Today's Refinance Rates Could Save You Thousands Instantly

Imagine instantly saving thousands of dollars on your mortgage by simply exploring today's refinance rates with a quick search of available options.

Understanding Today's Refinance Rates

Refinancing your mortgage can be a strategic financial move, offering the potential to lower your monthly payments, reduce the total interest paid over the life of the loan, or even access cash from your home’s equity. Today's refinance rates are particularly attractive due to the current economic climate, where interest rates have remained relatively low compared to historical averages1. By taking advantage of these rates, homeowners can significantly cut down their mortgage costs and free up funds for other financial goals.

How Refinancing Can Save You Money

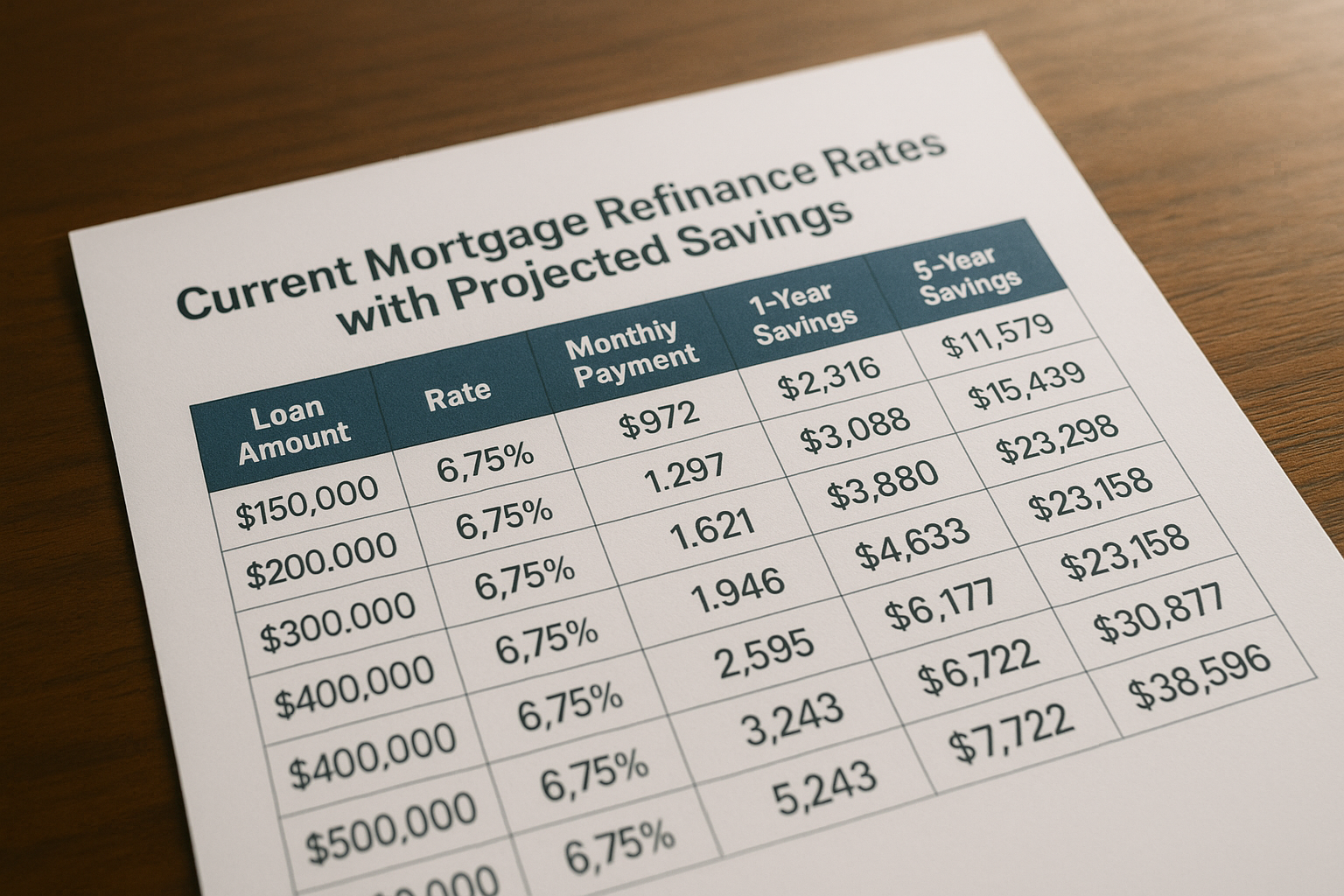

The primary benefit of refinancing is the potential for saving money. For instance, if you can reduce your interest rate by even one percentage point, the savings can be substantial. For a $300,000 mortgage, this could translate to over $3,000 in savings annually2. Additionally, refinancing to a shorter-term loan can reduce the amount of interest paid over time, although it may increase your monthly payments. This option is particularly appealing for those who are nearing retirement and want to pay off their mortgage sooner.

Types of Refinancing Options

There are several refinancing options available, each catering to different financial situations:

- Rate-and-Term Refinance: This is the most common type of refinancing, where you change the interest rate, the term of the loan, or both, without altering the loan amount.

- Cash-Out Refinance: This option allows you to borrow more than you owe on your home, taking the difference in cash. It’s ideal for those looking to fund home improvements or consolidate high-interest debt.

- Cash-In Refinance: Opposite to cash-out, this involves paying down your mortgage balance to qualify for a lower interest rate or to eliminate private mortgage insurance.

Evaluating Your Refinancing Options

When considering refinancing, it’s crucial to evaluate your financial goals and how refinancing aligns with them. Factors such as your credit score, the amount of equity in your home, and the length of time you plan to stay in your home all play a significant role in determining the best refinancing option for you. Utilizing online calculators and consulting with financial advisors can provide personalized insights into potential savings and costs3.

Steps to Take Before Refinancing

Before jumping into refinancing, ensure that you:

- Check your credit score and improve it if necessary, as this will directly impact your new interest rate.

- Gather necessary financial documents, including pay stubs, tax returns, and bank statements.

- Shop around by visiting websites of various lenders to compare rates and terms. This can help you secure the best deal possible.

Real-World Examples and Statistics

Recent data indicates that homeowners who refinanced in 2023 saved an average of $2,700 annually on their mortgage payments4. This underscores the significant impact refinancing can have on a household's budget. Furthermore, the Mortgage Bankers Association reports that refinance applications have surged by 20% compared to the previous year, highlighting a growing awareness and uptake of this financial opportunity5.

Refinancing your mortgage at today's rates presents a lucrative opportunity to save money and achieve greater financial flexibility. Whether you're looking to lower your monthly payments, pay off your mortgage faster, or access cash for other needs, exploring refinancing options could be a wise financial decision. Start by browsing options, consulting with experts, and leveraging online tools to ensure you make the most informed choice possible.