Is Your Health Insurance Covering Hidden Benefits Now

Is your health insurance policy harboring hidden benefits that you haven't yet discovered, offering you the chance to browse options that could enhance your coverage and save you money?

Understanding the Hidden Benefits in Health Insurance

Many individuals are unaware that their health insurance plans often come with a plethora of hidden benefits designed to enhance their healthcare experience and provide additional value. These benefits can range from wellness programs and preventive services to discounts on health-related products and services. By taking the time to explore your policy details, you can uncover these advantages and make the most of your coverage.

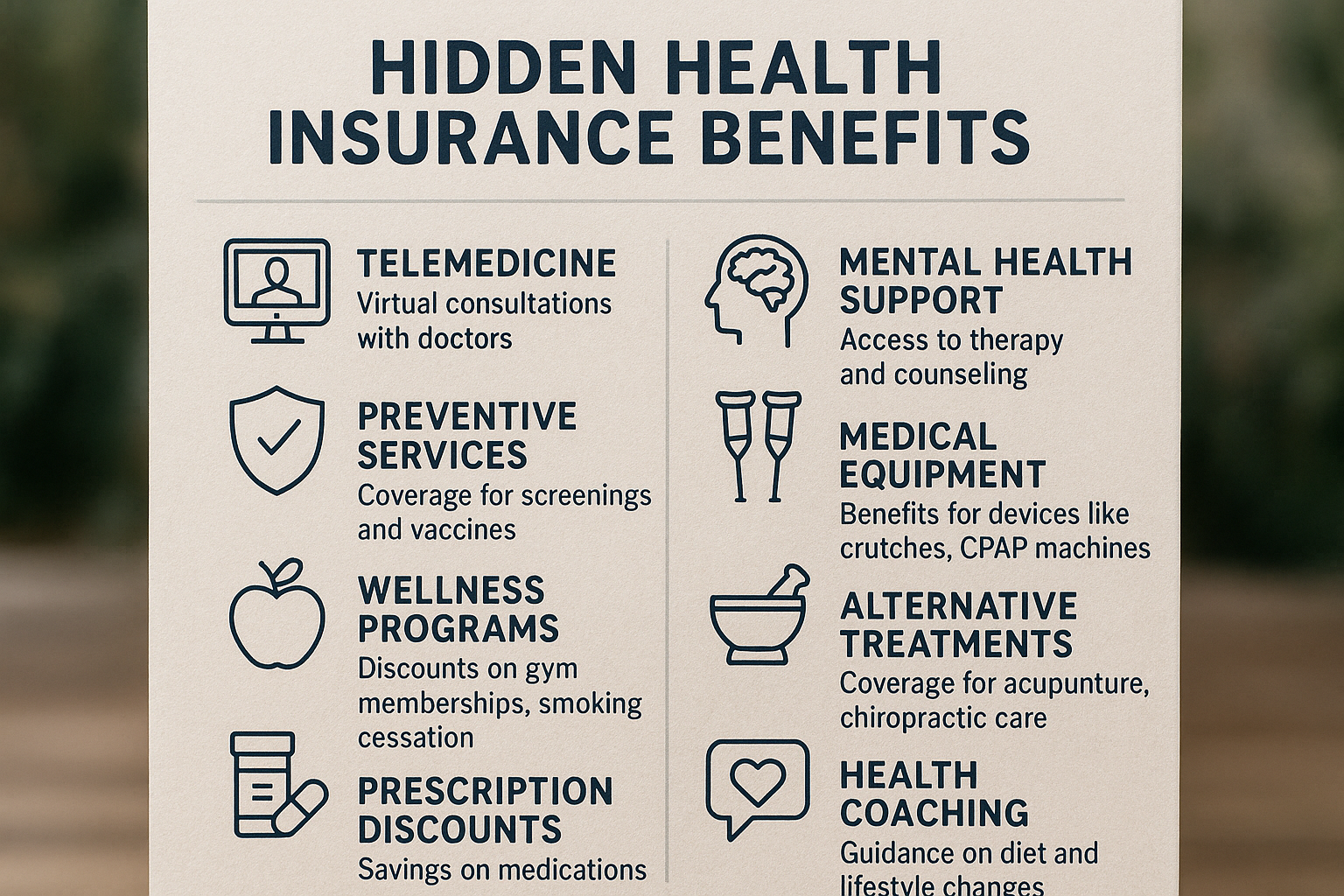

Types of Hidden Benefits

Health insurance plans frequently include benefits that go beyond basic medical coverage. Here are some common hidden benefits you might find:

1. **Wellness Programs**: Many insurers offer wellness programs that encourage healthy lifestyles. These programs can include gym membership discounts, nutrition counseling, smoking cessation programs, and even rewards for meeting certain health goals. For example, some insurers provide financial incentives for participating in fitness challenges or completing health assessments.

2. **Preventive Services**: Under the Affordable Care Act, many preventive services are covered without a copay, including vaccinations, screenings, and annual check-ups. These services are designed to catch health issues early when they are more manageable and less costly to treat1.

3. **Telemedicine Services**: With the rise of digital healthcare, telemedicine services have become a staple in many insurance plans. These services allow you to consult with healthcare professionals via phone or video calls, providing convenient access to medical advice without the need for an in-person visit2.

4. **Mental Health Support**: Mental health is an integral part of overall well-being, and many insurance plans now offer expanded coverage for mental health services, including therapy sessions, counseling, and access to mental health hotlines3.

5. **Discount Programs**: Insurers often partner with businesses to offer discounts on health-related products and services, such as eyewear, hearing aids, and alternative therapies. These discounts can significantly reduce out-of-pocket expenses for policyholders4.