Secure Your Fortune with Rental Property Insurance Secrets

Unlock the secrets to safeguarding your rental property investment while maximizing your returns by exploring the diverse insurance options available, and see these options today to secure your financial future.

Understanding Rental Property Insurance

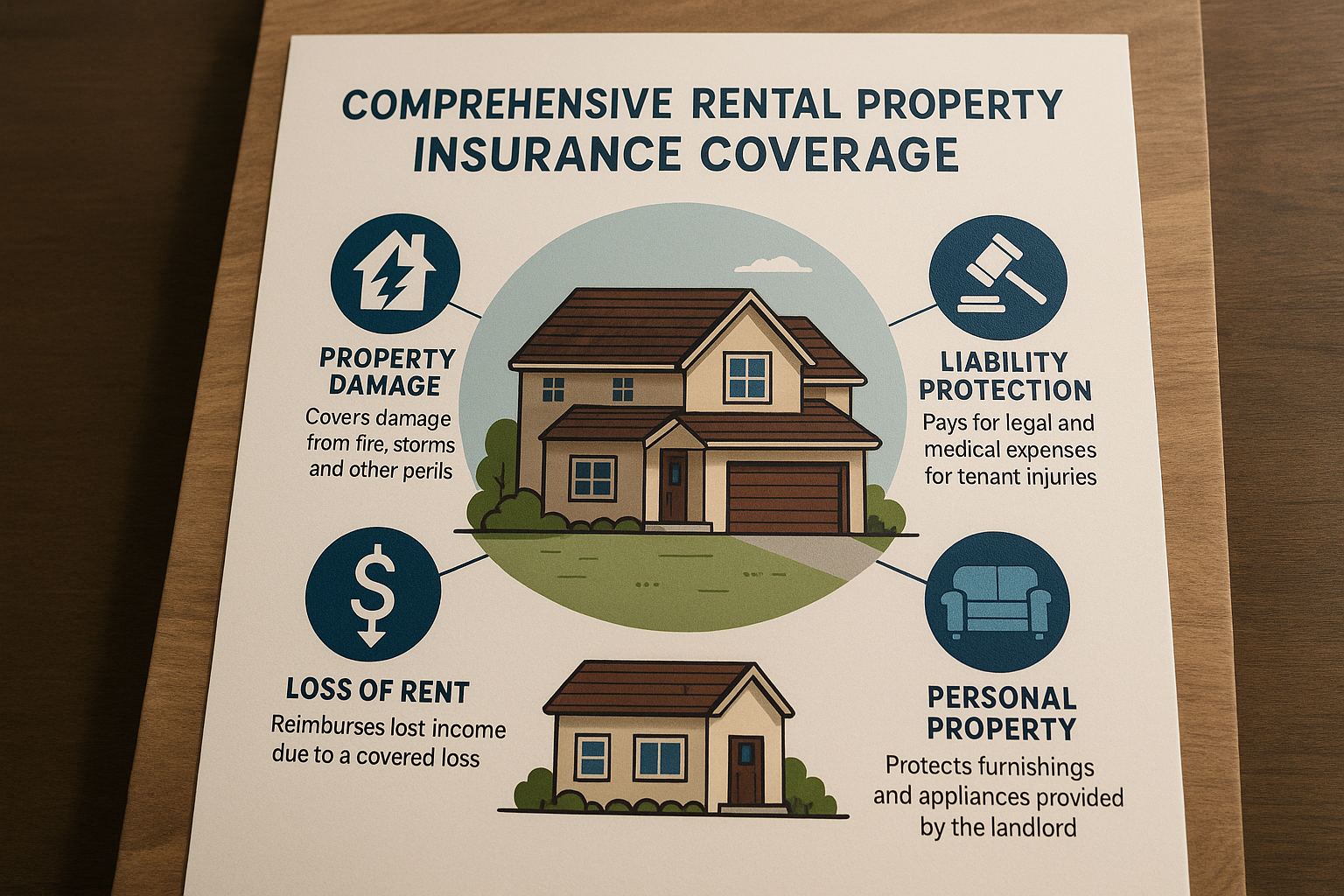

Rental property insurance, often referred to as landlord insurance, is a vital component for anyone looking to protect their real estate investments. Unlike standard homeowners insurance, rental property insurance is specifically designed to cover the unique risks associated with renting out properties. This type of insurance typically includes coverage for property damage, liability protection, and loss of rental income1.

Essential Coverage Options

When considering rental property insurance, it's crucial to understand the various coverage options available. Property damage coverage protects the physical structure of your property from perils such as fire, storms, or vandalism. Liability protection covers legal expenses in case a tenant or visitor is injured on your property and holds you responsible. Loss of rental income coverage compensates you for lost income if your property becomes uninhabitable due to a covered event2.