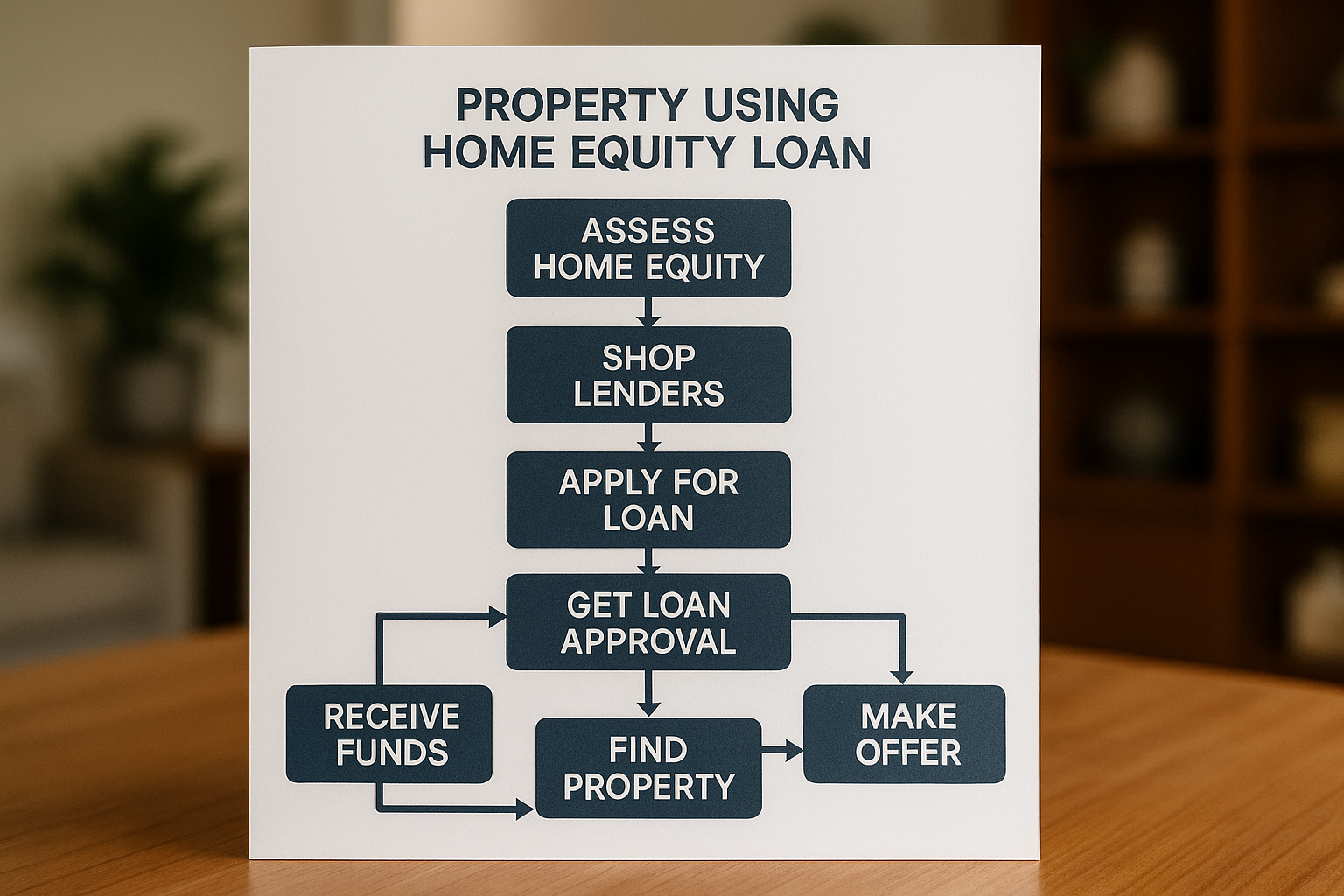

Master Effortless Property Buying Using Home Equity Loans

Unlock the potential of your existing home equity to simplify property buying, and as you explore this powerful financial tool, don't forget to browse options that can enhance your investment journey.

Understanding Home Equity Loans

Home equity loans offer a practical way to leverage the value of your current home to finance the purchase of additional property. Essentially, these loans allow you to borrow against the equity you've built up in your home, providing a lump sum that can be used for various purposes, including buying a new property. This approach can be particularly appealing if you're looking to invest in real estate without liquidating other assets or depleting your savings.

How Home Equity Loans Work

When you take out a home equity loan, you're essentially using your home as collateral, which typically results in lower interest rates compared to unsecured loans. The amount you can borrow is generally determined by the equity you have in your home, which is the difference between your home's current market value and the outstanding balance on your mortgage. Lenders often allow you to borrow up to 85% of your home’s equity, though this can vary based on your creditworthiness and the lender's policies1.