The surprising truth about home equity loans revealed

Unlock the hidden potential of your home's value with home equity loans and discover how you can strategically use this financial tool to achieve your goals—whether it's renovating your space, consolidating debt, or funding major expenses—by exploring the diverse options available to you today.

Understanding Home Equity Loans

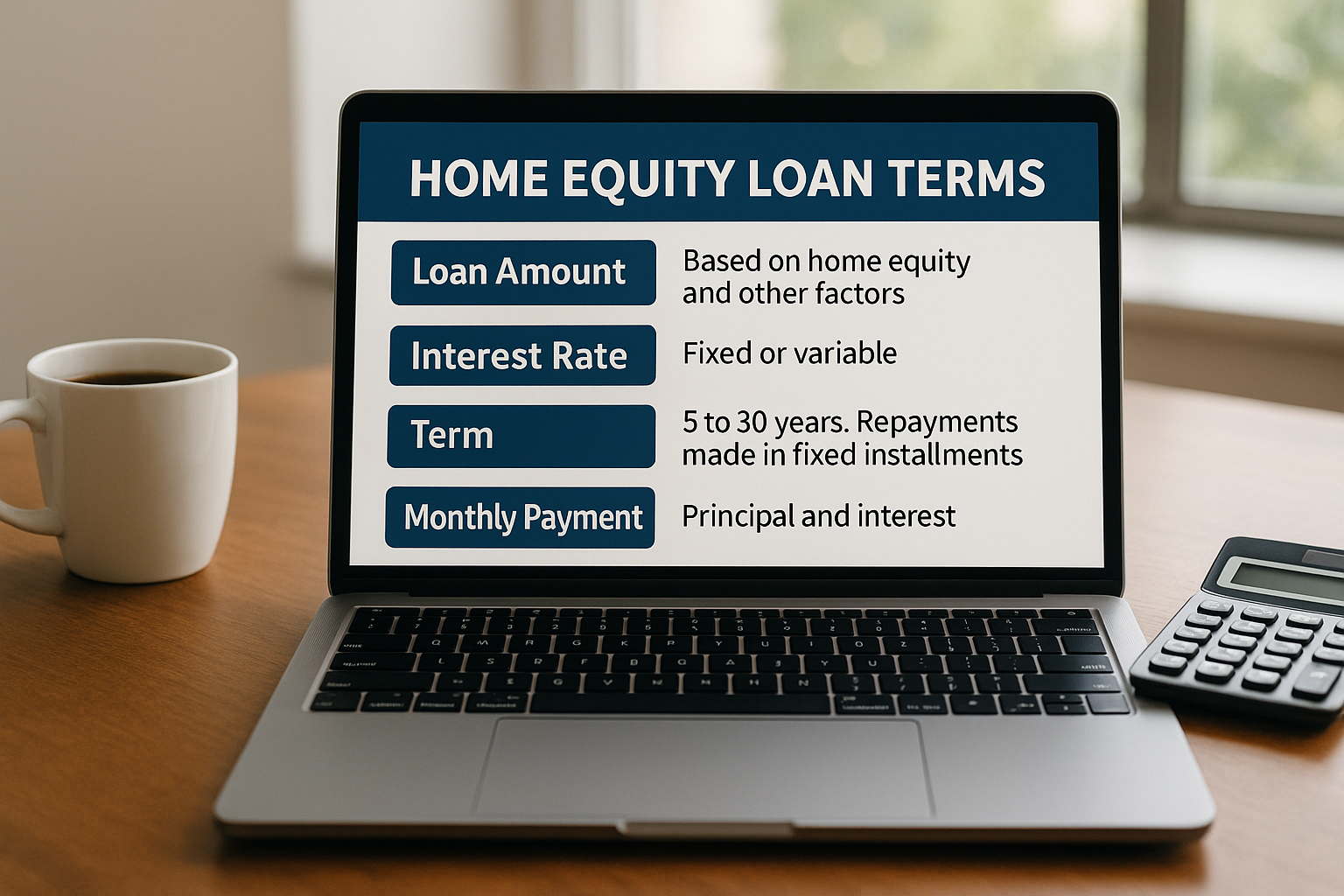

Home equity loans, often referred to as second mortgages, allow homeowners to borrow against the equity they have built up in their property. This type of loan provides a lump sum of money at a fixed interest rate, which is repaid over a set period. The loan amount is determined by the difference between your home's current market value and the outstanding balance of your mortgage. This financial product can be a powerful tool for those who need access to funds for various purposes.

Why Consider a Home Equity Loan?

The primary allure of home equity loans lies in their ability to provide substantial funds at relatively low interest rates compared to other types of loans, such as personal loans or credit cards. This is because your home serves as collateral, reducing the lender's risk. For instance, if you're looking to undertake significant home improvements, a home equity loan can offer the necessary capital to enhance your property’s value, potentially increasing your equity even further.

Moreover, home equity loans can be an effective way to consolidate higher-interest debt, such as credit card balances, into a single, more manageable monthly payment. This can lead to significant savings on interest over time, allowing you to pay off debt faster1.