Mortgage Rates Secrets Everyone Overlooks Get Ready Now

If you're ready to unlock the hidden secrets of mortgage rates that could save you thousands, it's time to browse options and see these opportunities that many overlook.

Understanding Mortgage Rates: The Basics

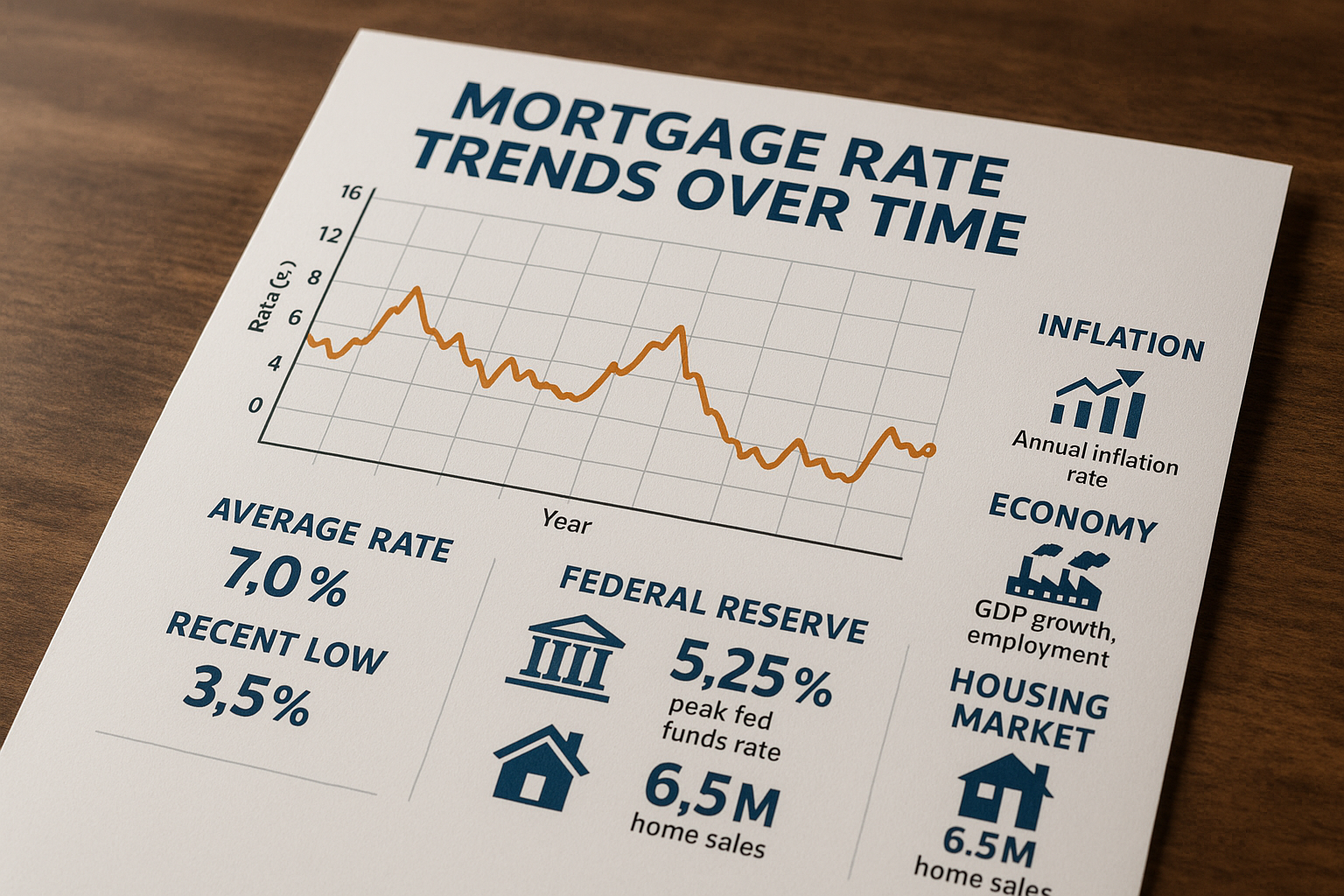

Mortgage rates are a crucial factor in determining the overall cost of your home loan. They are influenced by a variety of factors, including the economy, inflation, and the policies of the Federal Reserve. Essentially, a mortgage rate is the interest rate charged on a mortgage loan, and it can be fixed or variable. Fixed rates remain constant throughout the term of the loan, while variable rates can fluctuate based on market conditions.

The Hidden Factors Affecting Mortgage Rates

While many people focus on the visible aspects like credit scores and down payments, several overlooked factors can significantly impact mortgage rates. For instance, the type of property you are purchasing can influence the rate. Primary residences often have lower rates compared to investment properties, as lenders perceive them as less risky1.

Additionally, the loan-to-value ratio (LTV) is a critical factor that many overlook. A lower LTV can lead to better rates because it indicates a lower risk to the lender. Furthermore, economic indicators such as employment rates and GDP growth can also indirectly affect mortgage rates by influencing the overall lending environment2.