Virginia HELOC rates revealed 2023's best-kept secret

Unlock the potential of your home's equity with Virginia's best-kept secret in HELOC rates for 2023, and as you browse options, discover how these competitive rates can transform your financial landscape.

Understanding HELOCs: A Powerful Financial Tool

A Home Equity Line of Credit (HELOC) offers homeowners a flexible way to tap into the equity they've built up in their property. Unlike a traditional loan, a HELOC provides a revolving line of credit that you can draw from as needed, much like a credit card. This flexibility makes HELOCs an attractive option for funding home improvements, consolidating debt, or covering unexpected expenses.

Why Virginia's HELOC Rates Are a Game-Changer

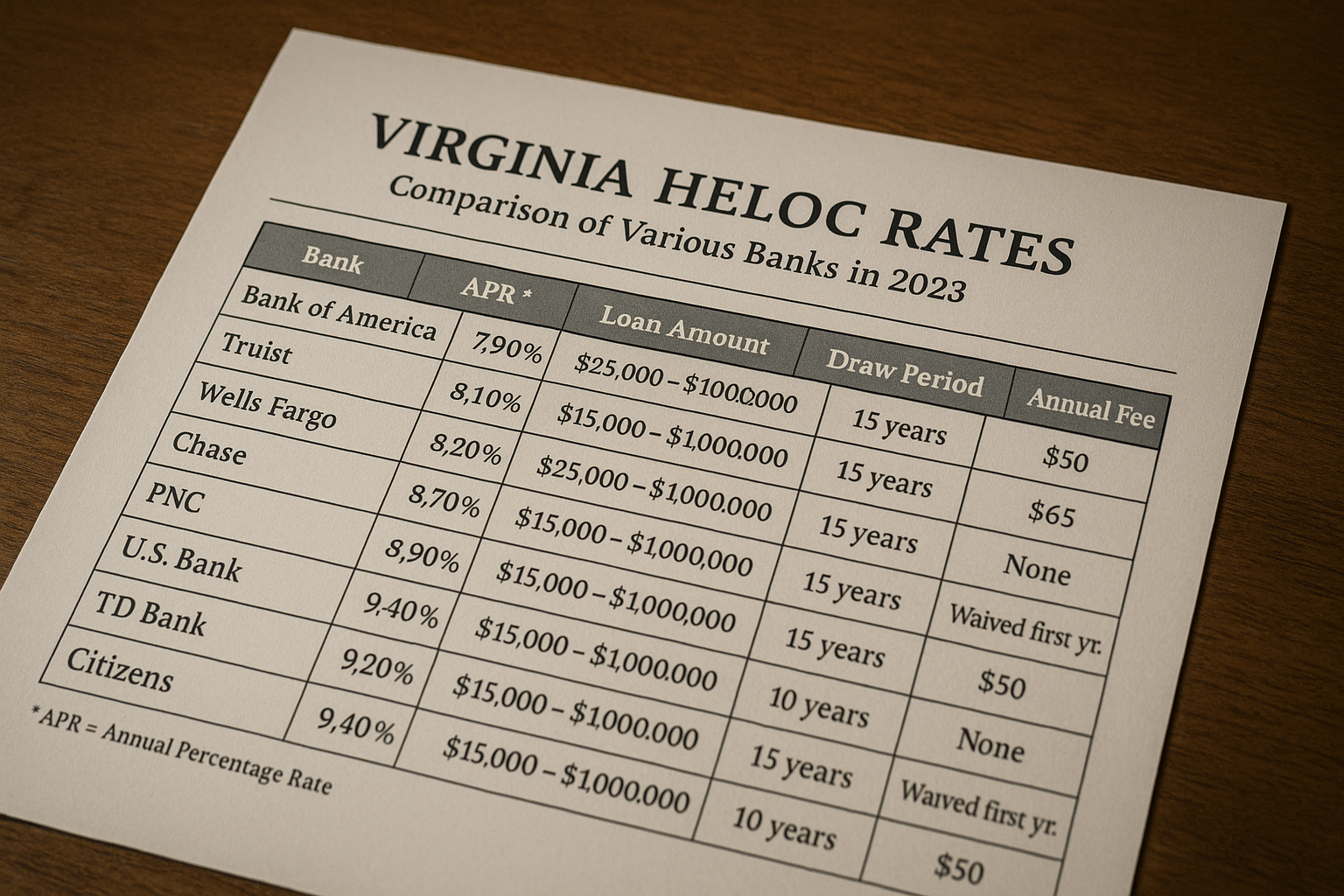

In 2023, Virginia has emerged as a hotspot for homeowners seeking competitive HELOC rates. The state's financial institutions are offering some of the lowest rates in the nation, creating an ideal environment for borrowers. With interest rates as low as 4.5% APR, Virginia's HELOC market is providing unprecedented opportunities for financial growth and stability1.

How to Leverage These Rates

To make the most of Virginia's favorable HELOC rates, it's crucial to understand the application process and eligibility requirements. Generally, lenders look at your credit score, income, and the amount of equity in your home. A higher credit score and more equity typically result in better rates and terms. Start by gathering your financial documents and assessing your creditworthiness. Then, visit websites of local lenders to compare offers and find the best fit for your needs.

Potential Savings and Financial Benefits

By securing a HELOC with a low interest rate, you can significantly reduce the cost of borrowing. For instance, if you need $50,000 for a major renovation, a lower interest rate could save you thousands over the life of the credit line. Additionally, the interest paid on a HELOC may be tax-deductible if used for home improvements, offering further financial incentives2.

Exploring Additional Resources

For those interested in diving deeper into HELOC options, there are numerous resources available. Websites like NerdWallet and Bankrate provide comprehensive comparisons and reviews of different lenders, making it easier to find the right match for your financial situation3. Additionally, consulting with a financial advisor can offer personalized insights and strategies tailored to your goals.

Virginia's HELOC rates in 2023 present a unique opportunity to access affordable credit and leverage your home's equity effectively. As you explore these options, remember that the right choice can lead to significant financial benefits and increased peace of mind. Whether you're planning a renovation, consolidating debt, or simply looking for a safety net, the time to act is now.