Expert Reveals Why Commercial Property Costs Beat Residential

Unlock the potential of commercial real estate and discover why its financial advantages often surpass those of residential properties by browsing options that could transform your investment strategy.

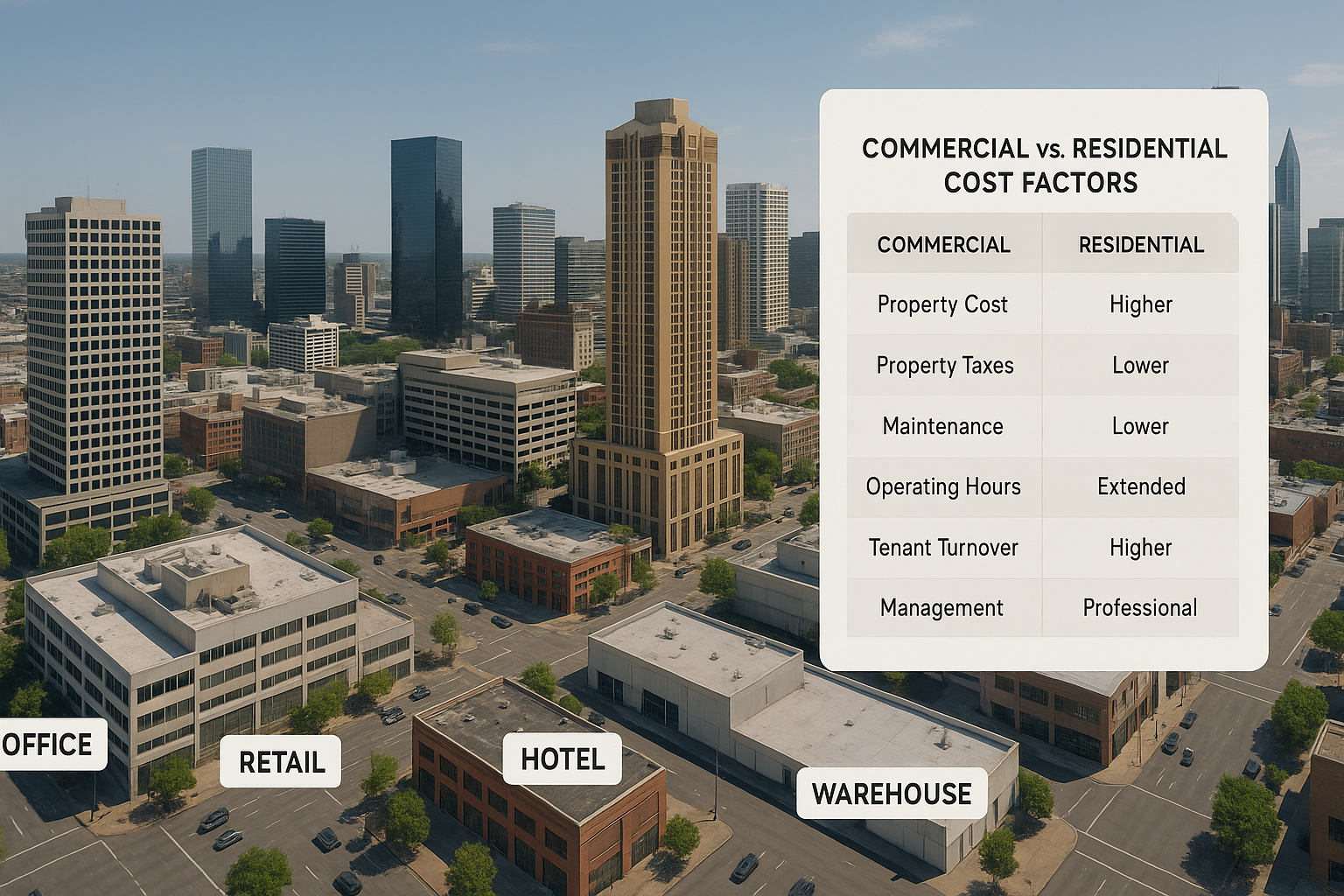

Understanding the Cost Dynamics

When it comes to property investment, commercial real estate often presents a more lucrative opportunity compared to residential options. The primary reason lies in the cost dynamics and the potential for higher returns. Commercial properties, such as office buildings, retail spaces, and industrial facilities, typically offer a higher rental yield. According to data from the National Association of Realtors, commercial properties can yield between 6% to 12% annually, whereas residential properties generally provide a yield of 1% to 4%1.

Higher Income Potential

One of the most compelling reasons investors are drawn to commercial properties is the income potential. Commercial leases tend to be longer, often ranging from three to ten years, providing a stable and predictable income stream. This stability is a significant advantage over residential leases, which typically last one year. Moreover, commercial tenants, especially those in retail or office spaces, are more likely to invest in the upkeep of the property to maintain their business operations, which can reduce maintenance costs for the property owner.