Navigate Epic Savings Comparing Home Equity Loan Products

Unlocking the potential of your home’s equity can lead to epic savings, and by taking the time to compare home equity loan products, you can find the best deals tailored to your financial needs—browse options, search options, and visit websites to make informed decisions.

Understanding Home Equity Loans

Home equity loans are a popular choice for homeowners looking to leverage the value built into their property. Essentially, these loans allow you to borrow against the equity in your home, providing a lump sum of money that can be used for various purposes such as home improvements, debt consolidation, or major purchases. The interest rates on home equity loans are generally lower than those on personal loans or credit cards, making them an attractive option for many borrowers.

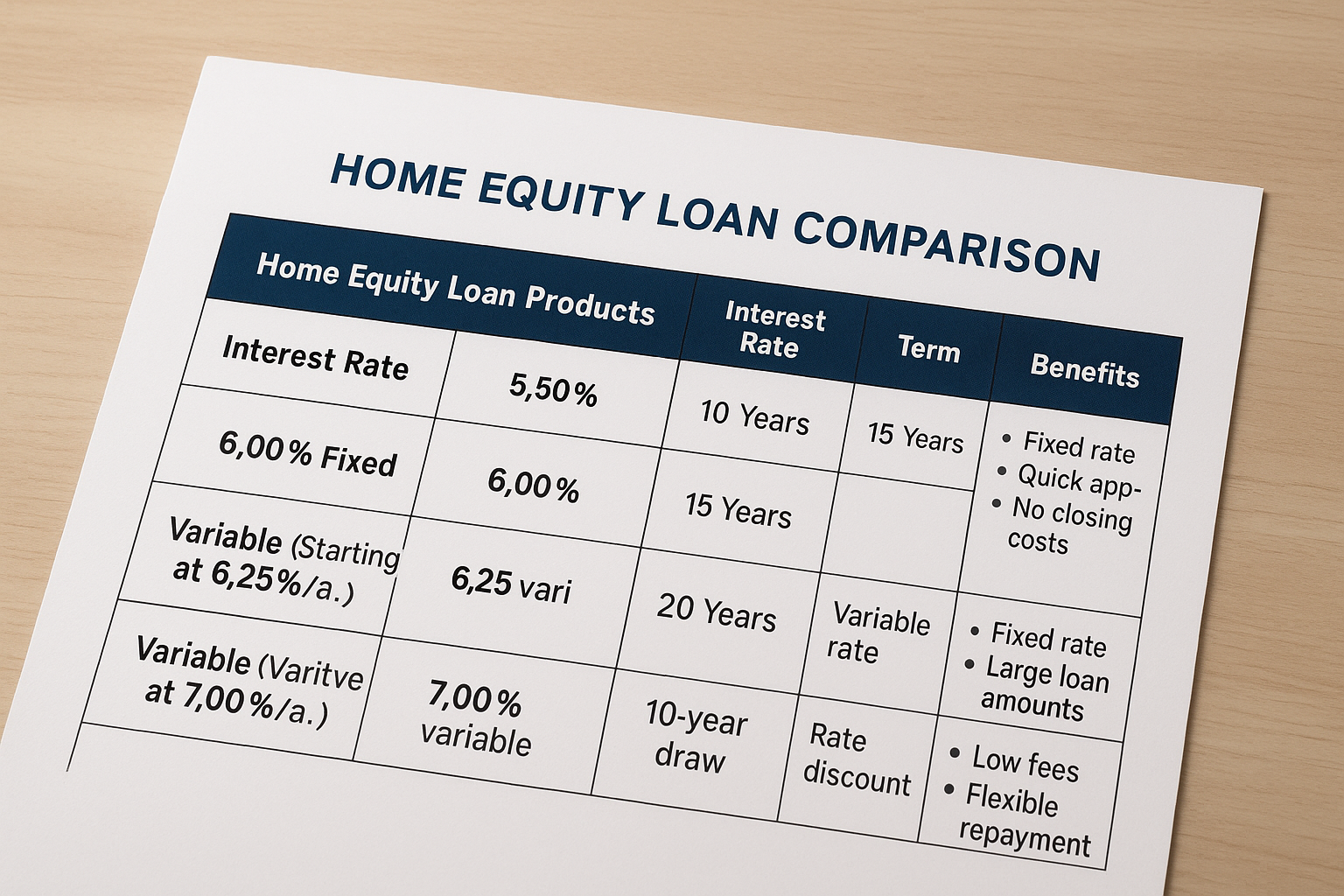

Types of Home Equity Loans

There are primarily two types of home equity loans: fixed-rate loans and home equity lines of credit (HELOCs). A fixed-rate home equity loan offers a one-time lump sum with a fixed interest rate and repayment schedule, which can be ideal for those who prefer predictable monthly payments. On the other hand, a HELOC provides a revolving credit line with a variable interest rate, giving you the flexibility to borrow and repay as needed, similar to a credit card. This option is suitable for ongoing expenses or projects with uncertain costs.