Secure Future Wealth With These Best HELOC Secrets

Unlocking the secrets of a Home Equity Line of Credit (HELOC) can be your gateway to financial security, and as you explore these options, you'll discover ways to effectively manage your wealth and secure your future.

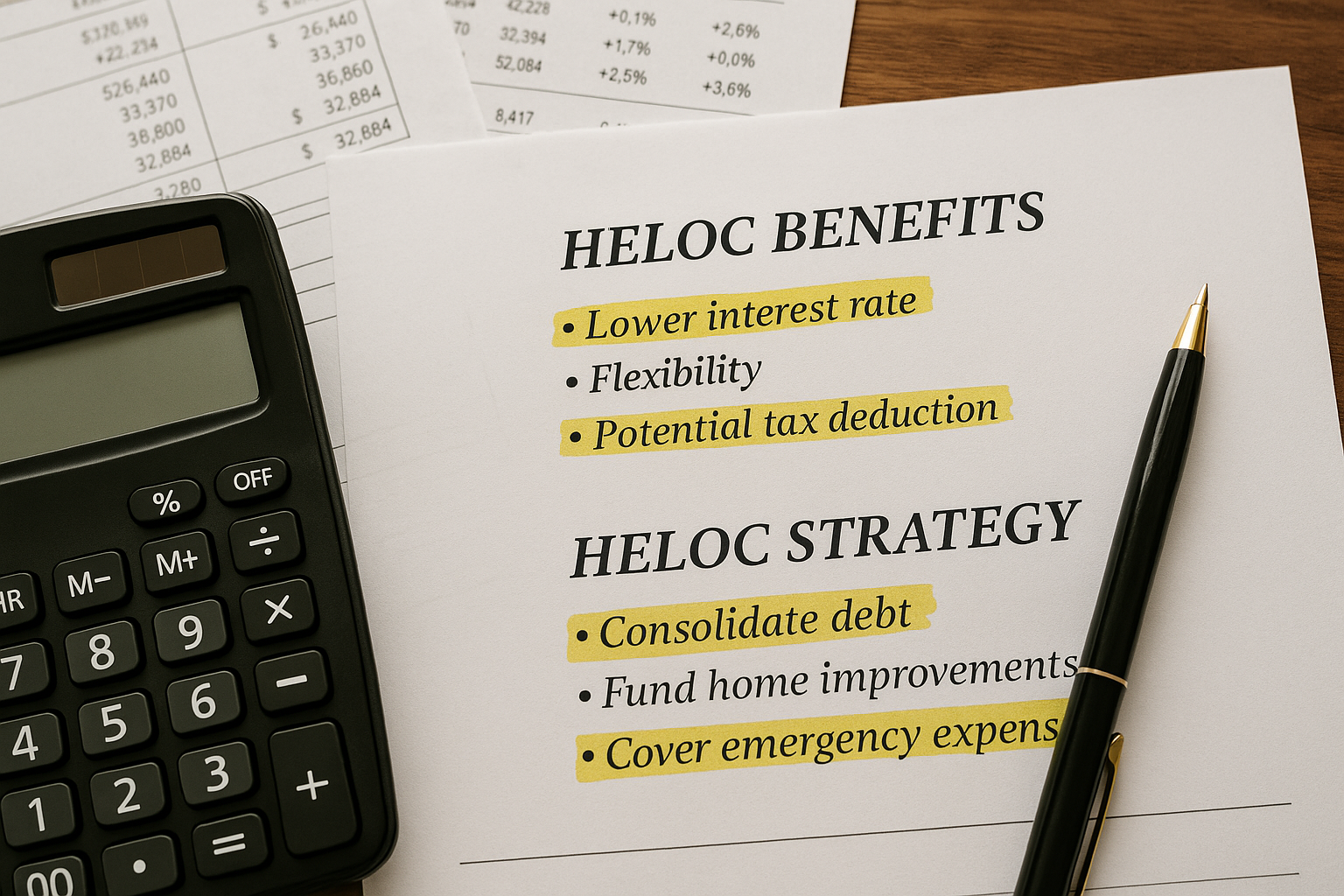

Understanding HELOC: A Smart Financial Tool

A Home Equity Line of Credit (HELOC) is a flexible financial tool that allows you to borrow against the equity of your home. Unlike a traditional loan, a HELOC provides you with a revolving line of credit, similar to a credit card, which means you can borrow, repay, and borrow again as needed. This flexibility makes it an attractive option for homeowners looking to manage large expenses or consolidate debt.

Why Choose a HELOC?

One of the primary benefits of a HELOC is its lower interest rates compared to personal loans and credit cards. As of 2023, the average HELOC interest rate is around 6.5%1, which is significantly lower than the average credit card interest rate of about 16%2. This can lead to substantial savings, especially if you're using the funds for home improvements, which can also increase your home's value.