Find Your Perfect Employer Health Insurance Plan Today

Discover how you can navigate the complex world of employer health insurance plans and find the perfect fit for your needs by exploring a variety of options that could lead to significant savings and enhanced benefits.

Understanding Employer Health Insurance Plans

Employer health insurance is a crucial benefit that can significantly impact your financial and physical well-being. With rising healthcare costs, having a comprehensive plan can save you thousands of dollars annually. In the U.S., employer-sponsored health insurance covers about 49% of the population, making it one of the most common forms of health coverage1. Understanding the nuances of these plans can help you make informed decisions that align with your healthcare needs and financial goals.

Types of Employer Health Insurance Plans

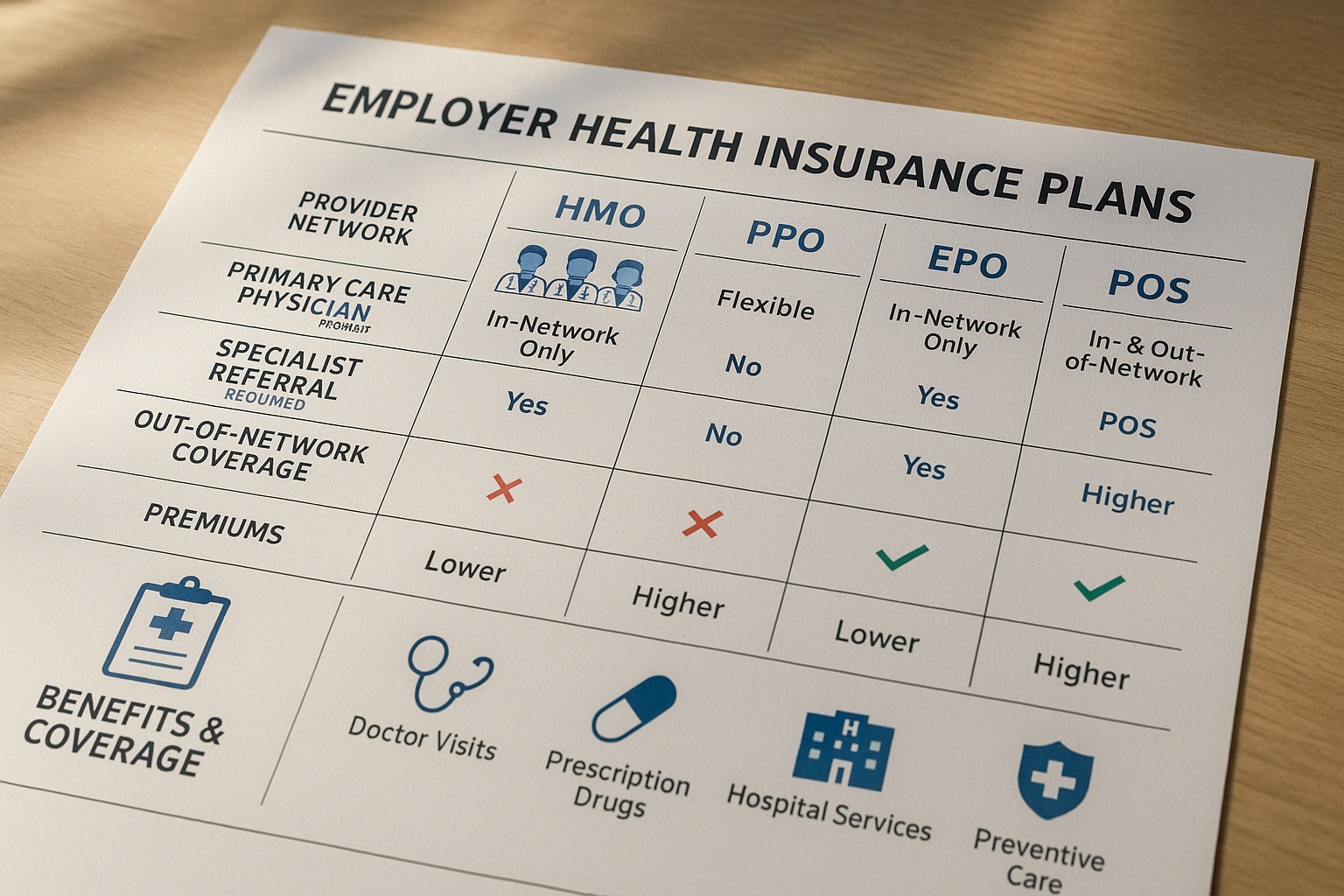

Typically, employers offer several types of health insurance plans, each with its own benefits and limitations:

- Health Maintenance Organization (HMO): HMOs require you to choose a primary care physician and get referrals for specialist care. They often have lower premiums and out-of-pocket costs but less flexibility in choosing healthcare providers.

- Preferred Provider Organization (PPO): PPOs offer more flexibility in choosing doctors and specialists without referrals, though they come with higher premiums and out-of-pocket costs.

- Exclusive Provider Organization (EPO): EPOs combine features of HMOs and PPOs, offering a network of providers but without the need for referrals. However, coverage is limited to in-network providers.

- Point of Service (POS): POS plans require a primary care physician and referrals for specialists, similar to HMOs, but offer more flexibility in seeing out-of-network providers at a higher cost.