Unlock Hidden Value in General Liability Limits 122

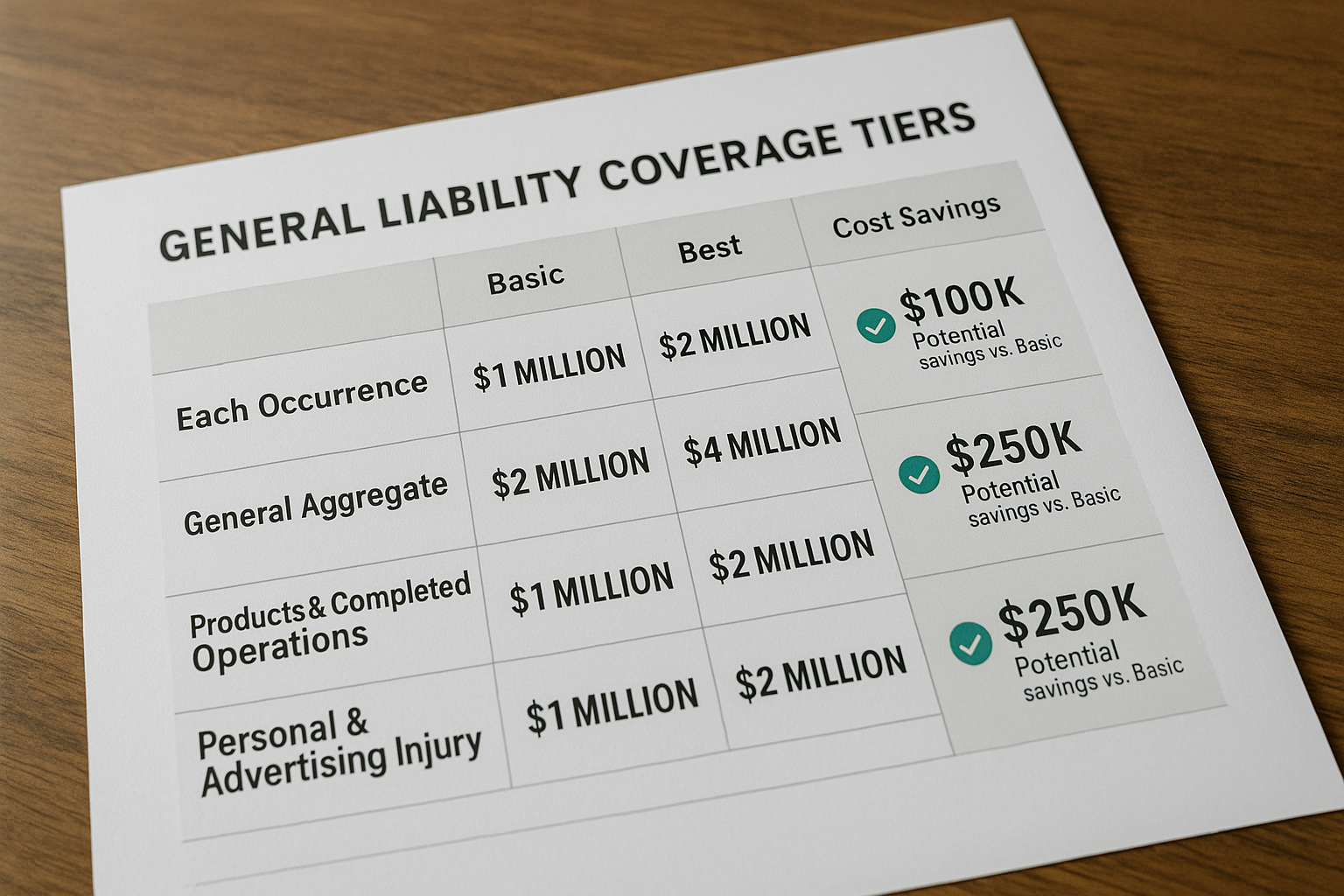

Unlocking the hidden value in general liability limits can significantly enhance your business's financial protection and peace of mind, and by browsing options, you can discover tailored solutions that fit your unique needs.

Understanding General Liability Insurance

General liability insurance is a fundamental component of any business's risk management strategy. It provides coverage for third-party claims involving bodily injury, property damage, and personal or advertising injury. This type of insurance is crucial for protecting your business from potentially devastating financial losses arising from lawsuits or claims. Many businesses underestimate the importance of reviewing and optimizing their liability limits, which can lead to insufficient coverage in the event of a significant claim.

The Importance of Adequate Liability Limits

Having adequate liability limits is essential for safeguarding your business assets. A common misconception is that the minimum coverage required by law is sufficient. However, this often leaves businesses vulnerable to claims that exceed their policy limits. For instance, if a claim results in a $1 million judgment and your coverage limit is only $500,000, your business would be responsible for the remaining $500,000 out of pocket. Therefore, carefully evaluating your coverage needs and adjusting your limits accordingly can prevent financial strain and ensure comprehensive protection.