Master Homeowners Insurance Coverage with These Expert Secrets

Understanding the intricacies of homeowners insurance can not only protect your most valuable asset but also save you money, so it's crucial to browse options and explore expert insights that could unlock significant benefits.

Understanding Homeowners Insurance

Homeowners insurance is a critical component of financial planning for anyone who owns a home. It provides a safety net against potential losses due to events like fires, theft, or natural disasters. However, navigating the complexities of coverage options can be daunting. By mastering the secrets of homeowners insurance, you can ensure comprehensive protection while optimizing costs.

Types of Coverage and Their Benefits

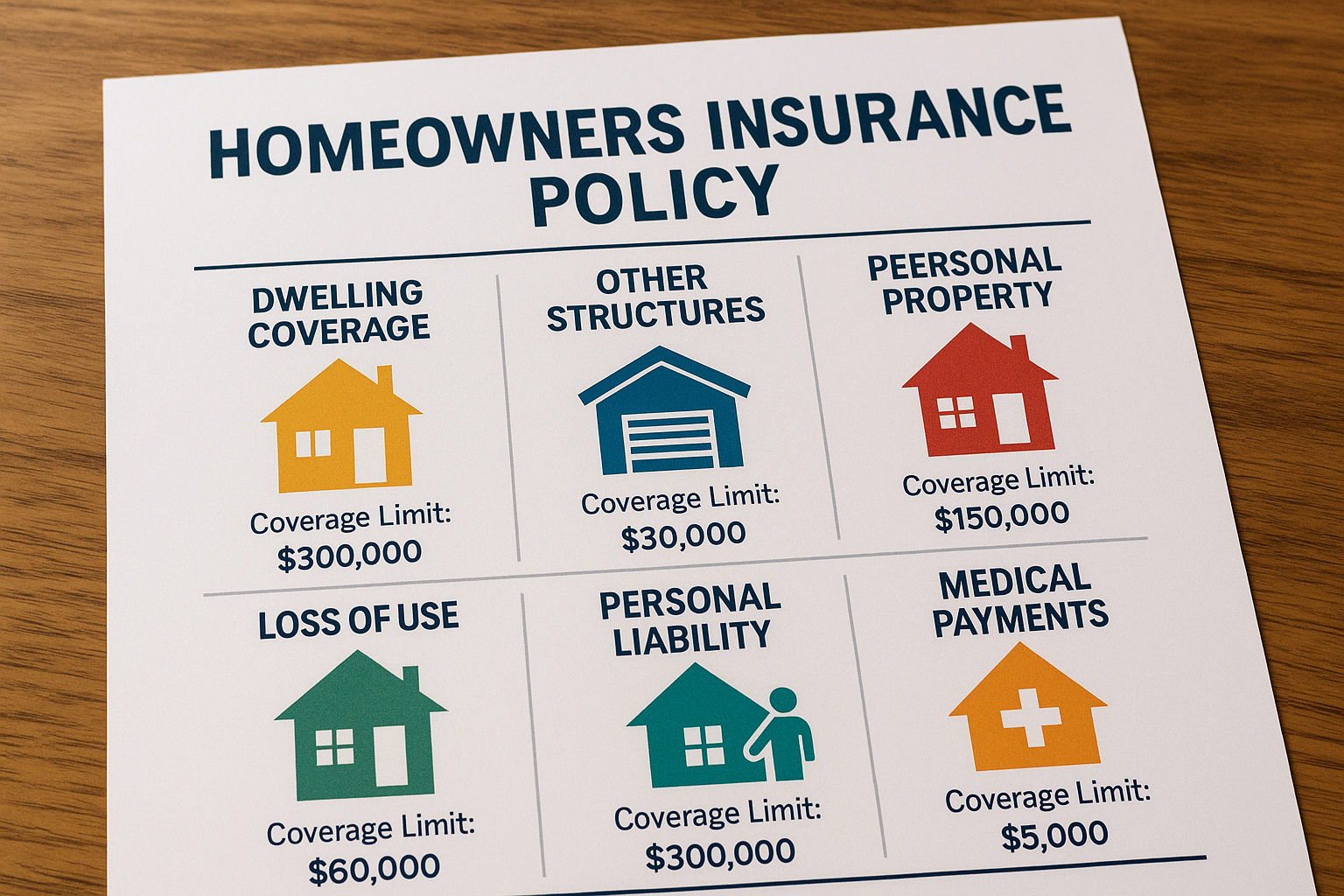

Homeowners insurance typically includes several types of coverage:

- Dwelling Coverage: Protects the structure of your home from damage caused by covered perils such as fire, windstorms, and hail. This is the core of any homeowners policy.

- Personal Property Coverage: Covers the contents of your home, including furniture, electronics, and clothing, against theft or damage.

- Liability Protection: Offers financial protection if someone is injured on your property and you are found legally responsible.

- Additional Living Expenses (ALE): Pays for temporary housing and other costs if your home is uninhabitable due to a covered loss.

Understanding these components allows you to tailor your policy to fit your specific needs. For instance, if you live in an area prone to floods, you might consider adding flood insurance, as standard policies typically do not cover flood damage.