Save Big Insure Your Home Below Replacement Cost

Unlock significant savings and protect your investment by insuring your home below replacement cost—browse options to find the best coverage that fits your needs.

Understanding Home Insurance and Replacement Cost

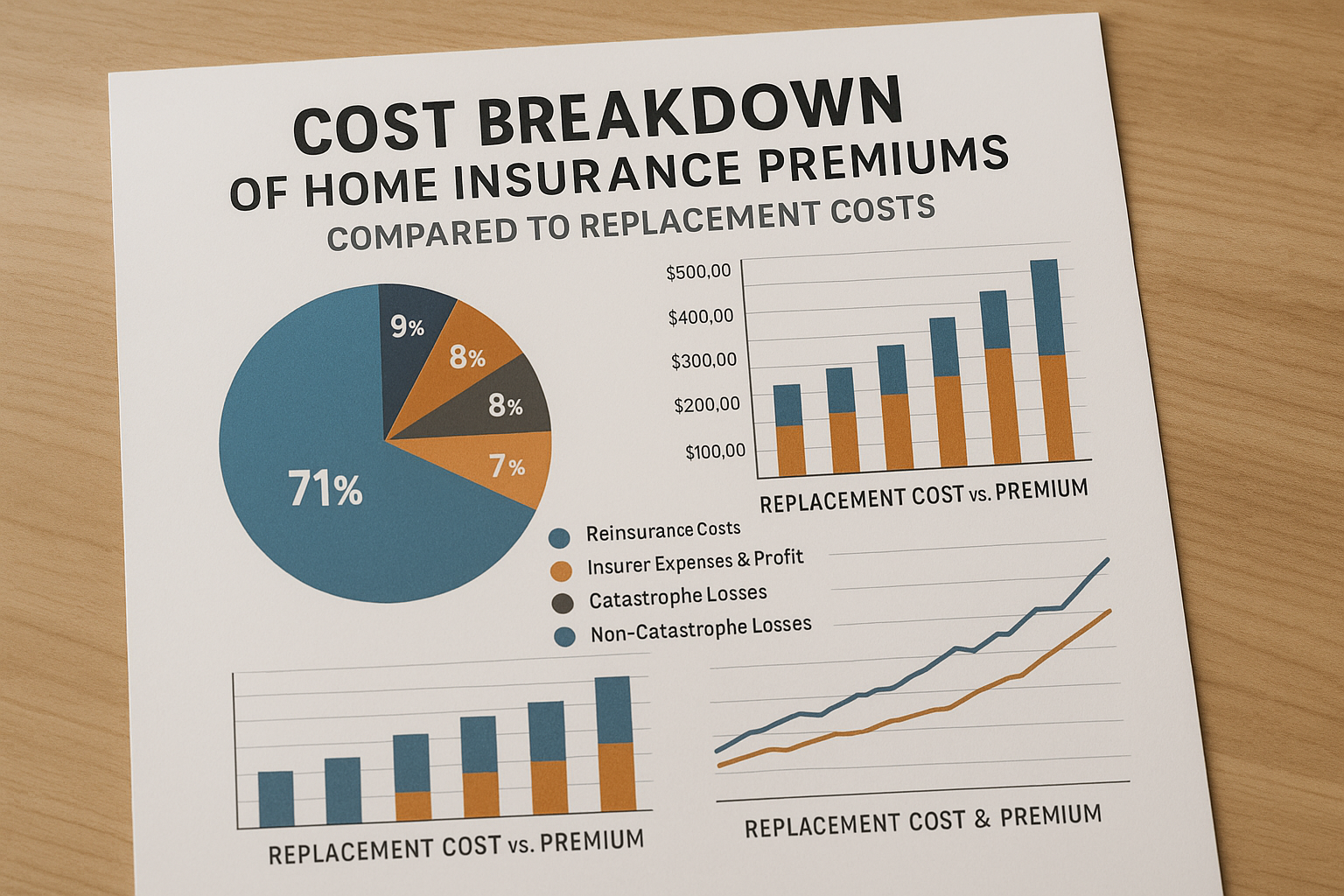

Home insurance is a crucial safety net, providing financial protection against unforeseen damages and losses. One of the key aspects of home insurance is the concept of replacement cost, which is the amount it would take to rebuild your home from the ground up, including materials and labor, at current prices. Insuring your home below its replacement cost might seem counterintuitive, but it can be a strategic move to save on premiums while still maintaining adequate coverage.

Why Insure Below Replacement Cost?

Insuring your home below replacement cost can lead to lower premiums, making it an attractive option for homeowners looking to cut costs. This strategy may be suitable if you have a robust emergency fund or alternative financial resources to cover potential gaps. Additionally, if your home is older or you plan to downsize in the future, reducing your insurance coverage could align better with your long-term financial goals.