Get Texas Home Equity Loan Despite Bad Credit

Unlock the potential of your home's equity even with bad credit by exploring tailored Texas home equity loan options that can help you achieve financial stability and growth—browse options today to find the right fit for your needs.

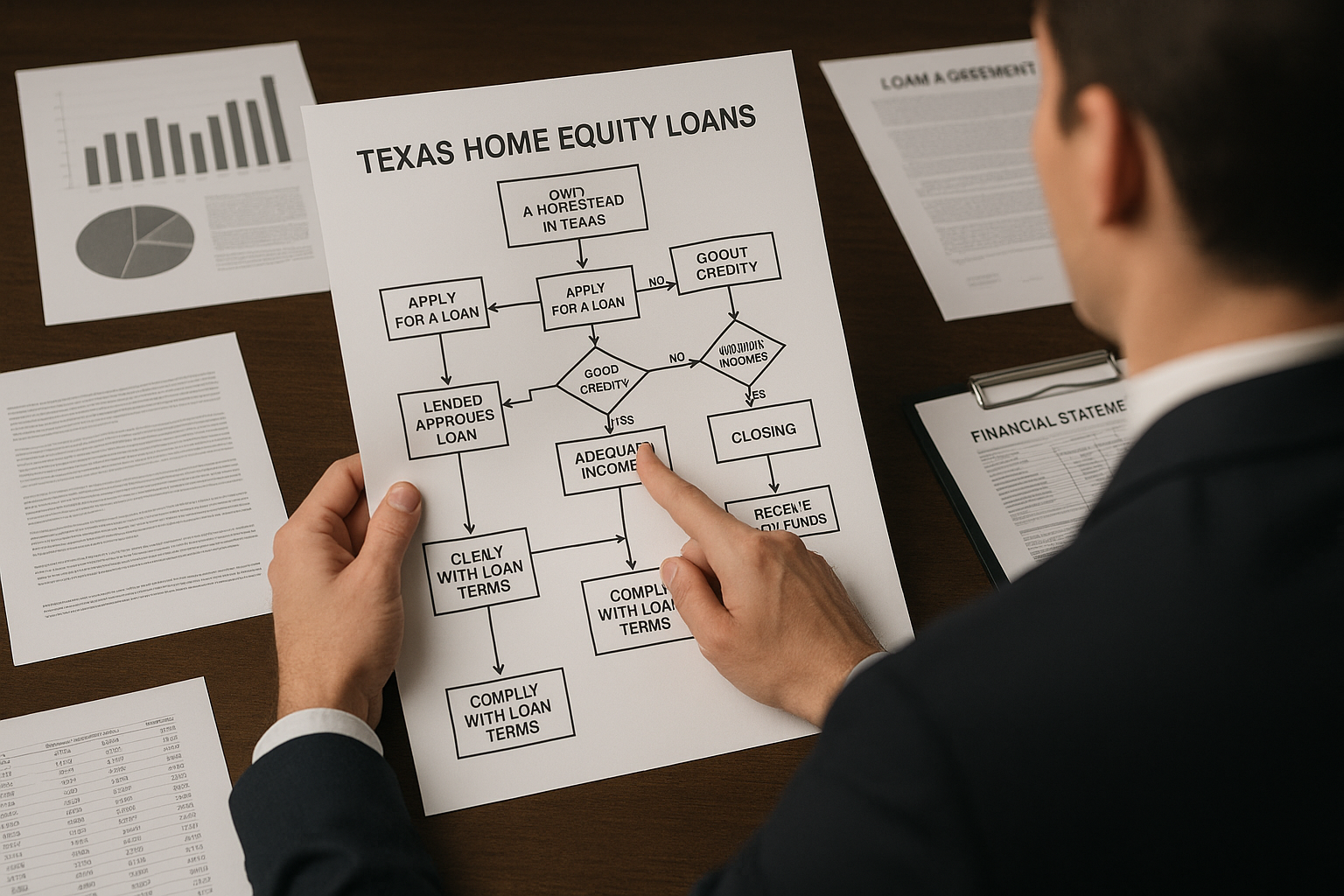

Understanding Texas Home Equity Loans

Home equity loans in Texas offer a viable way for homeowners to leverage the value of their property to secure financing, even if their credit score is less than stellar. These loans allow you to borrow against the equity you've built up in your home, providing a lump sum that can be used for various purposes such as debt consolidation, home improvements, or unexpected expenses. The key advantage of a home equity loan is its fixed interest rate, which ensures predictable monthly payments over the loan term.

Eligibility Criteria and Challenges

While having bad credit can pose challenges, it doesn't necessarily disqualify you from obtaining a home equity loan in Texas. Lenders typically look at several factors beyond your credit score, such as your debt-to-income ratio, the amount of equity you have in your home, and your overall financial situation. In Texas, regulations stipulate that you can borrow up to 80% of your home's value, minus any existing mortgage balance1. This means that if your home is worth $300,000 and you owe $200,000, you could potentially borrow up to $40,000.