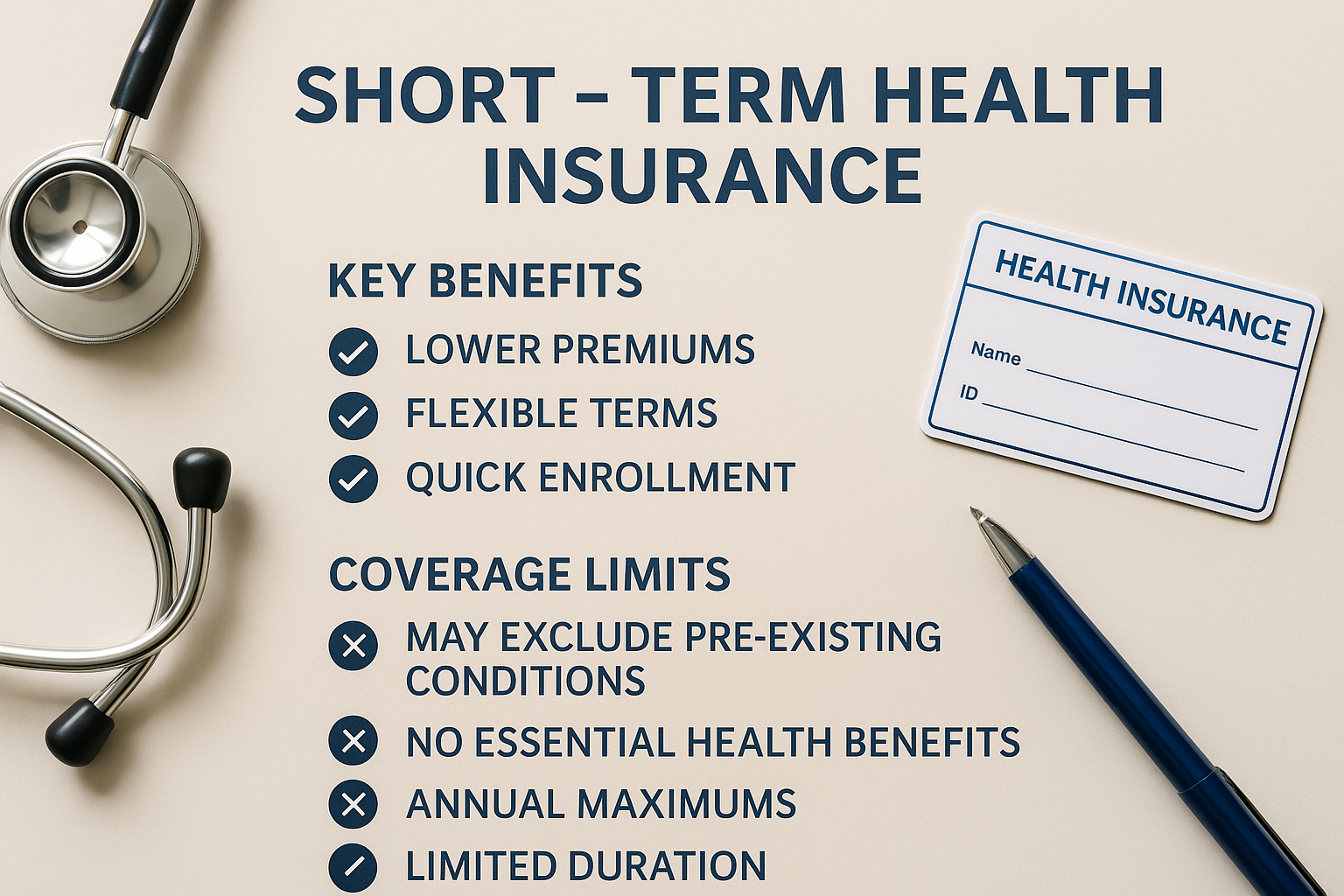

Short-term health insurance is designed to provide temporary coverage for individuals who are between permanent health plans. These plans typically cover a range of medical services, including doctor visits, emergency care, and hospital stays, but they may not cover pre-existing conditions or preventive care. The primary appeal of short-term health insurance lies in its affordability and flexibility, making it an attractive option for those in transition periods, such as recent graduates, individuals between jobs, or retirees not yet eligible for Medicare.

Benefits of Short-Term Health Insurance

One of the main benefits of short-term health insurance is cost savings. Premiums for these plans are generally lower than those for traditional health insurance plans, providing a more budget-friendly option for individuals seeking temporary coverage. Additionally, short-term plans offer quick enrollment processes and can be activated within a few days, allowing you to gain coverage almost immediately. This can be particularly advantageous if you're waiting for a new employer's health benefits to kick in or need coverage during a gap period.

Financial Considerations

While short-term health insurance can offer cost savings, it's important to understand the financial trade-offs. These plans often come with higher out-of-pocket costs, such as deductibles and co-pays, compared to long-term health insurance plans. Moreover, because they are not required to comply with the Affordable Care Act (ACA) regulations, short-term plans may have caps on coverage and exclude certain benefits, such as maternity care or mental health services. Therefore, it's crucial to carefully assess your healthcare needs and budget before opting for a short-term plan.

Exploring Your Options

When considering short-term health insurance, it's essential to compare different plans to find one that best suits your needs. Many insurance providers offer a range of short-term plans with varying coverage limits, deductibles, and premiums. Websites such as eHealthInsurance and HealthMarkets provide platforms where you can compare plans side-by-side, allowing you to make an informed decision based on your healthcare requirements and financial situation. Additionally, some providers may offer discounts or promotional rates for new enrollees, so it's worth exploring these options to maximize your savings.

Real-World Examples and Statistics

According to a report from the Kaiser Family Foundation, the average monthly premium for short-term health insurance is significantly lower than that of ACA-compliant plans, making it a viable option for those looking to reduce their healthcare expenses1. Furthermore, a study by the National Association of Insurance Commissioners found that many short-term plans offer customizable options, allowing consumers to tailor their coverage to match their specific needs2. These findings highlight the potential for short-term health insurance to serve as a cost-effective solution for individuals seeking temporary coverage.

Key Takeaways

Short-term health insurance can be a practical and economical choice for those needing immediate coverage during transitional periods. By carefully evaluating your healthcare needs and comparing available options, you can find a plan that provides the necessary protection without breaking the bank. Remember, while these plans offer significant savings, it's crucial to be aware of their limitations and ensure they align with your overall health strategy. As you explore your options, keep in mind the resources and platforms available to help you make an informed decision.