Find Out Your Perfect Personal Property Coverage Now

If you're seeking peace of mind with the right personal property coverage, now is the time to explore your options, browse choices, and secure the protection that best fits your needs.

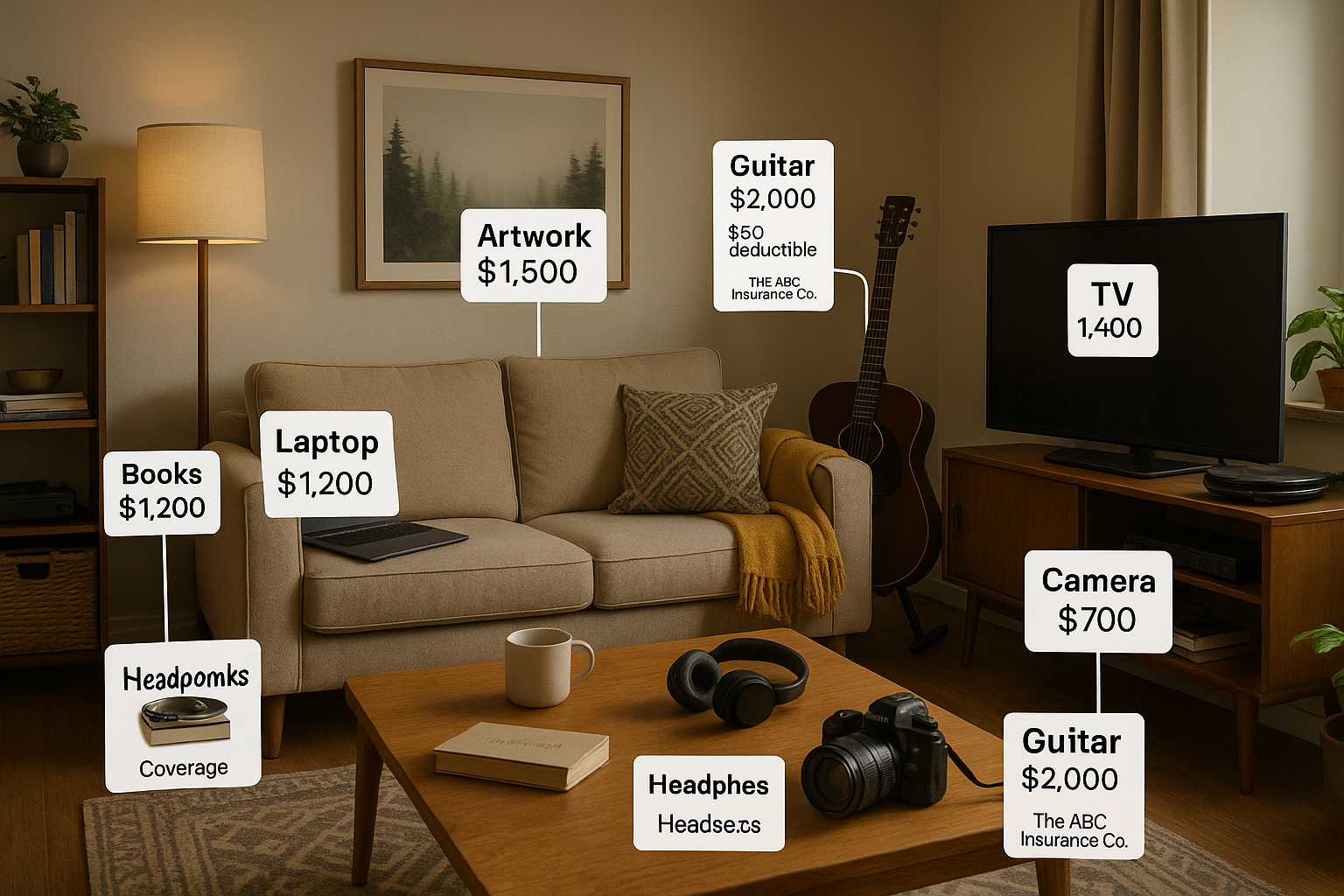

Understanding Personal Property Coverage

Personal property coverage is an essential component of homeowners or renters insurance that protects your belongings from unforeseen events like theft, fire, or natural disasters. This type of coverage ensures that you can replace or repair your items without bearing the full financial burden. Whether you're a homeowner or a renter, having adequate personal property coverage can save you from significant out-of-pocket expenses.

Types of Personal Property Coverage

There are generally two types of personal property coverage: actual cash value and replacement cost value.

1. **Actual Cash Value (ACV):** This coverage reimburses you for the depreciated value of your items. For instance, if your five-year-old television is stolen, ACV will cover the cost of the TV minus depreciation.

2. **Replacement Cost Value (RCV):** RCV provides a higher level of protection by covering the cost to replace your items with new ones of similar kind and quality. While premiums for RCV are typically higher, the peace of mind and financial protection it offers can be well worth the investment.