Slash Your Part D Premiums 2020 With This Secret

If you're tired of overpaying for your Part D premiums, you can discover new ways to save by browsing options and exploring hidden strategies that can significantly reduce your costs.

Understanding Part D Premiums

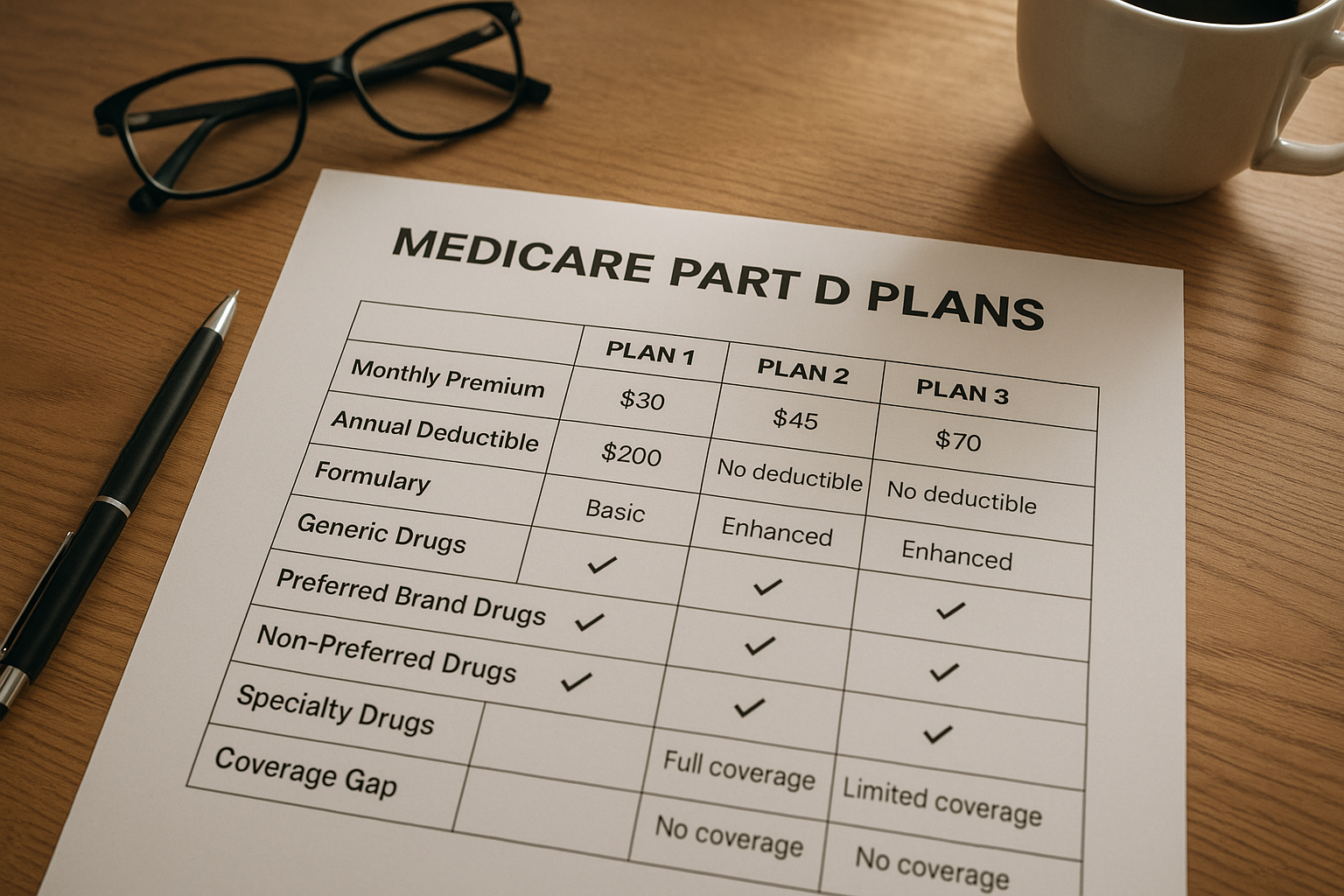

Medicare Part D is a crucial component of healthcare for many seniors, providing prescription drug coverage that helps manage medication costs. However, the premiums associated with Part D plans can be a financial burden. Understanding how these premiums are calculated and what factors influence them is the first step in finding ways to reduce them.

The cost of Part D premiums varies based on several factors, including the plan you choose, your income level, and whether you qualify for any assistance programs. In 2020, the average basic Part D premium was approximately $32.74 per month1. However, premiums can be significantly higher depending on the specific plan and provider.

Strategies to Slash Your Part D Premiums

One effective way to reduce your Part D premiums is by evaluating your current coverage and comparing it with other available options. Many seniors are unaware that they can switch plans during the annual enrollment period, which typically runs from October 15 to December 7. By taking the time to review and compare different plans, you can often find a more cost-effective option that still meets your medication needs.

Additionally, consider whether you qualify for the Extra Help program, which is a federal assistance initiative designed to help low-income individuals pay for Part D premiums, deductibles, and co-payments. This program can save eligible participants an average of $5,000 annually on prescription drug costs2.