Your Ultimate Guide to Best Renters Insurance Savings

If you're looking to unlock the secrets to saving on renters insurance while ensuring comprehensive coverage, browse options and discover how you can maximize your benefits today.

Understanding Renters Insurance

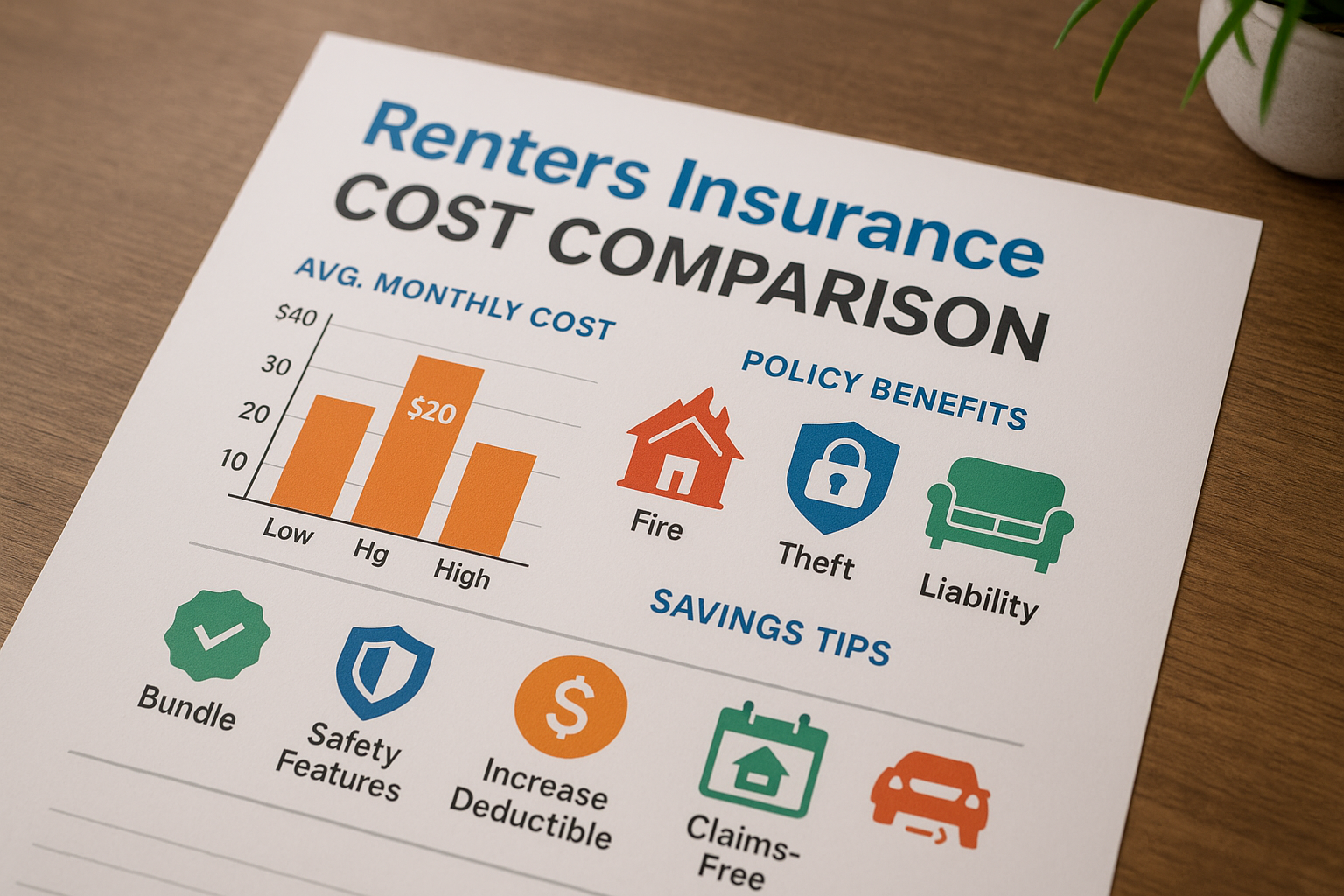

Renters insurance is a crucial safety net that protects your belongings against unforeseen events such as theft, fire, or water damage. Unlike homeowners insurance, which covers the structure of the building, renters insurance focuses on personal property and liability coverage. This makes it an essential consideration for anyone renting an apartment or home. By understanding the various components of renters insurance, you can make informed decisions and potentially save on your premiums.

Components of Renters Insurance

Renters insurance typically includes three main components: personal property coverage, liability coverage, and additional living expenses. Personal property coverage ensures that your belongings are protected against damage or loss. Liability coverage protects you in case someone is injured on your property or if you accidentally cause damage to someone else's property. Lastly, additional living expenses cover the costs of temporary housing if your rental becomes uninhabitable due to a covered event.