Cut Your Duplex Insurance Costs Today Effortlessly

Cutting your duplex insurance costs doesn't have to be a hassle—by exploring ways to save and browsing options, you can effortlessly reduce your expenses while maintaining the coverage you need.

Understanding Duplex Insurance

Duplex insurance is a specialized form of property insurance designed to cover multi-family dwellings. These policies typically protect against property damage, liability claims, and loss of rental income. As a duplex owner, you might be renting out one or both units, making it crucial to have comprehensive coverage that secures your investment against unforeseen events.

Key Strategies to Reduce Your Insurance Costs

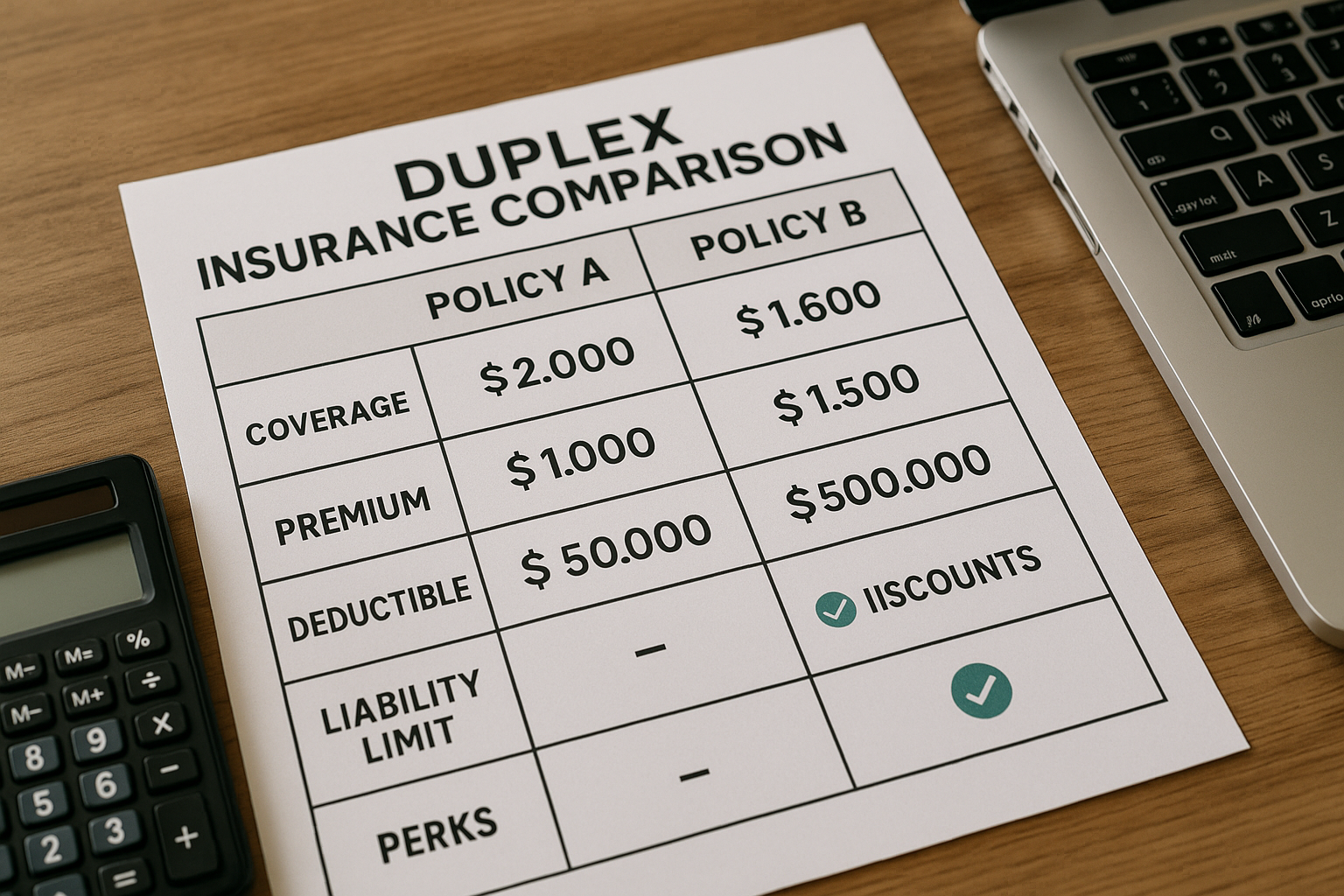

One of the most effective ways to lower your duplex insurance premiums is by increasing your deductible. A higher deductible means you'll pay more out of pocket in the event of a claim, but it can significantly reduce your monthly premium. For instance, raising your deductible from $500 to $1,000 could save you up to 25% on your premium1.

Another strategy is to bundle your insurance policies. Many insurers offer discounts when you combine multiple policies, such as home and auto insurance, with the same provider. This not only simplifies your billing process but can also lead to substantial savings2.